Next 24 hours: Have you seen oil lately?

Today’s report: Fed tempers rate hike expectations

Most of the latest movement in financial markets revolves around post FOMC Fed speak highlighted by Tuesday’s Fed Chair Powell comments that inflationary pressures are transitory and the Fed will not be in any rush to raise rates.

Wake-up call

- Dovish ECB

- Hawkish expectations

- BOJ intervenes

- CBA calls

- retail sales

- Wellington restrictions

- Stocks vulnerable

- Dealers report

- miner crackdown

- Risk off

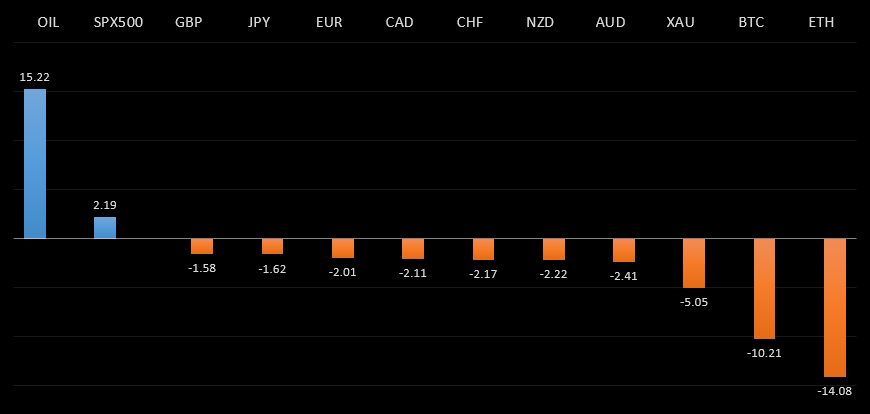

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- That Was a Lot of Sound and Fury for a 0.0% Return, J. Authers, Bloomberg (June 23, 2021)

- How will Brexit reshape the City of London?, J. Guthrie, Forbes (June 23, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has been looking for a higher low since topping out in 2021 up at 1.2350. Ideally, this next higher low is sought out ahead of 1.1600 in favour of the next major upside extension back through 1.2350 and towards a retest of the 2018 high at 1.2555 further up.EURUSD – fundamental overview

The Euro has been in recovery mode as Fed officials come out post last week's decision and talk down perceived hawkishness. However, softer Eurozone consumer confidence reads and dovish ECB speak have kept the lid on the the single currency into the rebound. Looking ahead, key standouts on the calendar come in the form of PMI reads out of Germany, the Eurozone, and the UK, Canada retail sales, the US current account, US PMI reads, US new home sales and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Technical studies are in the process of consolidating from stretched levels after the push to fresh multi-month highs. This leaves room for additional consolidation, before the market considers a meaningful bullish continuation towards a retest of the 2018 high. But look for setbacks to now be very well supported into the 1.3500 area.GBPUSD – fundamental overview

The recovery in the Pound has mostly been about renewed US Dollar selling as Fed officials talk down hawkish expectations. But we've also seen some demand for the Pound ahead of tomorrow's BOE decision in which many are pricing a hawkish shift in the outlook from the BOE. Looking ahead, key standouts on the calendar come in the form of PMI reads out of Germany, the Eurozone, and the UK, Canada retail sales, the US current account, US PMI reads, US new home sales and some Fed speak.USDJPY – technical overview

The major pair has run into massive resistance in the form of the monthly Ichimoku cloud, and has since stalled out. This translates to a longer-term trend that is still bearish despite the run up we saw in 2021, with risk for deeper setbacks ahead. It would take a clear break back above 113.00 to negate the outlook.USDJPY – fundamental overview

Tuesday's BOJ intervention in the Japanese equities market and the concurrent round of demand for US equities on the back of dovish Fed speak have been behind this latest selloff in the Yen. Looking ahead, key standouts on the calendar come in the form of PMI reads out of Germany, the Eurozone, and the UK, Canada retail sales, the US current account, US PMI reads, US new home sales and some Fed speak.