LMAX Global – FX trading excellence

LMAX Global offers direct access to the LMAX Exchange central limit order book and peer-to-peer institutional liquidity, delivering transparent price discovery and competitive spreads to clients worldwide, including broker dealers, money managers, MT4/5 brokers and professional traders:

- Tighter spreads on streaming, firm limit order liquidity

- Transparent execution with no ‘last look’ rejections

- Strict price/time priority order matching

- Real-time reports & reconciliation via web or FIX Drop Copy

- Streaming, full order book firm market data

- Access to margin facility and competitive financing rates

- Global exchange infrastructure based in Equinix LD4, NY4, TY3 and SG1

Instruments

Clients have access to our liquidity pools globally and are able to trade over 100 instruments: FX, metals, equity indices, commodities and crypto CFDs:

- LMAX Global UK – trading instrumentsview

- LMAX Global EU – trading instruments view

- LMAX Global NZ – trading instruments view

Trading hours

- BST ‐ Trading Hours Schedule ‐ Sunday 31 March 2024 to Saturday 26 October 2024 download

- DST ‐ Trading Hours Schedule ‐ Sunday 10 March 2024 to Saturday 30 March 2024 download

- GMT ‐ Trading Hours Schedule ‐ Sunday 5 November 2023 to Saturday 09 March 2024 download

Connectivity

24-hour professional access with optimum connectivity, ensuring highest quality of trade execution

Connectivity: cross connect at Equinix LD4/5, NY4, TY3 and SG1, PoP at Interxion, internet, extranet/hosted service providers more

- AWS Direct Connect

- BeeksFX

- BT Radianz

- Colt Prizmnet

- Equinix Cloud Connect for cloud providers

- FCM-360

- Fixnetix

- FluentTech

- Guavatech

- ICE/TMX Atrium

- LiquidityConnect

- LMAX Proximity

- Lucera

- OptionIT

- Pico

- PrimeXM

- TNSi/NetXpress

- UltraFX

Access

API trading more

LMAX Global Application Programming Interface (API) technology enables clients to automate their trading strategies and use our customisable client libraries (Java, .NET) or our FIX protocol for their integration.

FIX/API users benefit from:

- Free direct access to all our markets

- Ultra-low latency, anonymous trading

- Secure protocol

- Access up to 20 levels of market depth (via FIX only)

- Access to a knowledgeable API technical support team

- Risk-free testing in the demo environment

Market data access - more

Read API requirements - more

- Enter into a license agreement with LMAX Global - the LMAX Global API Agreement is entity specific which you will find on the New Clients page of the regional section.

- Have access to the expertise to implement complex computer programs in the supported languages.

- Understand you will be charged an inactivity fee if the minimum trading thresholds are not met.

Request API libraries - more

| .NET | Please send an email to [email protected] to request our LMAX .NET API |

| FIX | Please send an email to [email protected] to request our FIX Protocol library |

| Java | Please send an email to [email protected] to request our LMAX Java API |

Web trading more

- Direct access to all our markets

- Low latency, anonymous trading

- Streamlined efficient and superior execution

- Easy to use and feature-rich professional User Interface

More details about web trading can be found in our Trading Manual on the new clients page under the different entities. close

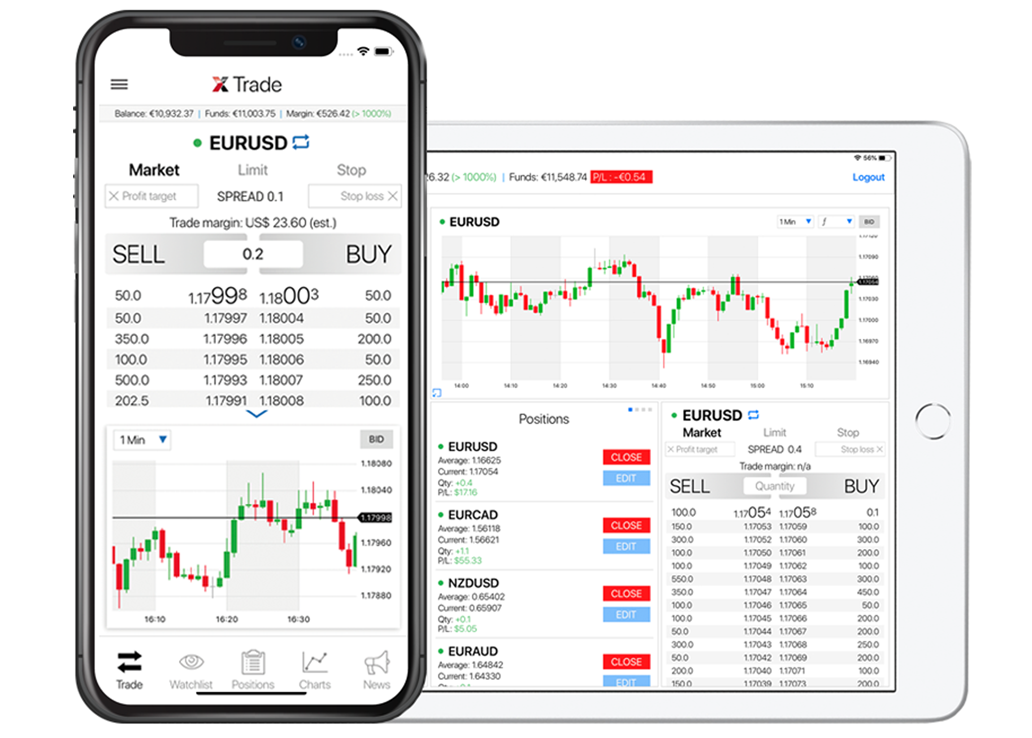

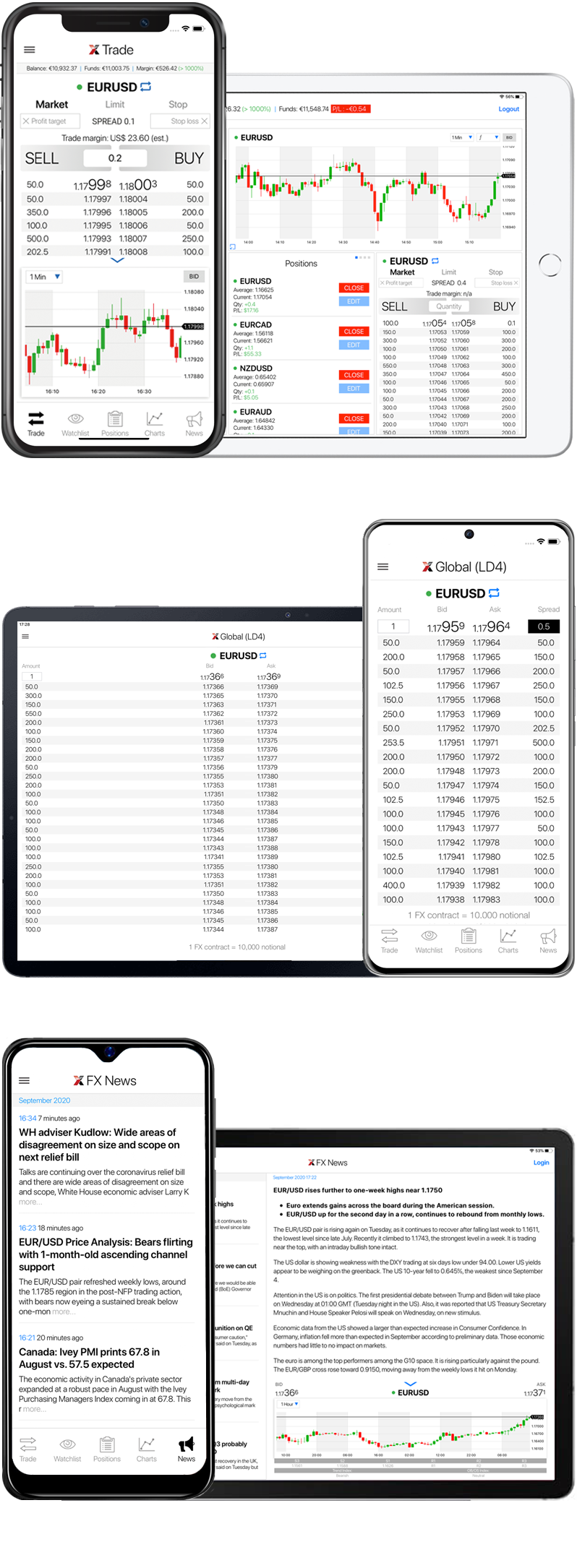

Mobile trading more

Get fast, mobile access to all LMAX Global markets, pricing and up-to-the-minute FX news.

The LMAX Global Trading app, available for Android™ and iOS®, is seamlessly integrated with all LMAX Global markets, delivering fast trading access, the very latest VWAP FX market data and up to the minute, vital, global FX news – at the touch of a screen.

- Available for iOS and Android

The app puts powerful trading tools in the palm of your hand. FX and CFD trades can be placed and managed on any Android™ or iOS® device, smartphone or tablet, through an orderly, intuitive interface.

Trade features

- Access to a wide range of instruments: rolling spot FX, metals, indices, commodities & crypto currencies

- Up to 15 levels of market depth

- Transparent price discovery, no ‘last look’ rejections with strict price/time priority order execution

- Multiple order types, including take profit and stop-loss contingent orders, to manage your risk

- 1-click trading, close, cancel or partial close position

- Real-time account status information to manage your positions

- Monitor key markets, with real-time prices, via your own customisable ‘Watchlist’

- Trade securely and with ease using touch ID

- Trading history

- Activity and account notification

Charts

- Track markets and trends using live & historical data

- Interactive charts (zooming/panning)

- Wide selection of timescale intervals

- Long tap enable/disable detail tooltip

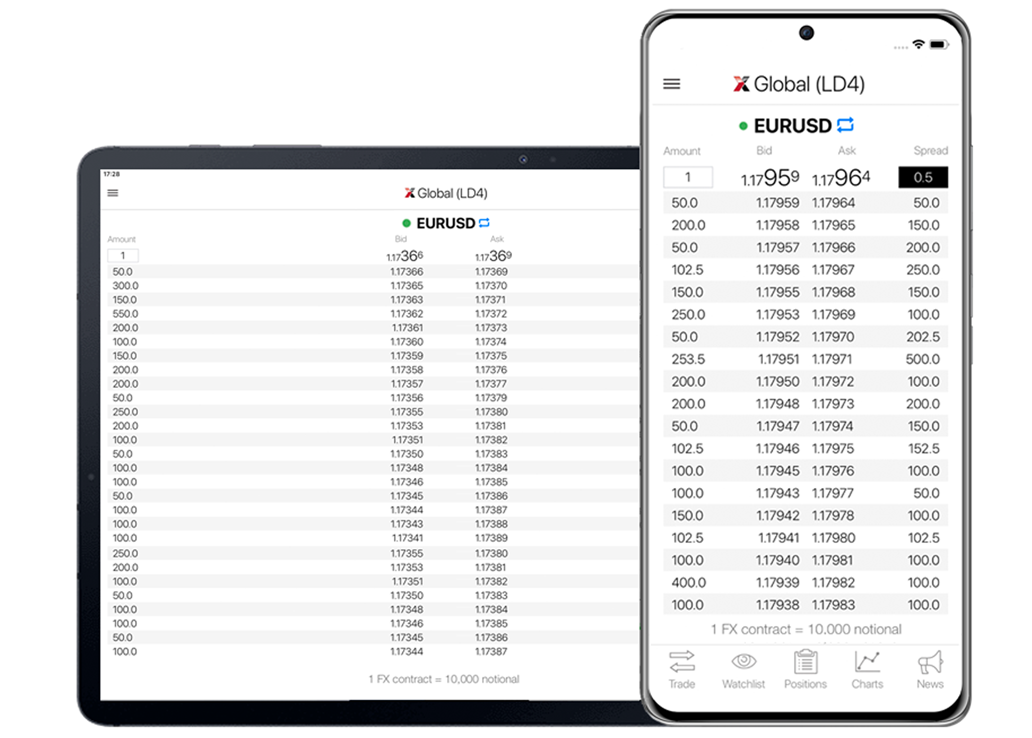

VWAP features

- Real-time, no ‘last look’ VWAP prices for specified order size

- Prices for all LMAX liquidity pools (London LD4, New York NY4, Tokyo TY3 and Singapore SG1)

- Up to 20 levels of market depth for all instruments

- Simple switching between instruments and venues

We deliver fast, secure and flexible access to help optimise trading.

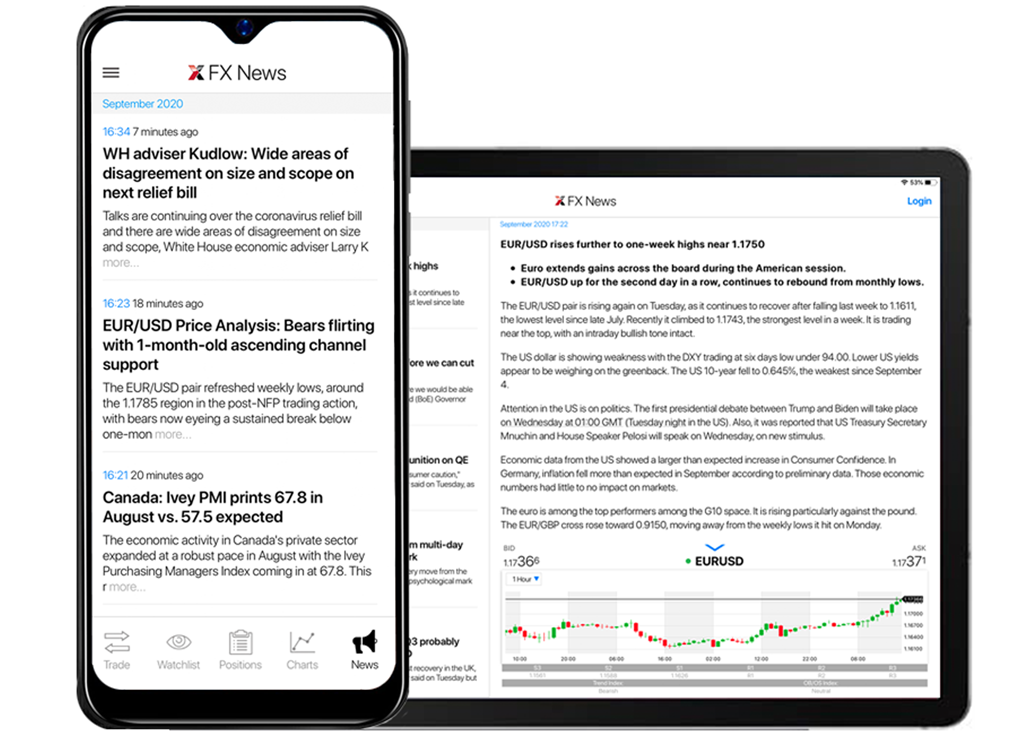

News features

- Global economic news

- Global FX insights with market research, analytics and opinion delivered in audio, video & report format

- Global economic calendar for advanced warning of important economic events

The app is free to download and use with either a live or demo LMAX Global account (register for a free demo account via the app or at www.lmax.com/demo).

Technology partners

We are integrated with all major technology and MT4/5 bridge providers:

Front-end trading software providers more

Front-end trading software solutions enable access to LMAX Global liquidity through a 3rd party trading interface.

AlphaNovae

AlphaNovae is designed for algorithmic and active professional trading that demands best execution. AlphaTrader modular infrastructure is fully integrated with the LMAX Global FIX and API, enabling clients to seamlessly benefit from low latency, exchange style execution on LMAX Global.

For more information, please visit www.alphanovae.com/alphatrader close

MultiCharts

MultiCharts is an award-winning, professional trading software for charting, backtesting and multi-broker automated trading. High-definition charting, built-in indicators and strategies, one-click trading from chart and DOM, high-precision backtesting, brute-force and genetic optimisation, automated execution and support for EasyLanguage scripts are all key tools available through MultiCharts.

For more information, please visit www.multicharts.com close

PTMC

PTMC (Protrader Multi-Connect) is a comprehensive professional trading platform developed especially for active traders. PTMC’s key features include fully customisable interface, advanced drawing and technical analysis charting tools, standard and advanced chart types. In addition, PTMC enables programming and testing of algorithmic strategies through AlgoStudio module, featuring strategies scripting, debugging, optimisation and back testing.

For more information, please visit www.protrader.org close

Sierra Charts

Sierra Charts is a full-featured, high-performance trading and charting platform, offering access to LMAX Global. Clients benefit from the following services and capabilities: server-side managed OCO and bracket orders, six month order fill history maintained on server and ultralow latency order routing.

For more information, please visit www.sierrachart.com/index.php?page=doc/LMAX.php close

TSLab

MT4/5 bridge providers more

MT4/5 bridge providers enable brokers to connect through their MT4/5 servers to all LMAX Global markets.

AMTS Solutions

AMTS Solutions is a fast and flexible solution for online trading, providing brokers with the maximum flexibility in configuring the liquidity, trading tools, risk management rules, order execution methods. In addition, broker clients receive high degree of protection from typical problems such as non-market quotes, arbitration and much more.

For more information, please visit www.amtssolutions.com close

Gold-i

Trading systems integrator, Gold-i, provides fast and reliable integration between retail and institutional trading systems on a global basis, automatically covering all retail broker risks with banks in real time.

For more information, please visit www.gold-i.com close

MetaQuotes

oneZero

oneZero Financial Systems provides low-latency software systems for the foreign exchange, commodities, and futures markets. oneZero also offers an array of risk management and back-office utilities that allow any broker, from start-up to established global leader, to provide better quality service to their clients via robust, flexible technology solutions.

For more information, please visit www.onezero.com close

PrimeXM

PrimeXM offers premium quality institutional grade solutions for MetaTrader4. PrimeXM can stream quotes via MT4 into liquidity providers and back to MT4 with thousands of real time executions per second.

For more information, please visit www.primexm.com close

Think Liquidity

The proprietary ThinkLiquidity enterprise risk engines allow for real time A book, B book and C book management and trade execution. ThinkLiquidity is an international technology firm specializing in the foreign exchange and CFD markets and is built from the ground up with a focus on maximizing brokerage revenue.

For more information, please visit www.thinkliquidity.com close

Tools4Brokers

MetaTrader-to-FIX Bridge connects servers to an external liquidity provider using the FIX protocol, which allows to hedge financial risks, synchronise prices with liquidity providers and benefit from this high-speed, robust solution with extensive functionality.

For more information, please visit www.tools4brokers.com close

WADMAX Technologies

WADMAX Technologies offers risk management, liquidity and other solutions for brokers using MetaTrader platform.

WADMAX Technologies MT4 FIX Liquidity Bridge allows brokers to offset client deals according to pre-defined rules. It is the perfect risk management tool, providing brokers with great flexibility to hedge specific client groups or even all clients.

For more information, please visit www.wadmaxtech.com close

Turnkey broker solutions more

Turnkey solution partners provide clients with a complete front to back office broker solution giving access to the LMAX Global pricing and liquidity.

Protrader

PFSOFT is a technology vendor providing customers with leading-edge trading technology and services. LMAX Global liquidity is integrated into PFSOFT’s Protrader platform, a professional DMA multi-asset trading platform that provides an all-in- one solution for brokerage businesses for all major markets: FX, Stocks, Futures, Options and CFDs.

For more information, please visit www.protrader.com close

ACTForex

ActForex is a leading independent provider of cutting-edge trading technology solutions for a multitude of FCMs, Forex Brokers, Broker/Dealers, Introducing Brokers, Money Managers and financial institutions worldwide since 2000.

For more information about ActTrader please visit www.actforex.comclose

Fair Trading Technology

Fair Trading Technology is a rapidly growing technology provider, creating new and innovative solutions for FX brokers and their clients. Our Integration Hub and T3 Broker Tools offer a suite of components to support your business, allowing you to manage all aspects of your business in one place.

For more information, please visit www.fairtradingtech.com close