|

|

8 March 2023 Bitcoin volume up, Ether volume down |

| LMAX Digital performance |

|

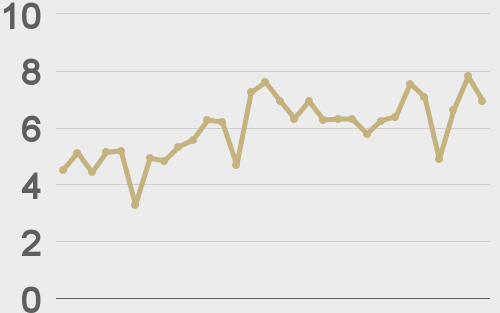

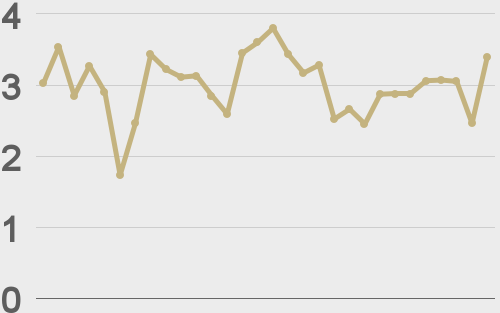

LMAX Digital volumes improved from Monday, pushing back towards 30-day average volume. Total notional volume for Tuesday came in at $364 million, just 5% below 30-day average volume. Volumes were however inconsistent, with bitcoin up and ether down. Bitcoin volume printed $232 million on Tuesday, 11% above 30-day average volume. Ether volume printed $69 million, 34% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,043 and average position size for ether at 3,048. Volatility has come off recent highs but still sits well off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $774 and $59 respectively. |

| Latest industry news |

|

The other day, we talked about how crypto assets weren’t hit as badly on the Silvergate fallout given a recent surge in US equities. But into Wednesday, the picture has changed. Perhaps the market is feeling just a little less uneasy about Silvergate. At the same time however, things have deteriorated in global markets after the Fed Chair not only retained his hawkishness in Tuesday testimony, but managed to exceed it. Powell said the Fed was prepared to speed up rate hikes if necessary and that the ultimate peak was likely higher than expected. This had the market responding with a push higher in the odds for a 50 basis point rate hike this month, now standing at around 50%. And naturally, as a consequence, yield differentials moved further in favor of the US Dollar, with currencies, including cryptocurrencies, suffering as a consequence. As we look at the technical picture, the next two bitcoin support levels to keep an eye on are the February low and the January 18 low. A break of these two levels would then open the door for an even deeper setback below $20k Looking at today’s calendar, the Fed Chair is once again the highlight, as he steps in to offer testimony, this time before the House Financial Services Committee. |

| LMAX Digital metrics | ||||

|

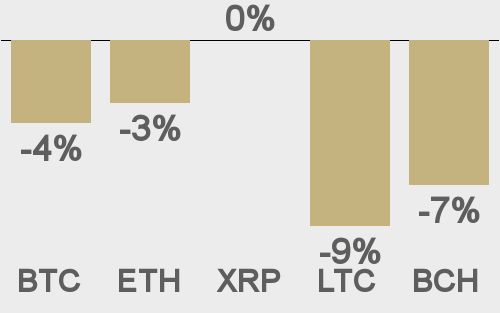

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

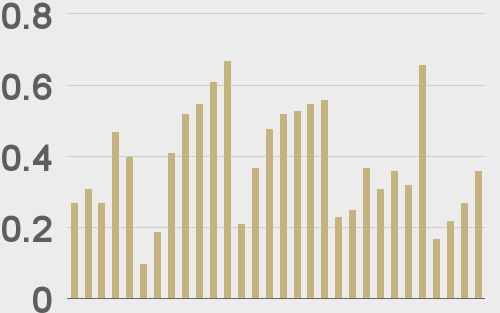

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

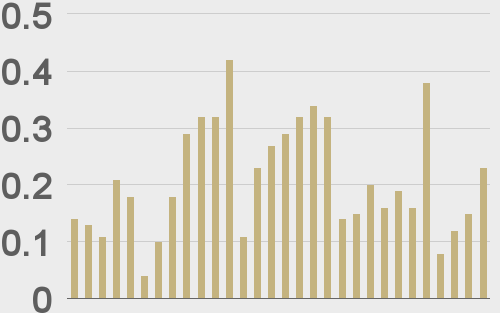

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@jeffjohnroberts |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||