|

|

15 February 2024 Takeaways from this week’s crypto performance |

| LMAX Digital performance |

|

LMAX Digital volumes have been impressive all week. Total notional volume for Wednesday came in at $605 million, 54% above 30-day average volume. Bitcoin volume printed $349 million on Wednesday, 44% above 30-day average volume. Ether volume came in at $190 million, 94% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,439 and average position size for ether at $3,222. Volatility has been turning back up after dropping by more than 40% from the January peak. We’re looking at average daily ranges in bitcoin and ether of $1,622 and $92 respectively. |

| Latest industry news |

|

This week has been an impressive week for crypto assets. On the surface, the price action alone speaks for itself. Bitcoin has traded to its highest level since November 2021, while ether has broken out as well, trading to its highest level since May 2022. But upon closer glance, the price action is even more impressive when considering what’s actually been going on. The first thing worth highlighting is the fact that when traditional risk assets came under intense pressure earlier in the week post US CPI, crypto assets were resilient. The reason this is important is that it sends a message to traditional players that crypto assets are uncorrelated to traditional assets, making them extremely attractive as a portfolio diversification asset. The fact that we’re seeing plenty of demand for ether is another important takeaway as it reflects an underlying recognition of the disruptive nature of the crypto space overall and all of the untapped potential that lies within. It’s also been impossible to ignore the ongoing inflows we’re seeing into the bitcoin spot ETFs. Bitcoin has become one of the most attractive assets on the planet. And as far as traditional market participant exposure goes, we’re only just getting started. As we come into the end of the week, global sentiment has once again turned back to the topside, which certainly shouldn’t be a hinderance to the crypto market. We believe investors were relieved by Wednesday’s softer US producer prices data, which has given them an excuse to be getting back to pricing in more investor friendly monetary policy in 2024. |

| LMAX Digital metrics | ||||

|

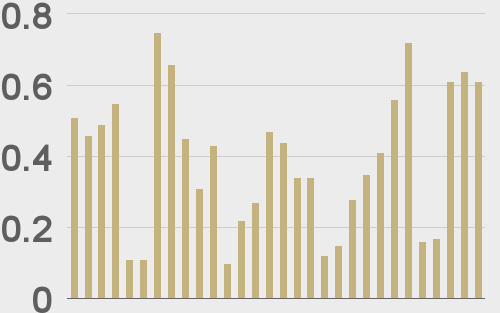

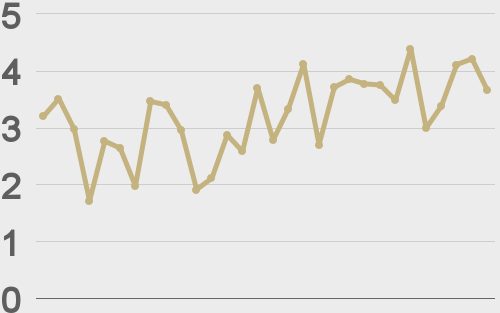

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

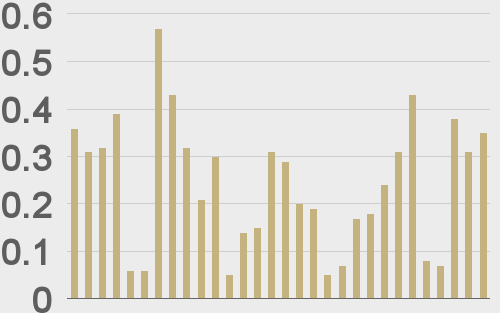

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

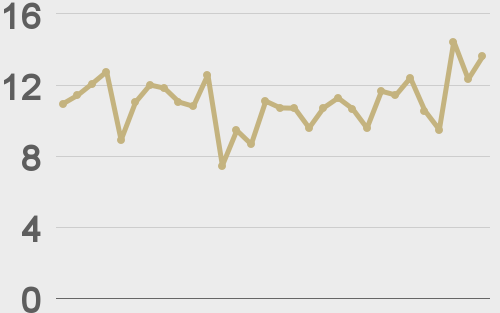

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||