|

|

21 September 2023 Bitcoin holds up well post Fed decision |

| LMAX Digital performance |

|

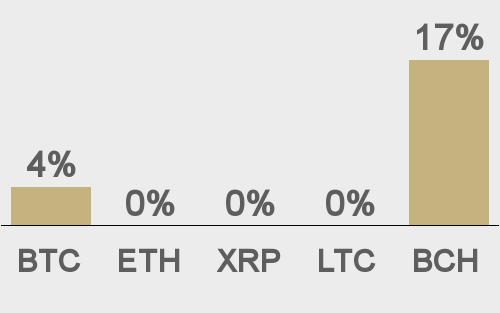

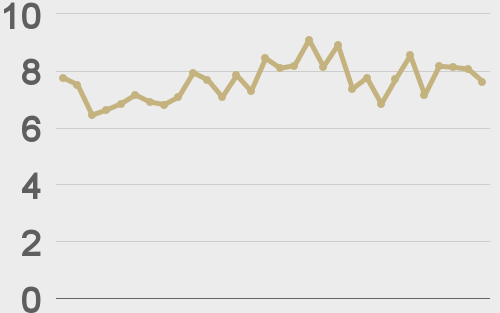

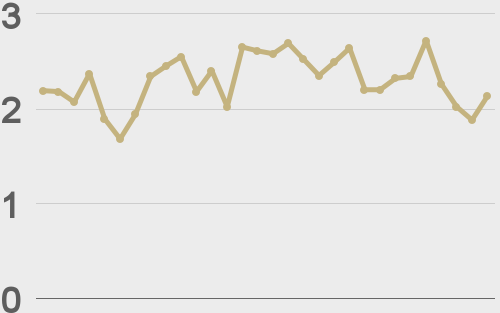

LMAX Digital volume has been impressive all week. Total notional volume for Wednesday cooled off from Monday and Tuesday levels, but still managed to come in at $234 million, 17% above 30-day average volume. Bitcoin volume printed $150 million on Wednesday, 17% above 30-day average volume. Ether volume printed $62 million, 17% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,597 and average position size for ether at $2,295. Volatility has steadied after picking up from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $664 and $42 respectively. |

| Latest industry news |

|

Bitcoin has held up rather well in the aftermath of the Fed decision. The Fed disappointed investors on Wednesday after sticking with a higher for longer policy track in light of a more solid growth outlook and ongoing concerns around inflation. Yield differentials have moved in the US Dollar’s favor across the board, with currencies getting hit hard against the Buck as a consequence. Naturally, this has also extended to cryptocurrencies, with bitcoin coming under some mild pressure. We think bitcoin has held up relatively well as there are many investors out there who recognize the value proposition of an asset that possesses qualities that should also make it attractive in times of broad US Dollar demand and flight to safety. The same can not be said for Ether. Ether has come under more pressure than its cousin post Fed decision. The price action makes sense when considering Eth as a more risk correlated asset. Ether and Ethereum assets are also under more scrutiny when it comes to regulatory crackdown, particularly in the US. The subject around what exactly can be defined as a security is something Ethereum assets are far more sensitive to. In fact, while bitcoin holds up impressively, we are seeing notable weakness to the point where Ether has sunk to its lowest levels against bitcoin since July 2022. Still, while bitcoin has held up better, we continue to warn that bitcoin will need to push back above a high from late August at $28,200 to suggest the market is ready to for that next big push to the topside. Until then, things could remain choppy. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

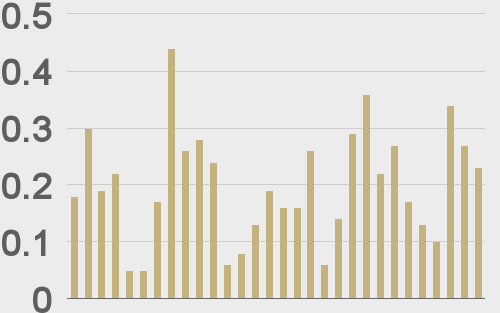

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

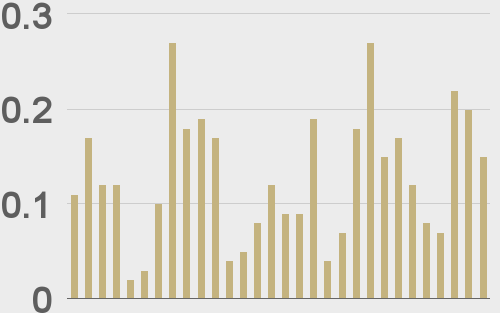

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||