|

|

28 November 2022 Crypto and traditional markets |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was off in the previous week, mostly on account of the thinner holiday trade. Total notional volume from last Monday through Friday came in at $1.26 billion, 6% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $669 million in the previous week, off 20% from a week earlier. Ether volume came in at $275 million, 15% lower from the week earlier. Total notional volume over the past 30 days comes in at $11.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,795 and average position size for ether at $2,500. Volatility has been anemic in 2022, though we’re finally seeing a little pick-up off yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $656 and $72 respectively. |

| Latest industry news |

|

We’ll get back to fuller market conditions this week and we expect volume to pick back up as the US returns from the holiday break. As things stand, the crypto market is still looking vulnerable in the aftermath of the FTX implosion. It’s unclear the full ripple effect from the fallout has been realized yet and market participants are cautious, sitting back and waiting for more clarity. Risk sentiment overall has come off into the new week, perhaps on the back of negative headlines out of China, or perhaps because of worry around a Fed that may still keep its foot on the gas with respect to rate hikes. One of the things that prevented the crypto fallout from being much worse in recent weeks was the round of softer inflation data out of the US and the wave of risk on flow this had inspired. But now that stocks have enjoyed a very nice run and considering the risk the Fed remains hawkish is still legitimate, we could see crypto assets back under pressure on this correlation we’ve been seeing in 2022 with traditional risk assets. Technically speaking, as per our commentary in today’s report, the key bitcoin levels to watch over the coming sessions come in at $16,800 and $15,460. Overall, the trend remains bearish, but a break back above $16,800 will at least take some of the immediate pressure off the downside. |

| LMAX Digital metrics | ||||

|

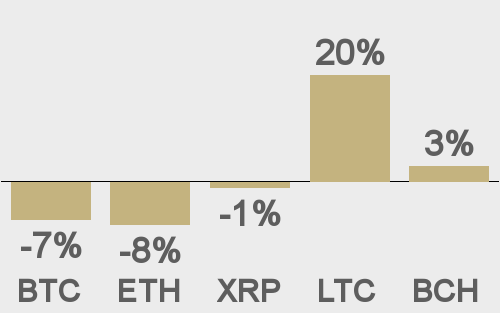

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

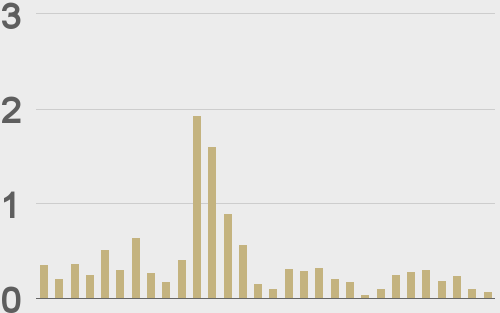

Total volumes last 30 days ($bn) |

||||

|

||||

|

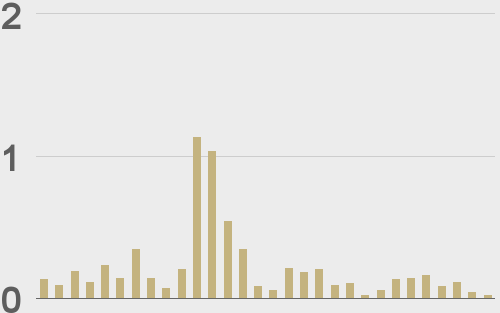

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

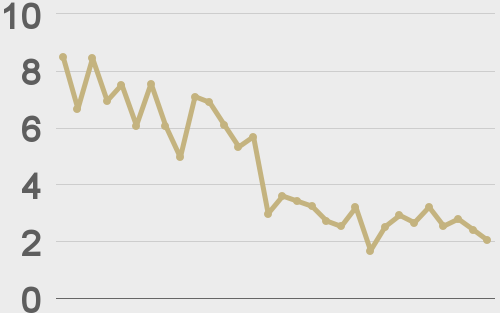

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

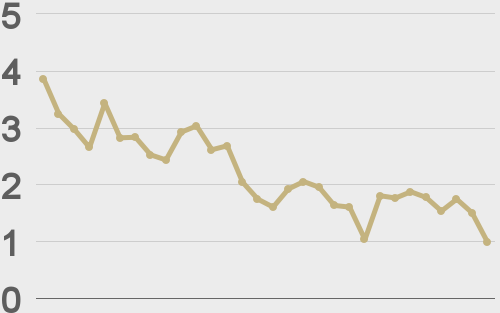

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||