|

|

19 May 2025 Shaky start to week as macro pressures weigh |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $3.1 billion, 16% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.38 billion, fractionally outpacing the previous week. Ether volume came in at $674 million, 6% higher than the week earlier. Total notional volume over the past 30 days comes in at $12.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,525 and average position size for ether at $2,143. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility has been surging, nearly doubling since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,862 and $158 respectively. |

| Latest industry news |

|

The crypto market is starting the week under modest pressure, with bitcoin reversing course and gravitating back towards $100,000 after stalling out ahead of the record high. The price action suggests short-term caution among traders, driven by recent macro jitters and heavy liquidations, alongside expectations of heightened volatility from upcoming US economic data. Global macro factors are contributing to the unease, as traditional markets react to Moody’s downgrade of the US credit rating to Aa1, pushing the US dollar lower and US stock futures, particularly the Nasdaq into the red. Uncertainty around President Trump’s tariff policies and their impact on global growth, coupled with softer-than-expected US retail sales and PPI data, are weighing on risk assets, including crypto. Despite the pressure, the crypto market remains resilient overall, with bitcoin still holding above $100,000 and ETH coming off its best weekly performance since 2021, supported by strong on-chain accumulation and record ETF demand. The market’s ability to weather April’s tariff-driven selloff, combined with a fear-and-greed index signaling sustained optimism, suggests setbacks are likely to find strong support into these dips. Encouraging developments bolster the outlook, notably Coinbase’s inclusion in the S&P 500, effective today, marking a milestone for crypto’s mainstream acceptance and driving a 24% surge in its stock price. Additionally, the SEC’s new chair, Paul Atkins, has outlined plans for clearer crypto token regulations, potentially easing compliance burdens and fostering institutional adoption. Looking ahead, markets will focus on the Eurozone’s April CPI and the US leading index for further clues on global economic health, while crypto-specific catalysts like ETF flows and Asian currency appreciation talks could support sentiment. |

| LMAX Digital metrics | ||||

|

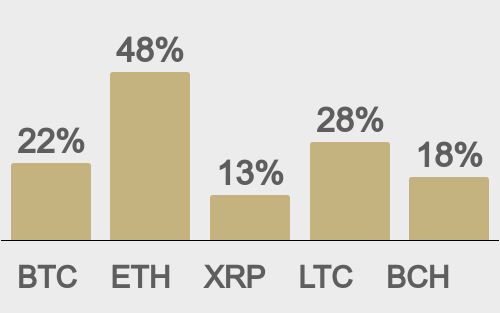

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

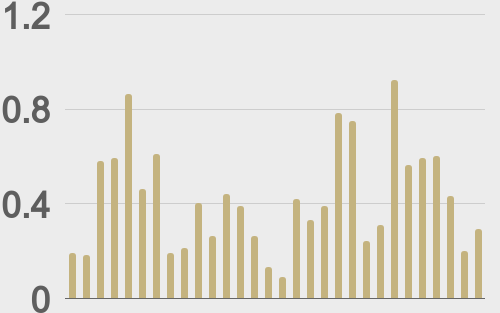

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

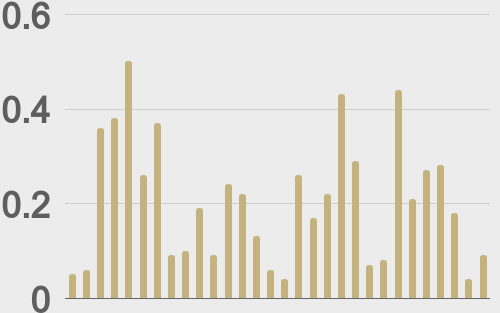

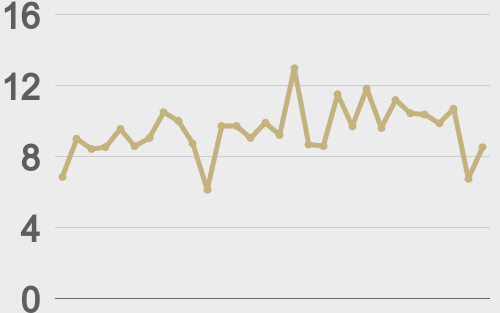

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

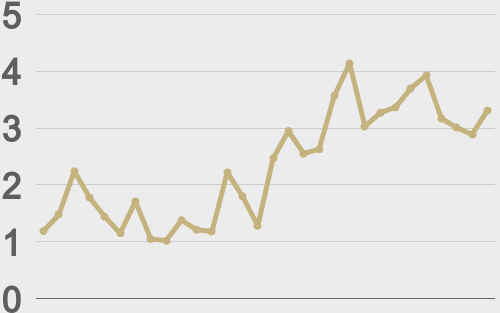

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||