|

|

24 January 2024 Putting the pullback in context |

| LMAX Digital performance |

|

LMAX Digital volumes were off overall on Tuesday, though we did get some mixed results. Total notional volume for Tuesday came in at $663 million, 18% below 30-day average volume. Bitcoin volume printed $427 million on Tuesday, 30% below 30-day average volume. Ether volume however was impressive, defying the daily trend, coming in at $178 million, 49% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $15,149 and average position size for ether at $3,736. Volatility remains elevated overall, tracking just off recent multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $1,752 and $112 respectively. |

| Latest industry news |

|

On Tuesday, we highlighted the primary drivers behind this latest round of setbacks in crypto assets. These included unwinding of GBTC positions, FTX bankruptcy estate selling, broad US Dollar demand, and bitcoin’s break below $40k. And while it’s possible we see setbacks extend further, we also expect the weakness to be exceptionally well supported into additional dips ahead of the next big run to the topside. It’s important to understand that bitcoin had enjoyed an aggressive run to the topside that began in September before finally topping out at its highest level since December 2021 earlier this month. The reason we bring this up is that the price was already looking due for some form of a correction after a big surge, irrespective of the fundamentals. After all, this is the way of markets – never only up, but higher in a pattern of higher highs and higher lows. And so, right now, we’re in a correction phase, with that next higher low sought out ahead of a bullish continuation. Fundamentally speaking, it will take a little time before financial advisors are able to get traditional investors more familiar with the benefits of crypto. But we don’t expect this will take too long and anticipate wider spread adoption on the back of the ETF approvals to come over the coming weeks and months. Our biggest concern at the moment is risk for a major liquidation in US equities and potential negative impact it could have on crypto assets. Stocks have been running to record highs on a daily basis, and we worry there could be a big pullback on the horizon. Having said that, we were specific in using the word ‘potential’ above as there is a compelling argument to be made for bitcoin demand as a flight to safety asset in periods of risk off. Moreover, in recent months, correlations with stocks have been less apparent. Still, we believe an intensified retreat in US equities could open some selling in crypto from participants who view the space as a risk correlated emerging asset class. Should this play out, it could open a deeper correction towards a more significant level of support for bitcoin we highlighted on Tuesday, which comes in around $32k. We believe if we do see weakness towards this level, it will also be a warning sign that we are close to the next meaningful low and getting ready for a return to the topside. We certainly don’t expect bitcoin to be trading below $30k for any meaningful period of time in 2024. |

| LMAX Digital metrics | ||||

|

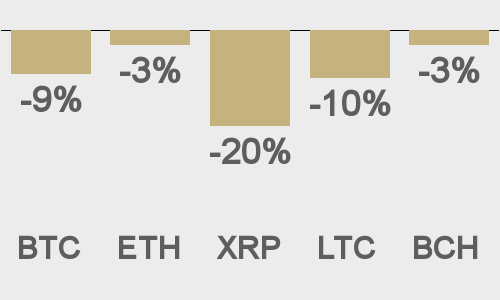

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

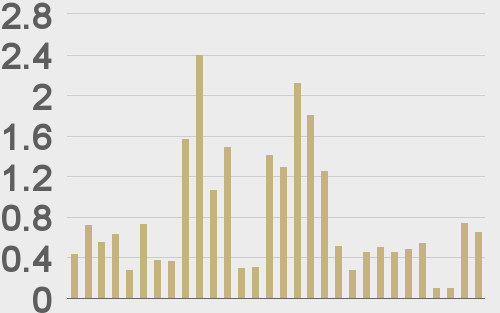

Total volumes last 30 days ($bn) |

||||

|

||||

|

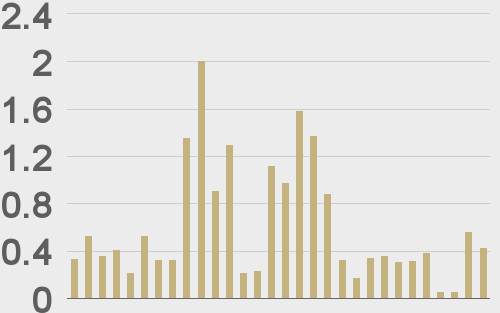

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

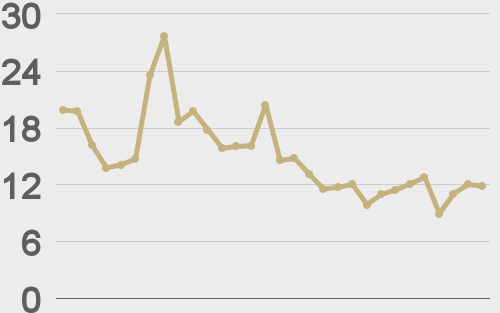

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

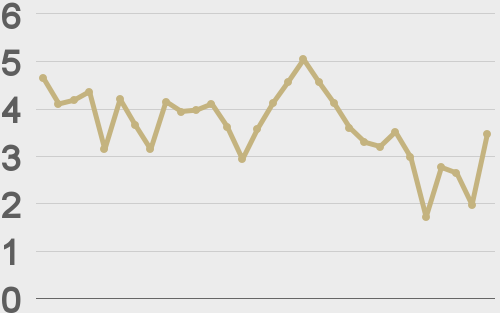

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||