|

|

1 February 2024 Fed decision weighs on crypto assets |

| LMAX Digital performance |

|

LMAX Digital volumes have been lighter in recent days on account of some tight price consolidation. Total notional volume for Wednesday came in at $442 million, 42% below 30-day average volume. Bitcoin volume printed $294 million on Wednesday, 49% below 30-day average volume. Ether volume came in at $93 million, 23% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,182 and average position size for ether at $3,493. Volatility remains elevated overall, but has cooled in recent sessions off of multi-month highs set in January. We’re looking at average daily ranges in bitcoin and ether of $1,552 and $95 respectively. |

| Latest industry news |

|

Wednesday’s Fed decision proved to be a disappointment for investors after the central bank failed to deliver the dovishness the market was looking for. The fallout from the decision has translated to a wave of risk off flow and flight to safety into the US Dollar. And while correlations between crypto and traditional markets have become less relevant, crypto assets aren’t entirely immune. The simplest way to reconcile the weakness is that a stronger US Dollar across the board is a stronger Dollar against all currencies, including cryptocurrencies. Post Fed decision, yield differentials have moved back into the Buck’s favor, which has in turn weighed on crypto assets. And yet, as we’ve highlighted many times in our analysis, crypto’s attractive value proposition should make the asset class a very well supported asset class into any dips, irrespective of any risk off flow that may persist in traditional markets. There’s plenty to look forward to in the months ahead. GBTC bitcoin selling has finally slowed down. The other 9 ETFs are showing positive inflows and will be looking to ramp up promotion efforts. The bitcoin halving event is coming up in Q2, and the SEC is likely to approve ether spot ETFs later this year. Seasonality trends are also supportive, with bitcoin producing net positive returns in the month of February going back to 2016. |

| LMAX Digital metrics | ||||

|

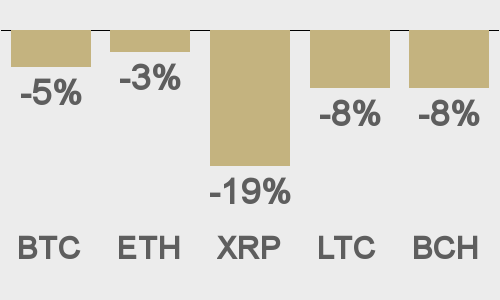

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

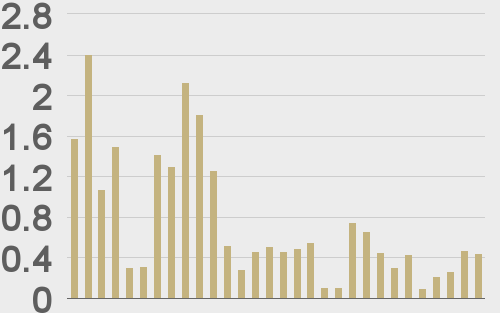

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

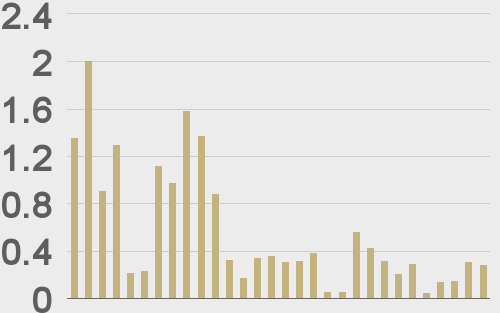

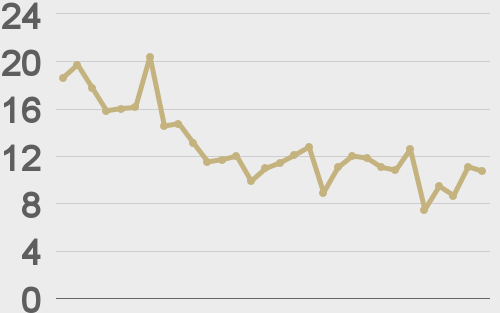

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

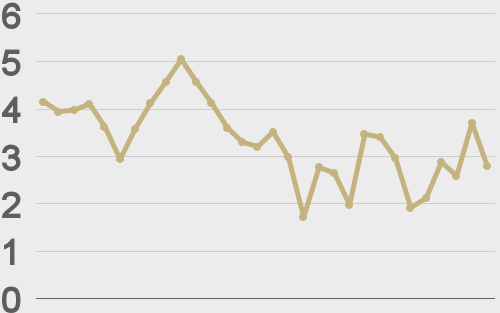

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Matt_Hougan |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||