|

|

17 June 2024 Bearish price action in a bullish consolidation |

| LMAX Digital performance |

|

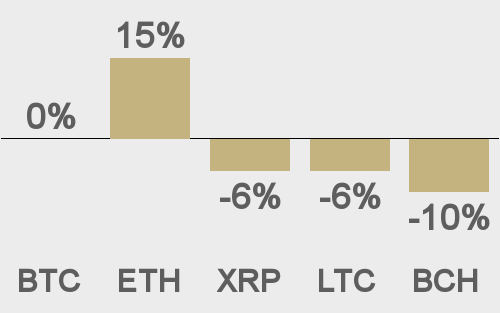

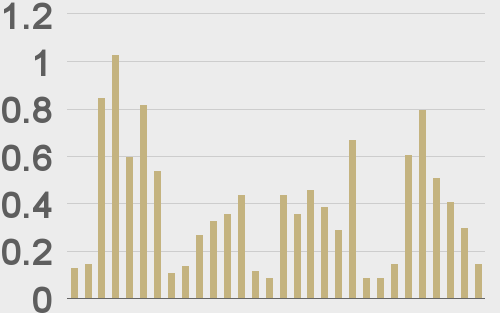

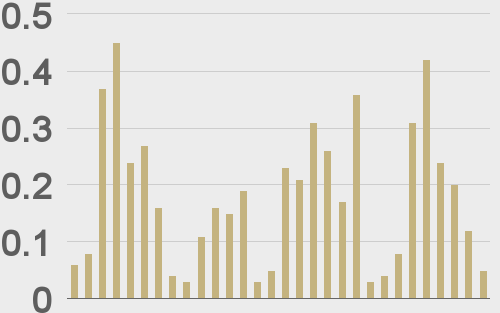

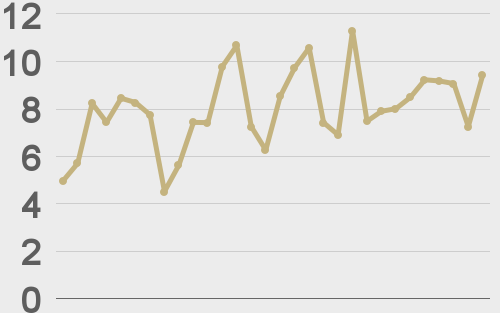

Total notional volume from last Monday through Friday came in at $2.5 billion, 15% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.25 billion, 5% lower than the previous week. Ether volume came in at $962 million, 78% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,336 and average position size for ether at $4,079. Market volatility continues to trend lower overall since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $1,913 and $141 respectively. |

| Latest industry news |

|

Overall, market conditions have been rather subdued for crypto assets, with price action confined to a consolidation. If we zoom in however, recent price action has been more bearish within the consolidation. As far as the catalyst for recent weakness goes, it’s possible it’s coming from a slowdown in bitcoin ETF inflows and waiting period before the ETH ETFs go live this summer. Alternatively, it’s possible we’re seeing downside pressure from a reduction in risk sentiment and broad based US Dollar demand in the aftermath of a more hawkish leaning Fed communication and unsettling election results in Europe. We’ve also heard some traditional market players talking about Q2 outperformance in US equities relative to bitcoin, which could be detracting from positive momentum in the crypto space. However, we think this last point isn’t exactly a strong one given overwhelming bitcoin outperformance against traditional assets on a year over year basis since bitcoin’s inception. Interestingly enough, despite the more hawkish Fed decision which has accounted for some Dollar demand, US inflation data has suggested the Fed should consider more rate cuts, which would be supportive of crypto assets into the second half of the year. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

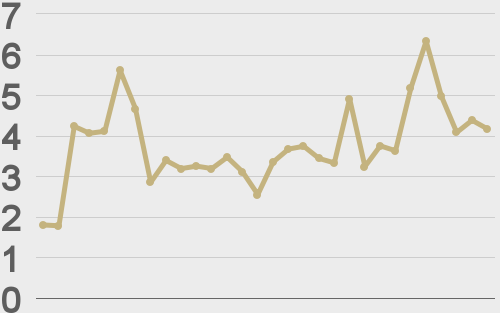

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||