Next 24 hours: Euro hit on multiple fronts

Today’s report: News of US stimulus is the gift that keeps on giving

The ability for the market to rally around news of the US stimulus is more than confounding at this stage, and one can only wonder how much more room there is in the tank to rally on something that has seemingly been priced in ad nauseam.

Wake-up call

- Italian PM

- IndyRef2 agenda

- two-way flow

- SNB policy

- risk appetite

- retail sales

- coronavirus case

- Stocks vulnerable

- Dealers report

- Bigger money

- defi bubble

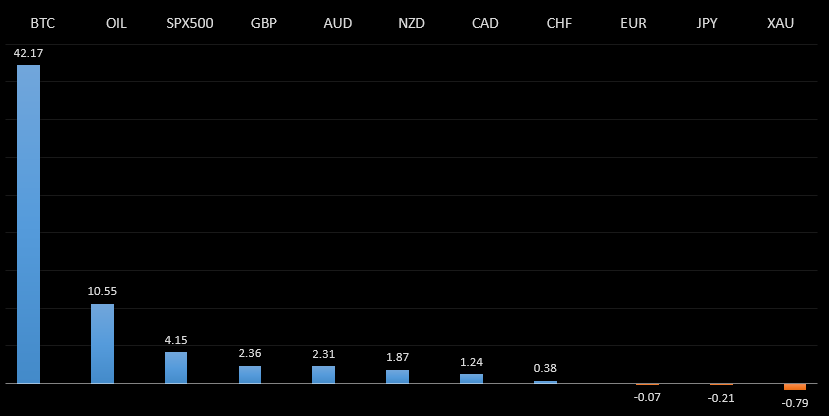

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- The Most Important Number of the Week Was 46, R. Burgess, Bloomberg (January 23, 2021)

- Weaker Data, Warmer Sentiment, Fisher Investments (January 21, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The recent breakout above 1.2000 ends a period of multi-week consolidation, with the major pair pushing to its highest level since April 2018. The break also opens the door for an eventual retest of the 2018 high up in the 1.2550 area. At this stage, setbacks should be very well supported above the previous range low around 1.1600.EURUSD – fundamental overview

The Euro continues to be supported overall on themes of broad based US Dollar outflows and risk on sentiment. At the same time, lockdowns across Europe and worry around the vaccine rollout are stumbling blocks that could prevent the single currency from running too much further to the the topside. Meanwhile, the Italian PM is still struggling to find an outright Senate majority. Key standouts on Monday’s calendar include German IFO readings, speeches from ECB’s Panetta and Lane, the Chicago Fed national activity index, Dallas Fed manufacturing, and a speech from ECB President Lagarde.EURUSD - Technical charts in detail

GBPUSD – technical overview

The recent breakout through the 2019 high at 1.3515 is significant and now sets the stage for the next major upside extension back towards 1.4000. Technical studies are however unwinding from extended readings, leaving room for some setbacks before the market starts to make its way higher. But look for setbacks to now be very well supported ahead of 1.3000.GBPUSD – fundamental overview

The Pound remains bid into the new week on the back of broad based US Dollar selling and a concurrent round of risk on flow. Scottish First Minister Sturgeon has again pushed the IndyRef2 agenda, telling the BBC she wants to force another legal independence vote if her SNP wins May's election. Key standouts on Monday’s calendar include the Chicago Fed national activity index and Dallas Fed manufacturing.USDJPY – technical overview

The latest breakdown below 104.00 opens the door for a deeper round of setbacks. Initial support comes in just ahead of 101.00, in the form of the 2020 low, which guards against the major psychological barrier at 100.00 and the 2016 low around 99.00. At this point, it would take a clear break back above 106.00 to take the immediate pressure off the downside.USDJPY – fundamental overview

We're seeing solid two way flow in the Yen on Monday with the currency caught between risk on sentiment and broad based US Dollar outflows. Earlier today, the Bank of Japan left purchases unchanged in its daily bond purchase operations. Key standouts on Monday’s calendar include the Chicago Fed national activity index and Dallas Fed manufacturing.EURCHF – technical overview

Lots of sideways price action here, with no clear directional insight. For the most part, price action has been confined between 1.0600 and 1.0900, and it will take a clear break above or below for an indication of the next big move.EURCHF – fundamental overview

The SNB remains uncomfortable with Franc appreciation and continues to remind the market it will need to be careful about any attempts at trying to force an appreciation in the currency. But the SNB will also need to be careful right now, as its strategy to weaken the Franc is facing headwinds from a less certain global outlook. Any signs of renewed risk liquidation will likely invite a very large wave of demand for the Franc that will put the SNB in the more challenging position of needing to back up its talk with action, that ultimately, may not prove to be as effective as it once was, given where we're at in the monetary policy cycle.AUDUSD – technical overview

Technical studies have turned up in recent months, after the market traded down to its lowest levels since 2003 in 2020. There is evidence of a longer-term bottom following the latest push back through 0.7000, though at this stage, there is risk for a pullback to allow for shorter term studies to unwind. Next big resistance comes in at 0.8000. Setbacks should now be well supported ahead of 0.7000.AUDUSD – fundamental overview

We're seeing renewed Aussie demand as the week gets going, mostly on the back of broad based US Dollar outflows and risk on sentiment. Key standouts on Monday’s calendar include the Chicago Fed national activity index and Dallas Fed manufacturing.USDCAD – technical overview

Has been in major decline since topping out in 2021 above 1.4600. At this stage, with the decline now well extended, the market is likely to find solid support into the 1.2500 area ahead of a resumption of gains. Ultimately, only a weekly close below 1.2500 would suggest otherwise.USDCAD – fundamental overview

The Canadian Dollar couldn't do much with Friday's round of better than expected Canada retail sales data, but has since recovered into Monday on the back of the risk on flow and concurrent round of US Dollar outflows. Key standouts on Monday’s calendar include the Chicago Fed national activity index and Dallas Fed manufacturing.NZDUSD – technical overview

There's a case to be made for a meaningful bottom, after the market bottomed out in 2020. The recent break back above 0.7000 further strengthens this outlook, with the market back in uptrend mode as per the weekly Ichimoku cloud and focused on pushing back towards longer-term resistance in the 0.7500 area. Any setbacks are expected to be well supported ahead of 0.6500.NZDUSD – fundamental overview

There was some initial selling pressure on the New Zealand Dollar as the day opened up, with the news of the first community coronavirus case in two months weighing on the currency. However, the market has since recovered on the back of broad based US Dollar outflow and risk on sentiment. Key standouts on Monday’s calendar include the Chicago Fed national activity index and Dallas Fed manufacturing.US SPX 500 – technical overview

Longer-term technical studies are looking quite exhausted and the market is showing signs of wanting to roll over after racing to another record high. Look for rallies to be well capped ahead of 3900, with a break back below 3600 to strengthen the outlook.US SPX 500 – fundamental overview

We're trading just off fresh record highs, and yet, with so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout should weigh more heavily on investor sentiment in 2021.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1700. Longer-term technical studies are however in the process of consolidating, with the market in search of a higher low ahead of a bullish continuation.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.BTCUSD – technical overview

The short-term outlook should be less constructive in the aftermath of the January wave of parabolic price action through $40,000. Key indicators are unwinding from extreme overbought territory across multiple timeframes, warning of a period of deeper correction and consolidation before any meaningful bullish continuation can be expected. At the same time, look for setbacks to now be well supported into the $20,000 area.BTCUSD – fundamental overview

Overall, ongoing adoption, continued innovation in the space, a warmer regulatory environment and healthy institutional investor appetite have all contributed to this latest wave of strong demand leading to fresh record highs into 2021. Market participants are also drawn to the asset as it proves to be an attractive store of value at a time when governments and central banks continue to print money at unprecedented rates. Still, the market had run a little too far and fast into January and we're now seeing a round of profit taking kicking in.BTCUSD - Technical charts in detail

ETHUSD – technical overview

The market has finally rallied up to a fresh record high, exceeding the previous peak from January 2018. At the same time, with daily studies showing overextension, there could be a period of consolidation and deeper correction that sets in before a meaningful bullish continuation. Setbacks should now be well supported ahead of 800.ETHUSD – fundamental overview

Bitcoin is getting all of the attention, though it's Ether that outperformed its older cousin in 2020. All of the healthy investor risk appetite in global markets has helped to fuel demand for innovation and the Ethereum blockchain is very much at the centre of this when it comes to cryptocurrencies. At the same time, we would be concerned about a bubble in the defi space, with valuations for these projects soaring to alarming heights. We've also warned that any downturn in global sentiment is likely to have a more significant negative impact on the more risk correlated Ether.