|

|

24 May 2023 Waiting for that range break |

| LMAX Digital performance |

|

LMAX Digital volumes improved nicely from Monday’s lackluster day, though still remained below 30-day average volume. Total notional volume for Tuesday came in at $314 million, 22% below 30-day average volume. Bitcoin volume printed $157 million on Tuesday, 34% below 30-day average volume. Ether volume did however impress, printing $119 million, 8% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,541 and average position size for ether at 2,866. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $806 and $58 respectively. |

| Latest industry news |

|

Price action continues to be quite choppy and frustrating. On Monday, it looked like we were on the verge of seeing a bullish breakout, before the rally stalled out ahead of key resistance, reversing course on Tuesday. And so, overall, no change to the short-term outlook as per our technical update, with a break of highlighted resistance or support in the price of bitcoin needed to determine in which direction that next meaningful move plays out. Fundamentally, we had seen some early demand on Tuesday, perhaps on the back of the announcement from Hong Kong regulators around the official approval for retail investors to start trading crypto. Michael Saylor was also out doing his thing to support the market, talking about how he believed bitcoin had bottomed out and that the current recovery from the yearly low is the start to the new bull run given the bitcoin halving, more adoption of the crypto asset, and a regulatory crackdown on the industry. But ultimately, it seems the intense wave of risk off flow in global markets, driven off rising US yields and renewed worry the Fed would need to be more aggressive with rate hikes, has been what’s opened the door for this latest bout of downside pressure on crypto. Looking ahead, the big calendar of the event of the day comes late in the form of the Fed Minutes. Any new insights we get from the Minutes could have a spillover impact on crypto. |

| LMAX Digital metrics | ||||

|

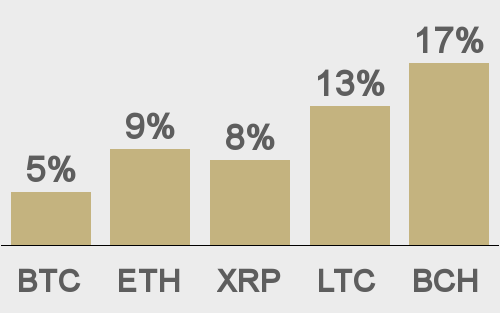

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

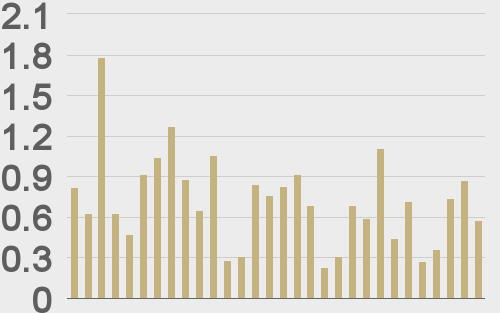

Total volumes last 30 days ($bn) |

||||

|

||||

|

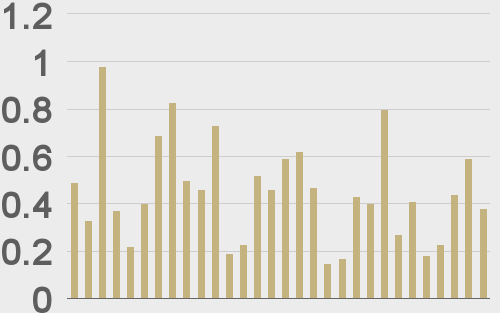

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

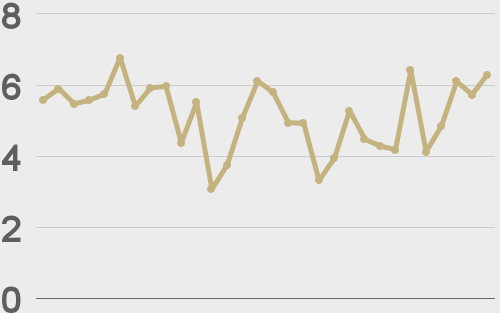

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

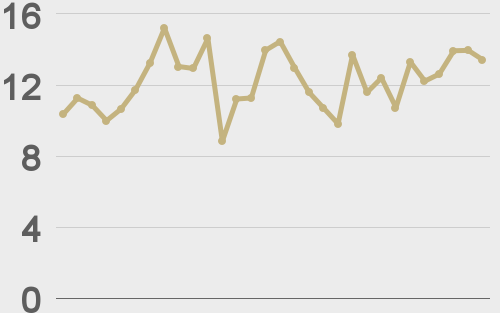

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@leomschwartz |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||