|

|

8 December 2022 Major execs see the bigger picture |

| LMAX Digital performance |

|

LMAX Digital volumes were thin on Wednesday. Total notional volume for Wednesday came in at $155 million, 53% below 30-day average volume. Bitcoin volume printed $85 million on Wednesday, 57% below 30-day average volume. Ether came in at $31 million, 64% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,186 and average position size for ether at 2,128. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $493 and $61 respectively. |

| Latest industry news |

|

Risk assets remain under pressure into the end of the week and the downside pressure on stocks has continued to have a weighing influence. Market conditions are also thinning out quite a bit into year end as traders lighten up activity into the holiday season. There has been a lot of talk around the prospect for deeper setbacks in crypto prices over the coming weeks, as investors continue to contend with challenges from the global macro front, disruption within the space and worry about aggressive regulatory crackdown. At the same time, even the players recognizing the possibility of lower prices are ultimately quite bullish on the outlook for crypto, which is highly encouraging. As per yesterday’s note, Goldman Sachs said it was looking to spend tens of millions of dollars on crypto firms whose valuations have been hit hard by FTX’s implosion. Mark Conners, head of research at digital asset manager 3iQ, notes encouragingly that institutions have been “doubling down on the promise of blockchain and digital assets, despite the FTX filing for Chapter 11 bankruptcy protection and other contagion.” BlackRock CEO Larry Fink’s has offered up favorable comments on the potential of DeFi, and BNY Mellon CEO Robin Vince has called for an embrace of digital asset innovation, while seeing a clear path forward for the space. |

| LMAX Digital metrics | ||||

|

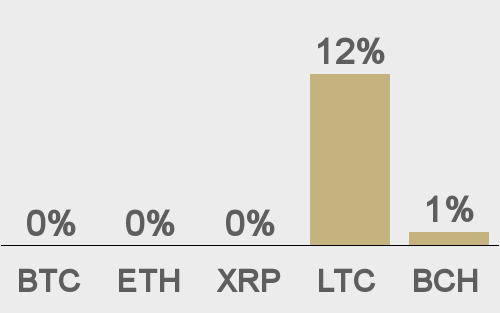

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

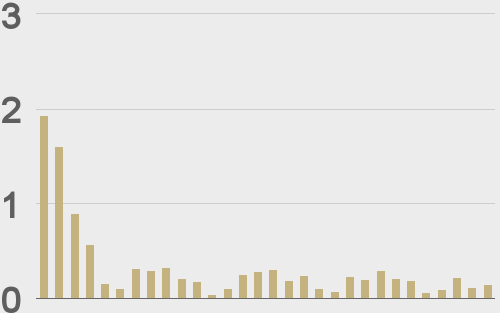

Total volumes last 30 days ($bn) |

||||

|

||||

|

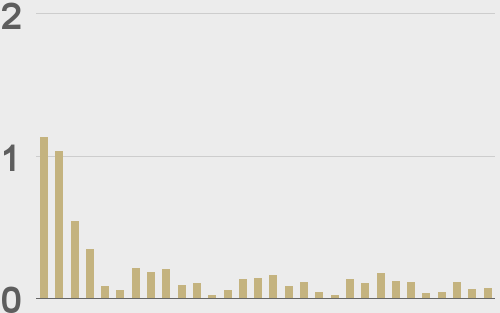

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

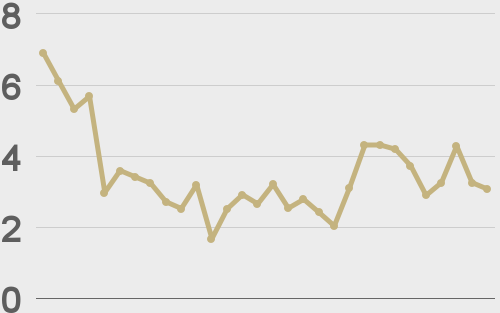

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

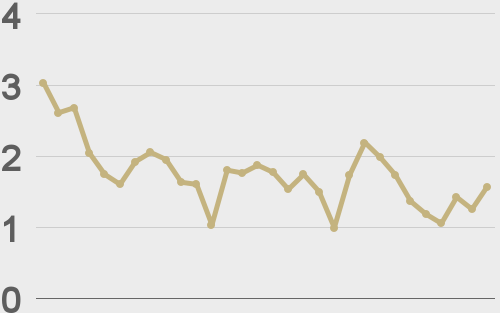

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||