|

|

17 April 2023 Volume up a healthy amount in previous week |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was up a nice amount in the previous week from a week earlier. Total notional volume from last Monday through Friday came in at $2.5 billion, 22% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.45 billion in the previous week, 24% higher than the week earlier. Ether volume came in at $720 million, 29% higher than the week earlier. Total notional volume over the past 30 days comes in at $13.24 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,345 and average position size for ether at $3,188. Volatility has come back down quite a bit after recently trading up to yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $909 and $74 respectively. |

| Latest industry news |

|

Bitcoin’s ability to hold up around $30,000 has been most impressive, especially in the face of this latest resurgence in broad based US Dollar demand. On Friday, we saw US bank earnings come in better than expected, and we saw Fed Waller out on the wires with hawkish comments, both of which fueled a broad based recovery in the Buck. And yet, bitcoin and ether remained resilient despite this price action. Technically speaking, as per our update in today’s chart analysis, the momentum remains firmly on the topside, with bitcoin’s next big target coming in the form of the June 2022 high just shy of $32,000. We continue to see the fallout in the traditional banking system as a critical narrative inviting more demand for bitcoin in recent weeks, and we believe this will continue to support the asset for the remainder of the year. It’s also worth noting some positives from the Ethereum side, after market concerns around Ethereum staking withdrawals in the aftermath of the latest upgrade proved to be highly overstated. Data actually showed most stakers only withdrawing from earned rewards, instead opting to leave the majority of their staked positions locked in, in the interest of benefiting from continued rewards. |

| LMAX Digital metrics | ||||

|

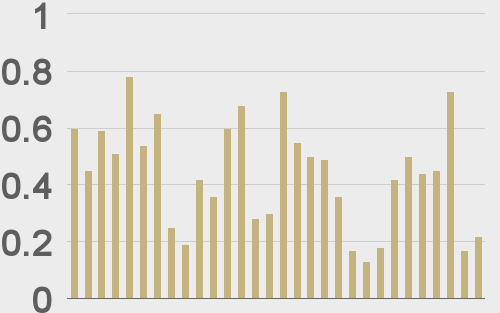

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

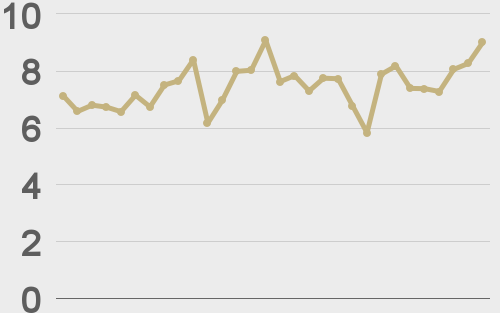

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

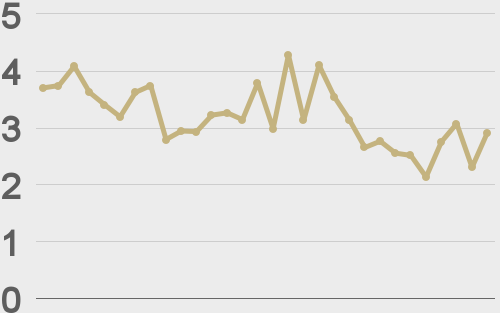

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||