|

|

14 February 2023 Crypto under pressure despite higher stocks |

| LMAX Digital performance |

|

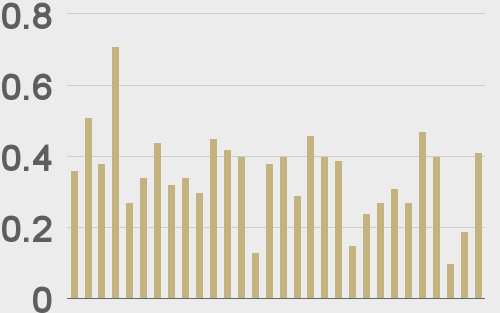

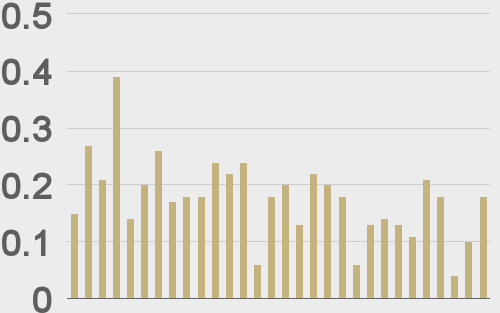

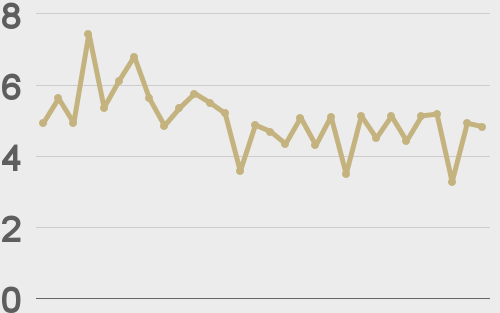

LMAX Digital volumes picked up nicely on Monday after trading a little softer last week. Total notional volume for Monday came in at $409 million, 17% above 30-day average volume. Bitcoin volume printed $182 million on Monday, 3% above 30-day average volume. Ether volume came in at $154 million, 57% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,196 and average position size for ether at 3,042. Volatility has cooled from recent peaks, but overall, has turned up a good deal from multi-month lows we were seeing in 2022. We’re looking at average daily ranges in bitcoin and ether of $632 and $65 respectively. |

| Latest industry news |

|

It’s definitely been interesting to see price action over the past 24 hours or so. For the most part, the way things have worked is that whenever we see decent moves in US equities, crypto will follow along. And yet, this hasn’t been the case in recent sessions. Whether or not this holds up is a completely different question. But for now, we are clearly seeing a divergence, where stocks have been trading higher and crypto has been under pressure. So what’s going on? We think a lot of this has to do with crypto specific headlines that haven’t been all that settling. There has been a clear ramping up of regulatory crackdown in the United States, and the SEC has been out an about making headaches for major players like Kraken, Coinbase, and Paxos. Now we’re getting additional reports the SEC could stop institutional players like hedge funds, pension funds, and private equity from working with crypto custodians. At the moment, qualified crypto custodians can hold assets on behalf of their clients. But the proposed rule change making the rounds could mean these institutional players would need to look elsewhere for such services. Looking ahead, things could get even more interesting for the crypto market when US inflation data it released later today. As things stand, if the data comes in above forecast, it could open even more downside pressure on crypto. If on the other hand the CPI data comes in below forecast, it will be taken as a relief to many investors, and potentially fuel additional upside pressure on stocks, which could then be a relief to struggling crypto assets. |

| LMAX Digital metrics | ||||

|

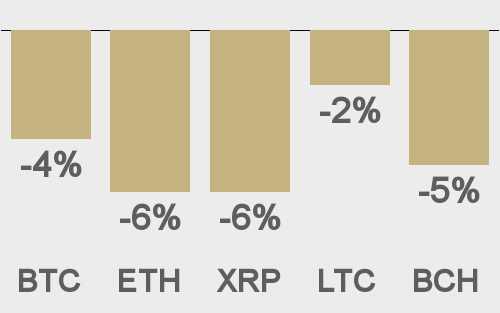

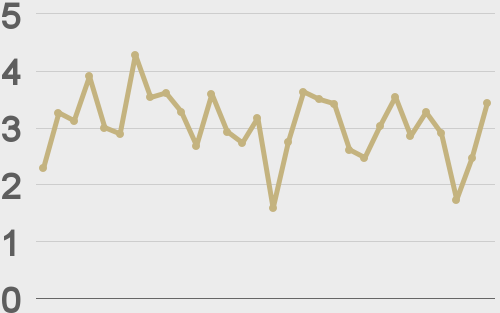

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||