|

|

5 October 2023 Why ether is underperforming relative to bitcoin |

| LMAX Digital performance |

|

LMAX Digital volumes were lower than Tuesday, but still managed to hold well above 30-day average volumes. Total notional volume for Wednesday came in at $261 million, 20% above 30-day average volume. Bitcoin volume printed $157 million on Wednesday, 12% above 30-day average volume. Ether volume came in at $74 million, 27% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,837 and average position size for ether at $2,422. Volatility continues to consolidate just off the August low levels. We’re looking at average daily ranges in bitcoin and ether of $641 and $43 respectively. |

| Latest industry news |

|

There are a couple of noteworthy updates within the crypto space over the past 24 hours or so. The first is the underperformance in ether relative to bitcoin, with ether trading just off the recent yearly low against bitcoin. We believe a lot of the relative weakness has come from risk off flow in global markets, with ether more sensitive to investor appetite given the nature of the risk correlated projects on the blockchain. We also see additional weakness coming from disappointment around the launch of the ether futures ETFs. These ETFs have been introduced with exceptionally low volume, which has caused some reason for concern. We don’t believe the market should be worrying about this too much and fully expect these volumes to pick up as the market matures. But for the time being, this could be adding to some of the downside pressure on ether. Another notable update comes from US Congress where Kevin McCarthy has been removed as Speaker and temporarily replaced by Patrick McHenry. The reason this is noteworthy is because McHenry has been a friend to the crypto space. The House Speaker holds considerable power in shaping legislative agendas, so this could result in more positive headway for crypto assets from the US regulatory front. Moving on, it’s worth reminding that October has been an exceptional month of performance for crypto assets. This could set the stage for some impressive gains over the coming weeks, especially considering how well bitcoin has been supported into $25k. |

| LMAX Digital metrics | ||||

|

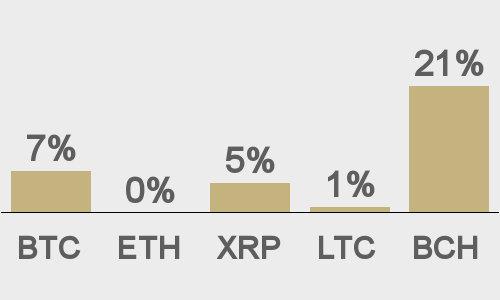

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

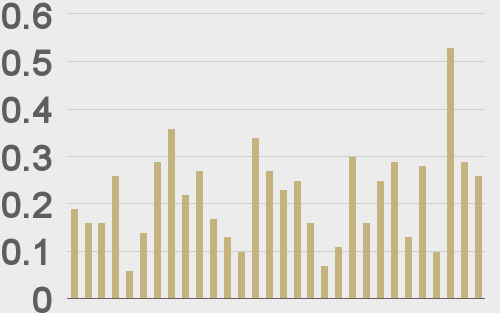

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

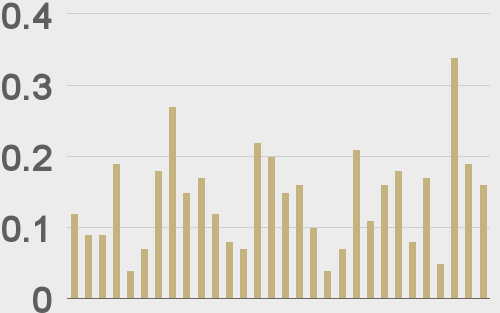

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

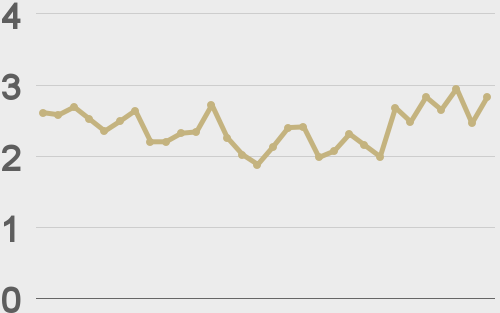

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

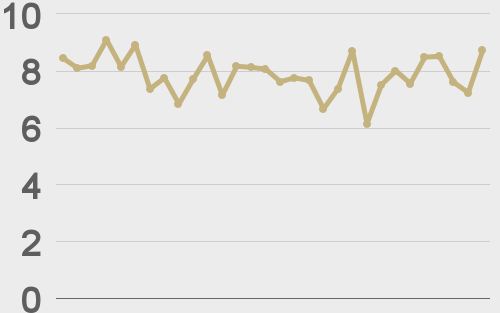

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||