Special report: NFP Preview

Today’s report: US Employment Report Gets Final Say

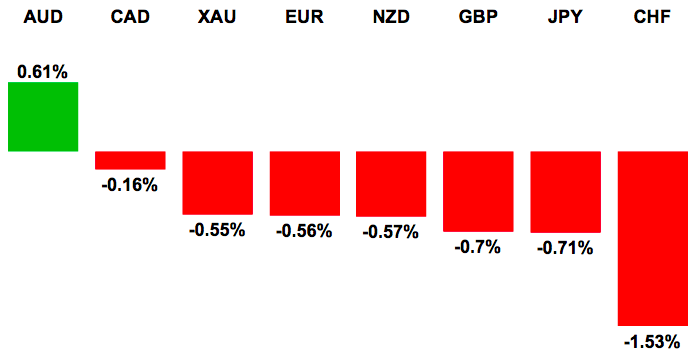

We enter Friday with the US Dollar marginally higher across the board on the week. Additional demand for the Buck has been mostly fueled by hawkish comments from Fed Lockhart and a blowout Wednesday ISM reading. But all of this could change quickly with the US employment report due.

Wake-up call

Chart talk: Major markets technical overview video

Suggested reading

- Job Market’s Signals For The Fed, M. El-Erian, Bloomberg View  (August 6, 2015)

- How Companies Try To Foil Short Sellers, D. McCrum, Financial Times (August 6, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Difficult to determine if the market is in the process of rolling back over below 1.0800, or if there is still room for a more meaningful bounce and another run higher. Ultimately, the downtrend remains firmly intact and a lower top is sought out in favour of a bearish resumption towards the critical multi-year low from March at 1.0462. In the interim, any rallies are viewed as corrective, with only a break back above 1.1130 to take the immediate pressure off the downside.

EURUSD – fundamental overview

The Euro has found some demand into a critical Friday session featuring monthly employment data out of the US. Thursday’s solid German factory orders have helped to generate some interest ahead of today’s event risk and it will be interesting to see where the dust settles after the market digests the US data. The US unemployment rate is expected to hold steady at 5.3%, while NFPs are forecast to come in at a solid 225K. Anything at or above forecast will further cement September rate liftoff prospects and support the US Dollar, while anything that disappoints will likely open some profit taking on Dollar longs. The major pair should remain confined to consolidation ahead of the US jobs report, but will also absorb data in Europe which includes German industrial production and trade.

GBPUSD – technical overview

Setbacks have been very well supported and the market could be looking to carve out a fresh higher low at 1.5350 in favour of the next major upside extension back towards and above the recent 2015 high at 1.5930. At this point, only back below 1.5350 would negate the constructive outlook and compromise the constructive outlook.

GBPUSD – fundamental overview

Although the Bank of England left policy on hold as was widely expected, the market interpreted the event as more dovish after the vote showed only one hawkish dissent versus what many had thought would be at least two. Meanwhile, the BOE was downbeat on the inflation outlook and this added to notable weakness in the Pound. The UK currency was a standout underperformer on the day, but did manage to find some support off the lows on broad based USD selling and comments from BOE Governor Carney that nothing had changed since his speech three weeks ago. Looking ahead, the UK trade balance could move things a bit, though most of the volatility for the day will almost certainly come from the anticipated US employment report.

USDJPY – technical overview

The latest push through internal resistance at 124.50 opens the door for fresh upside and a bullish continuation towards the critical multi-year high from June at 125.85. Still, with longer-term technical studies looking stretched, the risk for any meaningful appreciation could be limited, leaving the market vulnerable to another bearish reversal and corrective decline. A daily close back under 124.00 is however required to take the immediate pressure off the topside.

USDJPY – fundamental overview

No meaningful volatility from the Bank of Japan policy decision, which was to be expected considering the central bank has already made it clear that it is committed to remaining on hold for the time being. Otherwise, the Yen gets ready to digest what could be a big market mover later today with the monthly employment report out of the US due. While Thursday’s US initial jobless claims came in on the low side and was Dollar supportive, this was offset by a downturn in equity markets with the inversely correlated Yen finding some risk liquidation bids.Â

EURCHF – technical overview

The market looks to be in the process of carving out a meaningful base. From here, there is risk for a recovery back towards the February 1.0815 peak, with any setbacks expected to be very well supported above 1.0575 on a daily close basis. However, ultimately, only a daily close below 1.0400 would delay the recovery outlook and give reason for pause.

EURCHF – fundamental overview

The SNB has to be feeling really good about the depreciation in the Franc over the past few weeks. There has been talk the central bank has been taking advantage of the thin summer trade to pressure the Franc lower. A broad based US Dollar rally has also helped the SNB’s cause, with the move pushing USDCHF to its highest levels in months. Still, the SNB is far from out of the woods at this point. Global sentiment is looking shaky and any intensified downturn on this front will likely inspire a resurgence in sizable Franc inflows that will prove difficult to offset.

AUDUSD – technical overview

The recent break back above 0.7350 has triggered a double bottom that could open the door for a push to 0.7500 in the sessions ahead. Ultimately however, the broader downtrend remains firmly intact and any gains should be very well capped ahead of 0.7800 in favour of the next lower top and bearish continuation.

AUDUSD – fundamental overview

The Australian Dollar has managed to extend its recovery out from recent multi-year lows. The recovery has been driven on a number of factors which include US Dollar profit taking ahead of today’s US NFPs, some solid components within Aussie employment data, and an RBA SOMP with a slightly less dovish than expected tone. While the RBA has left the door open for additional rate cuts, it has also said recent cuts are still working through the system. The RBA has also scaled back its talking down of the Australian Dollar.

USDCAD – technical overview

The market is locked within a well defined, strong uptrend, pushing to fresh 11-year highs. However, with daily studies tracking in overbought territory, there is risk for some form of a meaningful corrective pullback in the sessions ahead to allow for these stretched studies to unwind. Ideally, any corrective declines should be well supported ahead of 1.2600, with a higher low sought out in favour of a bullish continuation.

USDCAD – fundamental overview

An impressive recovery for the Canadian Dollar in Thursday trade, despite another drop in OIL prices, now just shy of the critical March low. OIL did manage to recover of the daily low, though most of the Canadian Dollar gains were attributed to broad based profit taking on US Dollar longs ahead of today’s all important US employment report. But it isn’t just about US employment for this pair today, with Canada employment data due at the same time. This could very well produce some fireworks for the beaten down Loonie into the weekend. The US unemployment rate is expected to hold steady at 5.3%, while NFPs are forecast to come in at a solid 225K. The Canada unemployment rate is also expected to hold steady at 6.8%, with Canada jobs projected to come in at +5K.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold, and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6500. Still, any rallies should be well capped ahead of 0.6850 in favour of the existing downtrend.

NZDUSD – fundamental overview

Some welcome relief into Friday for a very beaten down New Zealand dollar that traded to fresh multi-year lows earlier this week. Most of the recovery has been attributed to nothing more than pre-US NFP positioning and broad based profit taking on US Dollar longs. But with another soft dairy auction and discouraging New Zealand employment this week, the outlook remains quite negative, with the RBNZ expected to consider additional accommodation while the Fed moves in the opposite direction. Plenty of fresh offers are reported in this market into rallies.

US SPX 500 – technical overview

The market has stalled out just shy of the May record high, with the lack of bullish momentum suggestive of exhaustion and warning of deeper setbacks ahead. Look for the latest topside failure to strengthen the bearish outlook in favour of deeper setbacks below the critical March low at 2040. At this point, only a break and daily close above 2137 would negate and open a bullish continuation to fresh record highs.

US SPX 500 – fundamental overview

Sellers continue to emerge into rallies ahead of the record high from May and there is a growing sense this market could be in the process of carving out some form of a material top. The reality of a September liftoff is something the equity market has not properly considered to date, but with Fed Lockhart saying this week a September rate hike would be appropriate, the market may be getting a little jittery. Clearly today’s NFPs will be important to watch for additional insight into the Fed timeline. Anything at or above forecast will further cement September liftoff odds and could in turn trigger a more intensified liquidation.

GOLD (SPOT) – technical overview

The market remains under intense pressure, breaking to fresh multi-year lows below 1100. At this point, the downside break opens the door for the possibility of another drop towards major psychological barriers at 1000. However, it is worth noting that daily studies are oversold and there is room for a short-term bounce. But a daily close back above the previous 2015 base at 1142 would be required to take the immediate pressure off the downside.

GOLD (SPOT) – fundamental overview

The GOLD market remains under pressure at multi-year lows, with the prospect for a Fed rate hike and broad based US Dollar demand opening intense downside pressure in the beaten down metal. Speculative positioning has recently shifted to the short side and the market is now contemplating the next major drop down towards critical barriers at $1000. The market will now look to today’s critical monthly employment report out of the US, with anything at or above expectation to likely fuel additional liquidation in the beaten down metal.

Feature – technical overview

USDSGD remains locked in a very well defined uptrend, with the market trading into some channel resistance and closing in on a retest of the multi-year peak from March at 1.3938. Look for any setbacks to now be very well supported ahead of 1.3500, while only a break back below 1.3284 would compromise and force a shift in the structure.

Feature – fundamental overview

Domestic fundamentals are much less of a factor for emerging market FX right now, with broader flows directing all of the traffic. The expectation for Fed liftoff in September has created a further narrowing in yield differentials back in the US Dollar’s favour, while risk correlated EM also struggles to contend with the negative forces of an overdone global equity market and slowing China economy. USDSGD is now approaching a retest of its multi-year high from March and plenty of demand is reported on dips from buy-side accounts. No stops reported until below 1.3750.