|

| 12 November 2025 Why bitcoin’s Monday high matters in a big way |

| LMAX Digital performance |

|

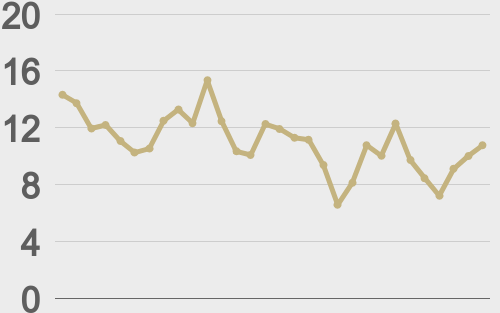

LMAX Digital volumes have been on the softer side in the early week as the market struggles to find direction. Total notional volume for Tuesday came in at $484 million, 27% below 30-day average volume. Bitcoin volume printed $246 million, 30% below 30-day average volume. Ether volume came in at $80 million, 50% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,066 and average position size for ether at $3,421. Bitcoin and ETH volatility remains elevated just off recent multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,760 and $219 respectively. |

| Latest industry news |

|

Over the past 24 hours, the crypto market has shown some weakness but no fundamental shift in our view. Technically speaking, with bitcoin still holding up above its 50-week moving average on a weekly close basis, the uptrend remains intact. Both bitcoin and ETH are well off last week’s lows and the early-week softness appears more like a correction ahead of what could be renewed upside, rather than a breakdown of the shorter-term reversal trend. The fact that sentiment is currently very muted also suggests that the balance of risk favors a surprise to the upside, especially if traders interpret this dip as a buying opportunity rather than a capitulation. As far as confirmation levels go, reassurance of the constructive outlook hinges on bitcoin’s ability to reclaim the $107,500 area — which corresponds to Monday’s high. A break back above this zone would likely act as a catalyst for fresh demand and could give the market fire-power for a sustained push higher into year-end. We continue to lean on seasonal trend analysis as well, which has historically shown strong performance in Q4 and into Q1 for crypto assets, and given the current setup — trend intact, sentiment low, macro supportive — we believe the next leg higher remains very much intact. Meanwhile, broader macro conditions are providing tailwinds: equity markets are back in rally mode, and pricing in for Federal Reserve rate cuts has turned more investor friendly, which typically benefits risk assets — crypto included. In short: this continues to feel less like the end of an up-trend and more like a consolidation phase ahead of further upside to fresh record highs. |

| LMAX Digital metrics | ||||

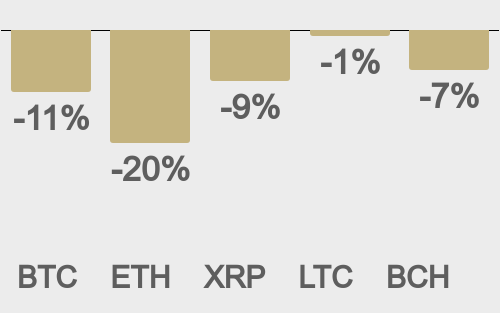

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

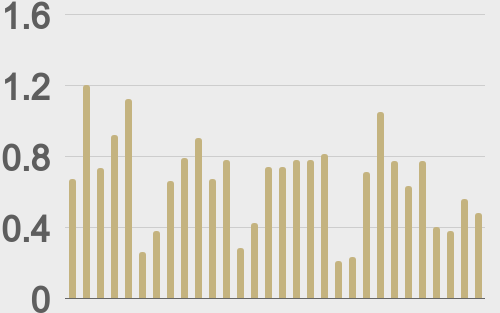

| Total volumes last 30 days ($bn) |

||||

|

||||

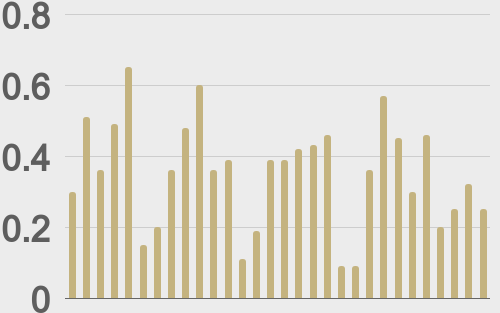

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||