|

|

29 January 2024 Volumes improve in previous week |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital recovered in the previous week off monthly low levels from a week earlier. Total notional volume from last Monday through Friday came in at $2.6 billion, 5% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.8 billion in the previous week, 6% higher than the week earlier. Ether volume came in at $528 million, 18% higher than the week earlier. Total notional volume over the past 30 days comes in at $23 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,673 and average position size for ether at $3,556. Volatility has come off after trading to multi-month highs earlier this month. We’re looking at average daily ranges in bitcoin and ether of $1,586 and $95 respectively. |

| Latest industry news |

|

We’ve been seeing a nice recovery in bitcoin and crypto assets in recent sessions. The wave of selling-the-fact in the aftermath of the bitcoin spot ETF approvals is behind us and the market has managed to catch its legs. A lot of the selling we had seen had also come from what had been an anticipated healthy run of bitcoin outflows on the back of the exodus from Grayscale’s GBTC. Now that this has mostly played out, we’re once again getting glimpses of what should be a more consistent bout of healthy demand in 2024. Technically speaking, while bitcoin did break down below $40k in the previous week, the market did not want to settle below the psychological barrier on a weekly close basis, which has kept the structure constructive and looking higher. Still, we wouldn’t rule out the possibility for another dip in 2024. But if we do see such a dip, we expect it will be limited to the $30k area and do not see bitcoin below $30k for any meaningful period of time. Fundamentally, we expect there will be a large effort on behalf of the ETFs to start promoting bitcoin to clients over the coming week’s and months. As these clients become more educated, we should start to see this translate to a healthy appetite for bitcoin and other crypto assets. Our biggest concern for bitcoin at the moment comes from the outlook for Fed policy and the potential negative impact it could have on global risk appetite. Economic data out of the US has been stronger of late and does not necessarily justify the aggressive rate cut schedule the market has been pricing in 2024. Should we see market expectations let down and the Fed turn back towards less accommodative policy, it could act as a catalyst for an intense wave of risk off flow, which in turn, could open the door for some downside pressure on bitcoin. However, it’s important to highlight the fact that any such downside pressure will only come from crypto market participants who are invested because they view the asset class as an emerging, risk correlated asset class. We believe bitcoin’s value proposition justifies plenty of demand in periods of risk off, given its highly attractive properties as a store of value asset, something that should ultimately translate to even more buying on any dips we do see from a possible capitulation in US and global equities. |

| LMAX Digital metrics | ||||

|

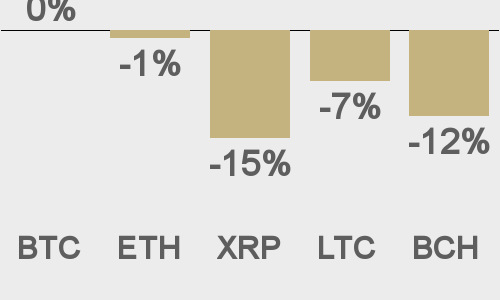

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

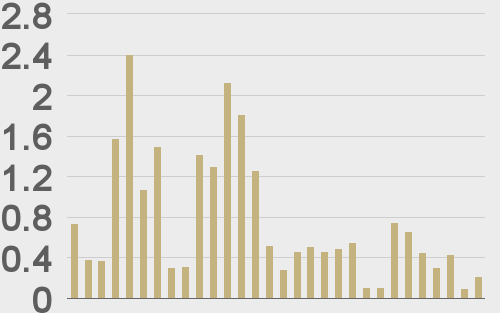

Total volumes last 30 days ($bn) |

||||

|

||||

|

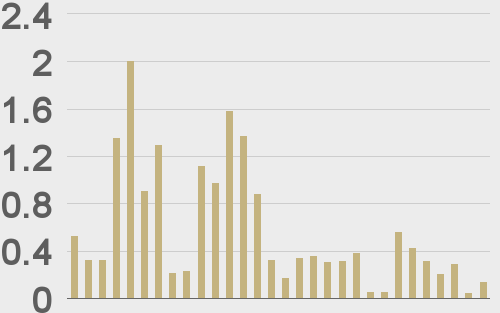

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

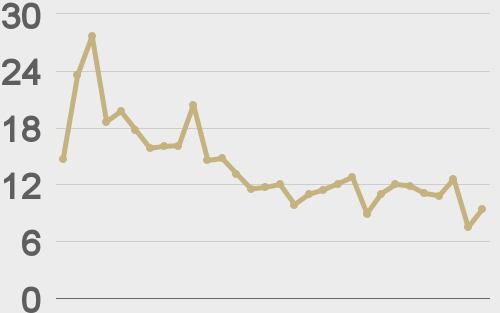

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

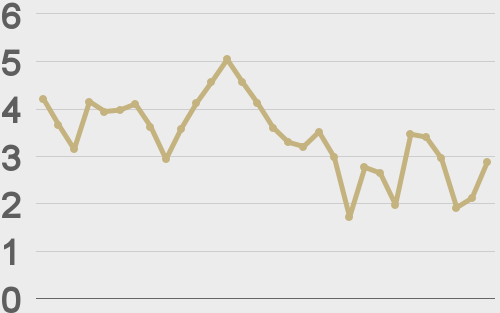

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||