|

|

11 June 2024 Bitcoin ETF inflow streak comes to an end |

| LMAX Digital performance |

|

LMAX Digital volumes were thin on Monday. Total notional volume for Monday came in at $154 million, 60% below 30-day average volume. Bitcoin volume printed $76 million on Monday, 59% below 30-day average volume. Ether volume came in at $49 million, 64% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,931 and average position size for ether at $3,727. Market volatility for bitcoin continues to trend lower since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $1,992 and $135 respectively. |

| Latest industry news |

|

As per today’s technical insights, the latest intraday pullback has been intense, but has done nothing to compromise the outlook. Even on a short-term basis, the outlook remains constructive while bitcoin holds above $66,000. We suspect there will be plenty of demand into this current dip, and only a break and daily close below $66,000 would open the door for a more significant corrective decline, possibly back towards the low from early May at $56,500. Fundamentally speaking, there hasn’t been much in the way of any crypto specific headlines that would reconcile the price action. It’s possible a broken string of what had been 19 consecutive days of inflows into the bitcoin spot ETFs is behind some of the negative sentiment. But we think the bigger driver of weakness right now is coming from the traditional markets, where the combination of a hawkish repricing of Fed bets in the aftermath of last week’s strong US jobs report and political uncertainty post the European elections results have opened a resurgence in US Dollar demand. Given crypto assets could be more sensitive to these macro updates, it will be important to keep an eye on tomorrow’s massive calendar risk in the form of US inflation data and the Fed decision. Equity market investors have done a good job forcing the Fed into more accommodative policy at every turn, and we suspect these investors will be looking to do the same after digesting tomorrow’s calendar risk. If this proves to be the case, it will open renewed selling of the US Dollar, drive yield differentials back into currencies, and serve as a prop to crypto assets as well. |

| LMAX Digital metrics | ||||

|

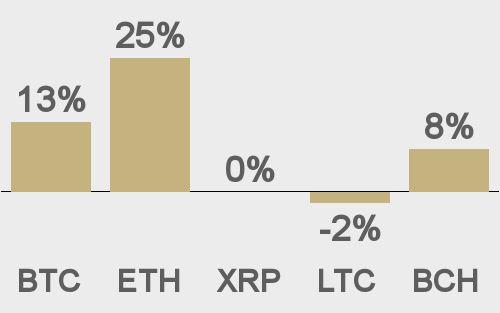

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

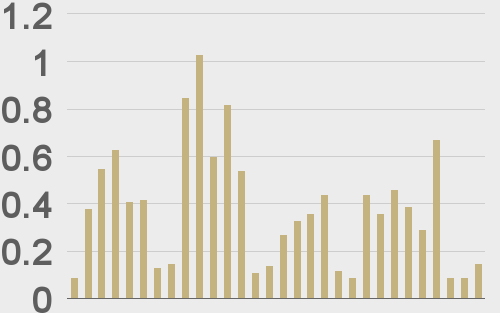

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

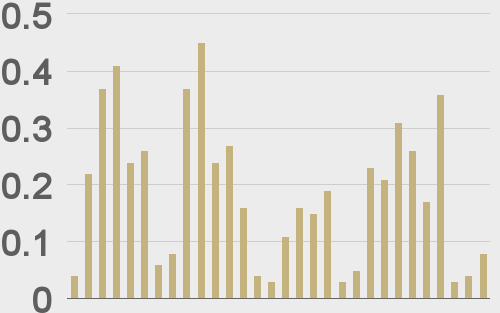

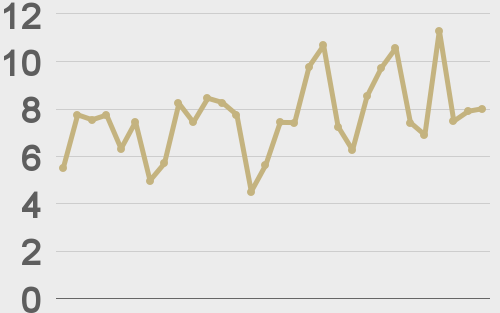

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

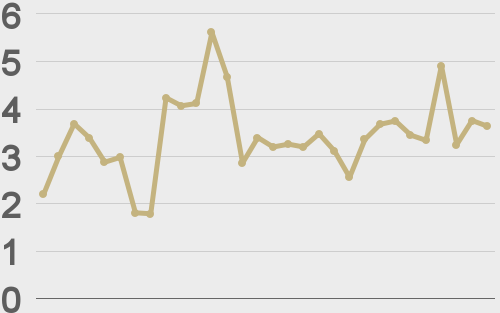

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||