|

|

1 September 2022 Monthly review and outlook |

| LMAX Digital performance |

|

LMAX Digital volumes headed south on Wednesday. Total notional volume for Wednesday came in at $383 million, 21% below 30-day average volume. Bitcoin volume printed $200 million on Wednesday, 27% below 30-day average volume. Ether volume came in at $152 million, 11% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,155 and average position size for ether at 3,130. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $890 and $111 respectively. |

| Latest industry news |

|

All the market optimism that we had seen in July faded away in August. There had been hope that a bottom for the crypto market had been firmly established in June following an impressive recovery in July. But August has cast serious doubts on this prospect. Bitcoin was off some 14% in the month of August, while ether was down around 8% on the month. The bearish performance in August was largely attributed to macro forces, with the Federal Reserve’s unwavering commitment to a higher for longer monetary policy track shaking up risk assets, while opening broad outperformance in the US Dollar. And as has been the case, with crypto assets being treated as emerging market assets, crypto was also exposed. Looking ahead, all signs now point to what could be another ugly month. We believe there is risk for more capitulation in US equities as valuations become far less attractive on account of higher rates, and a weaker outlook for the global economy. This fallout could very well add enough pressure on crypto assets to result in fresh yearly lows for bitcoin and ether. As per our technical consideration, should we see a drop to a fresh yearly low in the price of bitcoin, this could open the door for a deeper drop towards $10k. Seasonality trends are certainly supportive of this case. The month of September has produced negative returns over the past 7 years, with the last 5 years of September performance all negative. Still, there are many positives out there to leave the market with plenty of confidence with respect to the outlook beyond short-term hiccups. Volumes have been picking back up ever so slightly after an anemic start to 2022. We have also talked at length about our view that we are getting closer to levels where correlations with risk sentiment will fade away, with bitcoin leading the charge back to the topside on recognition of the asset as a highly attractive store of value. Institutional adoption is also alive and well, despite the market environment. Those players that have already dipped in will be looking to increase exposure at attractive levels. New players that have been monitoring the space and that have committed to taking on exposure will also be excited to take advantage of the crypto market dip. Finally, the market will be focused on the highly anticipated Ethereum merge. There have been many discussions around risks associated with the merge, especially in the aftermath of the Tornado Cash story. But on the whole, the merge is expected to result in a substantial upgrade that will bring about many exciting rewards including a more scalable and secure network. |

| LMAX Digital metrics | ||||

|

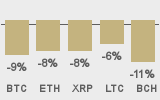

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

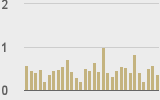

Total volumes last 30 days ($bn) |

||||

|

||||

|

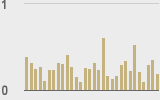

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||