One of the key metrics you need to consider in your choice of liquidity and transaction cost analysis, is market impact. Or put simply, the effect your trading has on the wider market post trade. Rather simplistically you are told that, if the market moves a lot in reaction to your trading, then that’s a bad thing and you pay wider spreads with a high cost of rejection and higher response times.

But, if you trade on ‘last look’ prices, lower market impact would mean you benefit from tighter spreads and lower cost of rejections and hold times. Let’s take a deeper look at this. The easy one first.

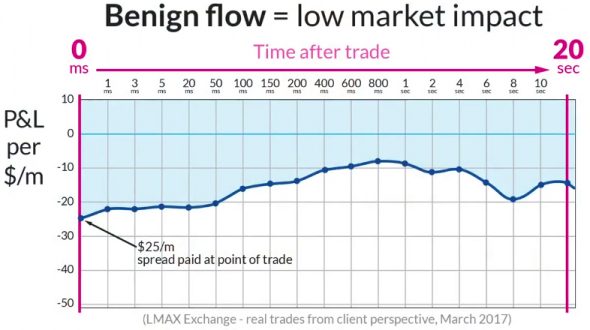

If your flow is benign and looks a bit like this:

and you trade on firm liquidity, the cost of rejection and hold time, should be close to zero. The same should also be true on ‘last look’ venues, if it isn’t, then you must add those costs to your spread and commission calculations.

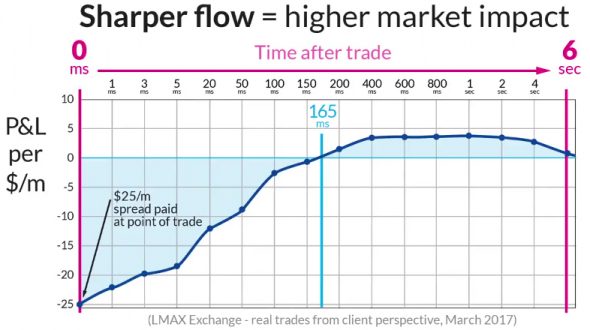

What if your flow is more informed, lo and behold, even profitable? Your flow may look like this:

and the next question is, do you actually desire market impact?

If you’re a day trader, I would argue yes. Your key considerations then should be, fill rates and any cost of hold times or rejection, it is obvious in this case that firm liquidity with much higher fill rates and lower cost of hold time and zero cost of rejection is better for you. However, it is unlikely that you will see the tighter spread available and you’re probably happy to pay a higher spread in exchange for greater certainty of execution.

Conversely, if you’re a real money hedger, then you may want to adjust your style of trading, so as not to create too much market impact and benefit from tighter spreads – as this will form a high proportion of your hedging costs in the long term.

The reality is that your flow most likely sits between these two extremes, and your choice is not simple. You need to weigh up, spreads, fill rates, cost of rejection, cost of hold time and price improvement. Market impact is not a simple metric and we will have more details of this in our whitepaper out soon. For more information just email us at [email protected].