|

|

1 March 2022 Confined to January range |

| LMAX Digital performance |

|

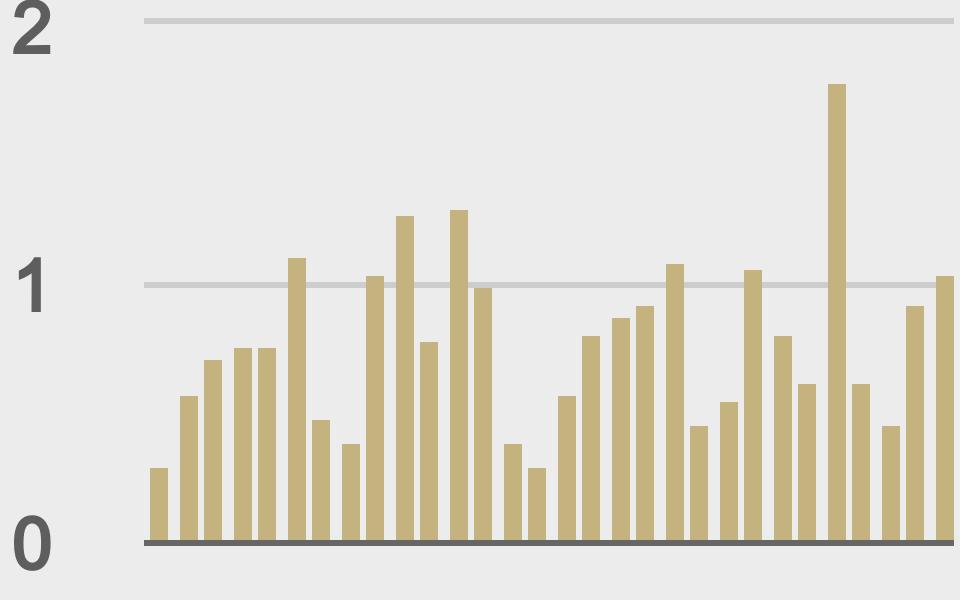

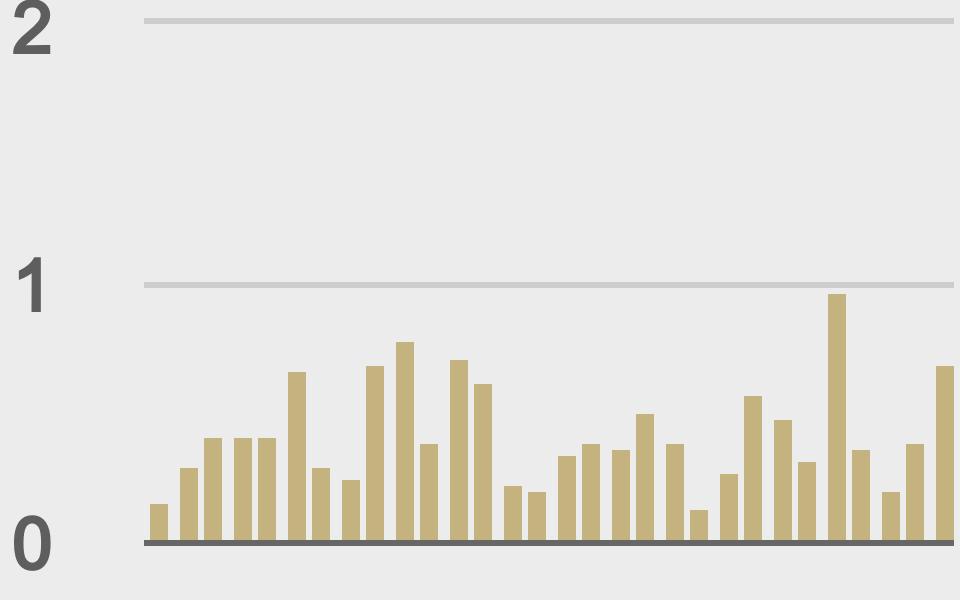

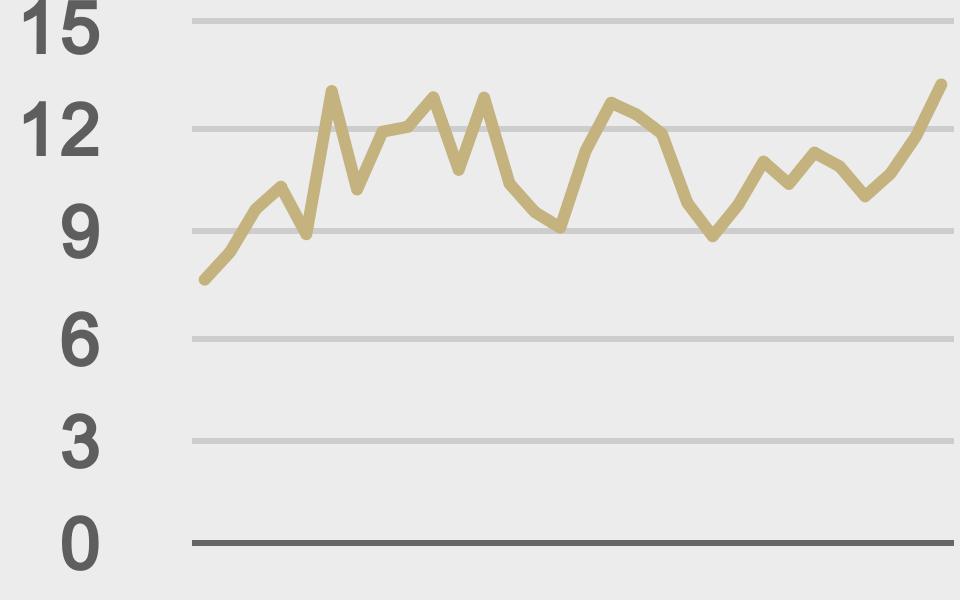

LMAX Digital volume got off to a good start to the week. Total notional volume for Monday came in at $1 billion, 30% above 30-day average volume. Bitcoin volume printed $686 million on Monday, 56% above 30-day average volume. Ether volume came in at $258 million, 11% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,756 and average position size for ether at 6,632. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,469 and $220 respectively. |

| Latest industry news |

|

There wasn’t a whole lot of interesting market activity in February, with both bitcoin and ether closing out the month moderately higher thanks to a late surge. If there was one interesting takeaway, perhaps it was the fact that crypto assets did manage to outperform stocks, with US equities decidedly lower in February. Though we did see downside pressure on crypto resulting from the profit taking in equities, there were signs of other factors at play towards the end of the month, which reaffirmed our core bias that crypto correlating with risk off is nothing more than a short-term phenomenon. We believe a lot of this had to do with the move higher in gold and many market participants recognizing what is expected to be a closer correlation with the yellow metal given the similar property as a limited supply asset. This holds especially true with respect to bitcoin, but can else be extended to ether as well. Of course, none of this changes the fact that whatever the driver of crypto right now, it seems to be coming from traditional market forces, with global macroeconomics and geopolitical risk playing their part. Looking ahead, we suspect this will continue to be the case in March. We think crypto will be looking to these developments around geopolitical risk and central bank outlooks for its cues and will be less reactive to any crypto specific fundamentals. At the same time, we believe we are getting closer to the point in which bitcoin and ether track higher again as medium and longer-term players look to build exposure at more attractive levels. |

| LMAX Digital metrics | ||||

|

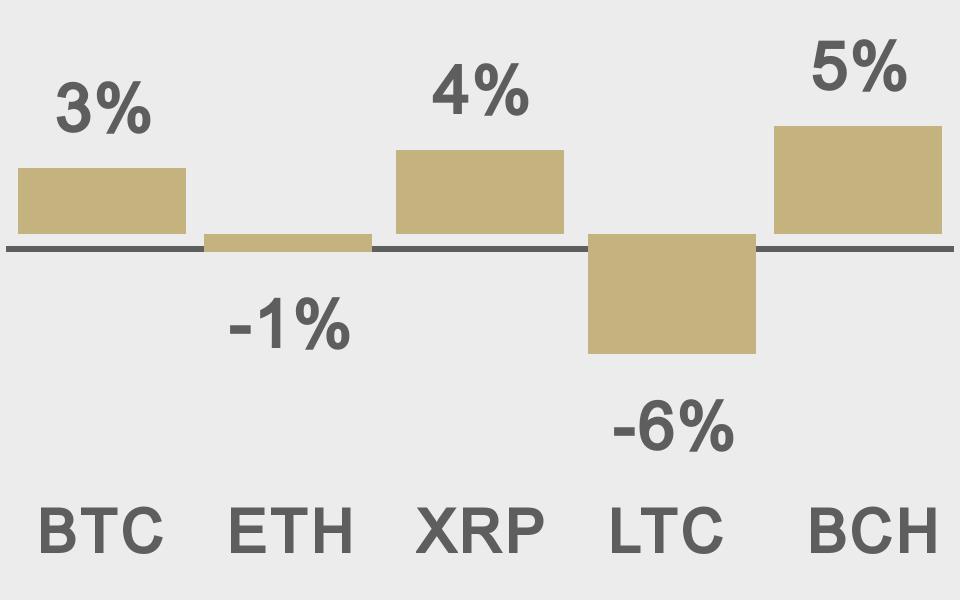

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

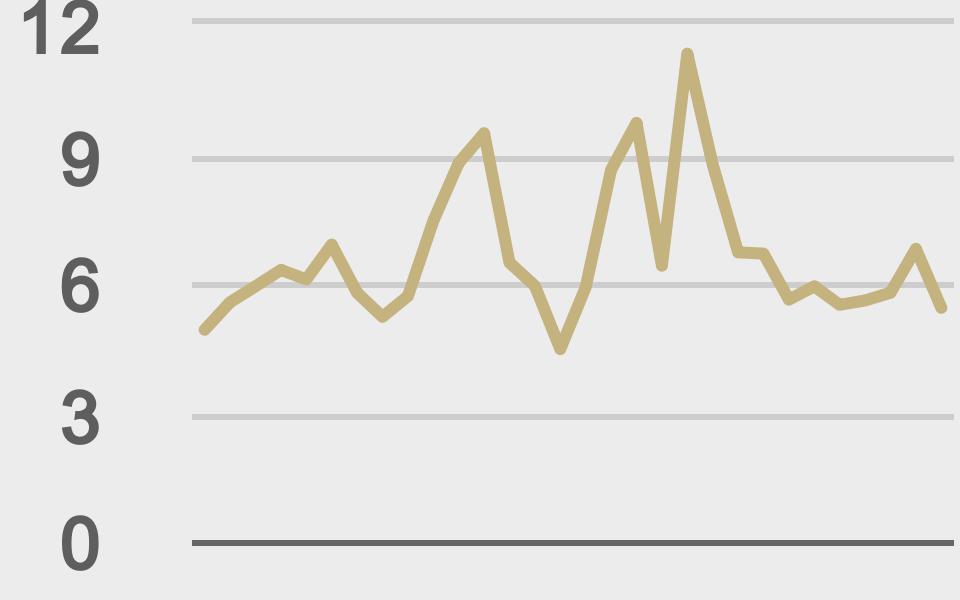

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||