|

|

2 February 2022 Lots of good news to go round |

| LMAX Digital performance |

|

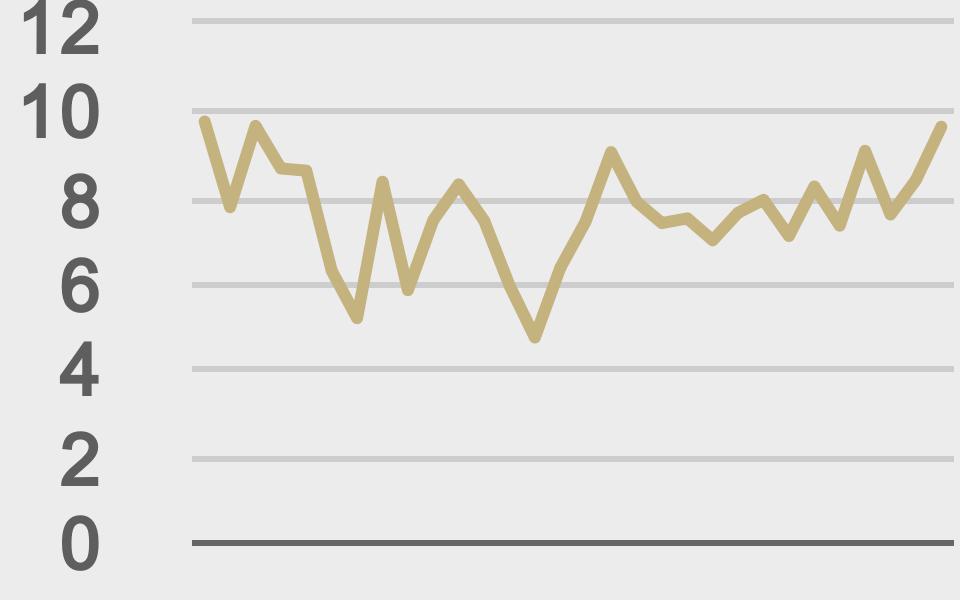

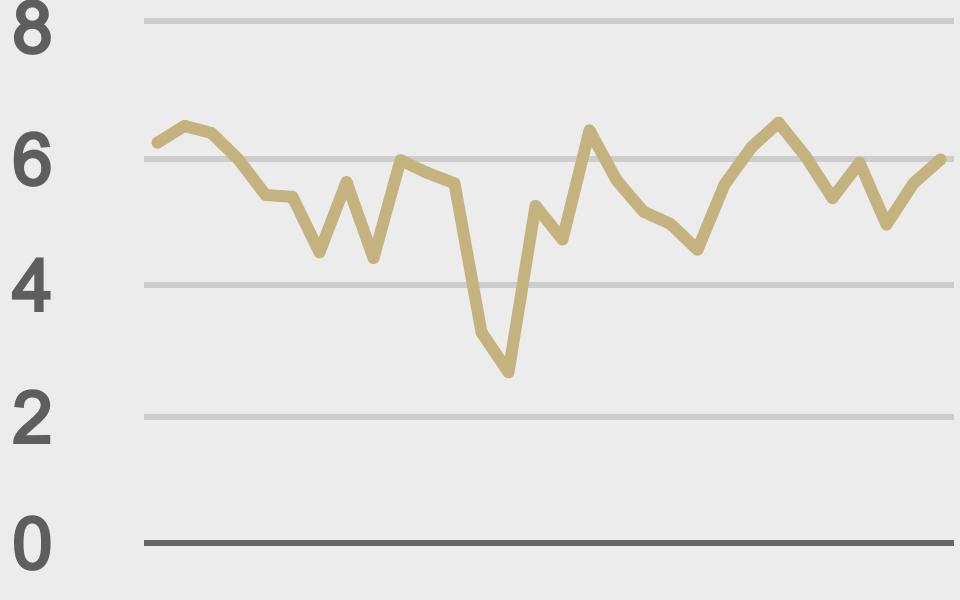

LMAX Digital volume leveled off on Tuesday after a cool start to the week. Total notional volume for Tuesday came in at $729 million, just 5% off of 30-day average volume. Bitcoin volume printed $423 million on Tuesday, 8% above 30-day average volume. Ether volume came in at $231 million, 15% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,626 and average position size for ether at 5,350. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,022 and $205 respectively. |

| Latest industry news |

|

Plenty of news around the crypto space in recent sessions. We’ve heard about the ballooning valuation over at FTX after its latest funding round, and we’ve heard from Morgan Stanley, after the banking giant put out its latest thoughts on the space. All of it clearly positive and reflective of an ongoing mainstream adoption of cryptocurrency and web 3 technology. The biggest downside risk at the moment remains that correlation with global risk sentiment. We don’t think this will stick around much longer, but for the time being it’s still relevant and still needs to be watched. One of the things that’s been helping crypto in recent sessions is a combination of the market now pricing in hawkish Fed bets for 2022, less hawkish words from various Fed officials post FOMC, and indications other central banks won’t be that far away from the Fed when it comes to normalization moves. We also continue to hear about positive developments with respect to regulation and adoption. Having said that, we continue to recommend being prepared for another decent downside move in crypto, and have highlighted bitcoin $25,000 and ether $1,800 as possible downside targets. But we also believe any additional declines below those levels (if we even get there) should be limited, and as such, looking to build exposure into this dip is likely to be a strategy that many adopt. |

| LMAX Digital metrics | ||||

|

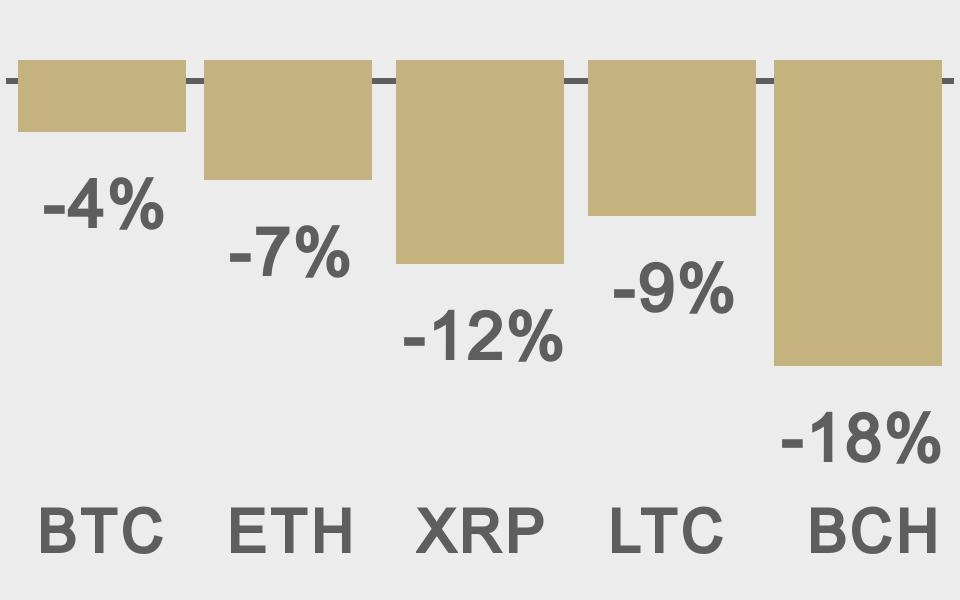

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

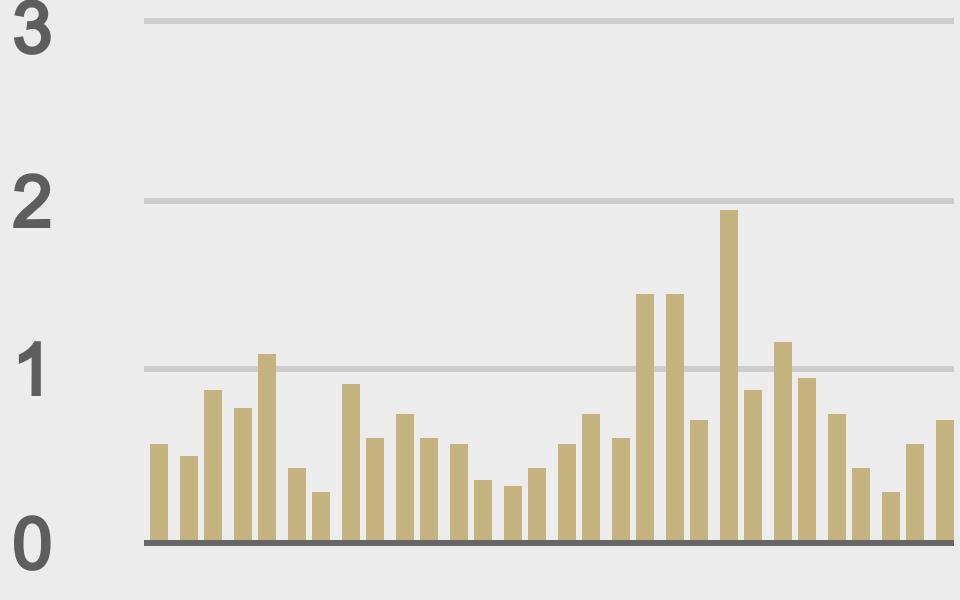

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

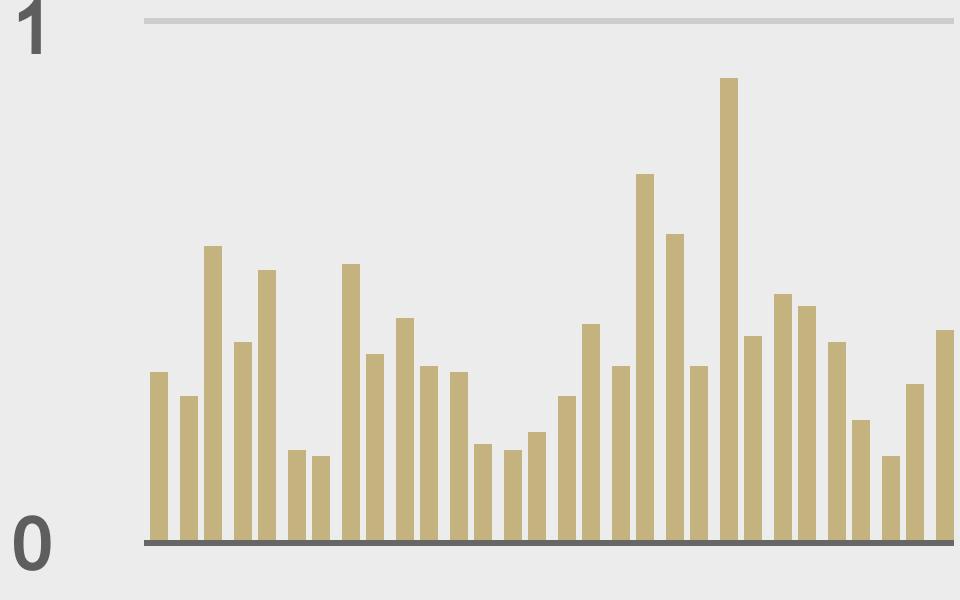

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||