|

|

4 October 2023 Crypto assets resilient in the face of macro pressures |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off from a massive day of Monday volume, but were still well above 30-day average volumes. Total notional volume for Tuesday came in at $285 million, 34% above 30-day average volume. Bitcoin volume printed $187 million on Tuesday, 35% above 30-day average volume. Ether volume came in at $75 million, 31% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,795 and average position size for ether at $2,411. Volatility has been trending higher in recent days after bouncing ahead of August multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $648 and $46 respectively. |

| Latest industry news |

|

Crypto assets have held up exceptionally well of late, including through a September month that has been the worst month for performance on record. We’re now into an October month in which seasonality trends show to be one of the best for crypto, which should be encouraging. All of this comes at a time when this recent performance should be even more impressive when considering how crypto has stacked up against traditional assets over the past 30 days. Looking at 30-day performance across crypto (bitcoin, ether), the major currencies, gold, and the S&P500, crypto is far and away the strongest performer, tracking in positive territory, despite notable losses across currencies, gold, and the S&P 500. And so, even with yield differentials moving decidedly in the US Dollar’s favor of late, and even with equity investors heading for the exits, bitcoin and ether have been able to hold their own, dispelling the idea these assets are positively correlated to risk sentiment. This reflects a maturing market becoming more acutely aware of the longer-term value proposition of bitcoin, ether and other crypto assets. We’ve also been seeing signs of a shift in sentiment amongst lawmakers in the US, with calls ramping up for the SEC to approve bitcoin spot ETF applications, and ether futures ETFs going live. At this point, the SEC is taking its time, and it doesn’t look like any bitcoin spot ETF applications will be approved before year end. However, momentum is building, and the market believes it’s only a matter of time before the approvals come through, which should usher in an overdue and welcome wave of institutional adoption in 2024. |

| LMAX Digital metrics | ||||

|

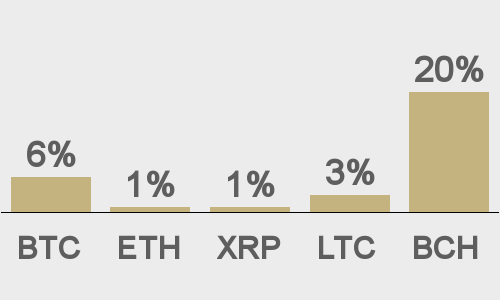

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

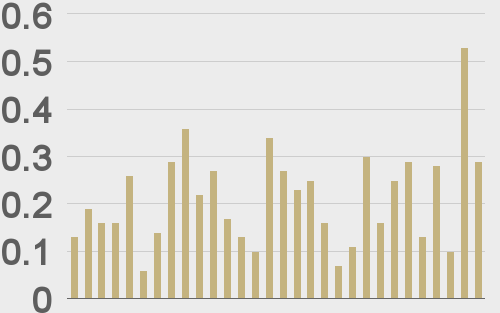

Total volumes last 30 days ($bn) |

||||

|

||||

|

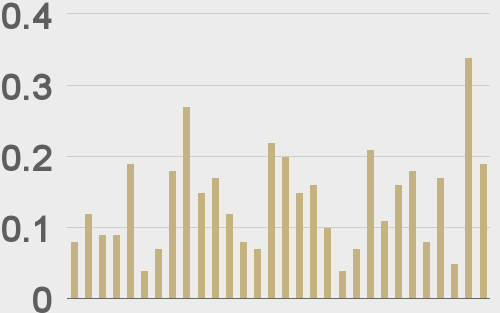

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

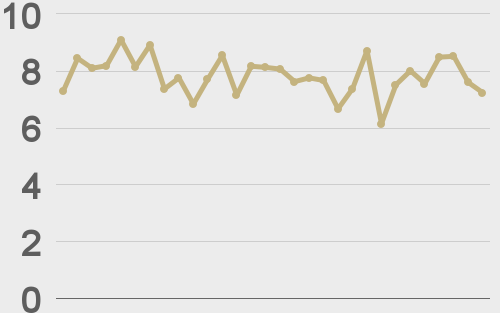

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

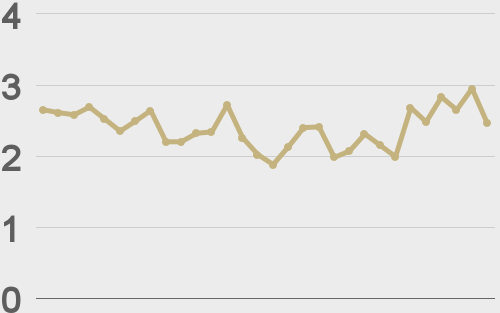

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||