|

|

11 May 2023 Big rebound in volume |

| LMAX Digital performance |

|

LMAX Digital volumes rebounded impressively on Wednesday. Total notional volume for Wednesday came in at $696 million, 51% above 30-day average volume. Bitcoin volume printed $388 million on Wednesday, 43% above 30-day average volume. Ether volume printed $213 million, 62% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,617 and average position size for ether at 2,766. Volatility has been in correction mode after peaking out at a yearly high in March, though we are seeing signs of volatility turning back up again. We’re looking at average daily ranges in bitcoin and ether of $1,024 and $76 respectively. |

| Latest industry news |

|

We’re actually a little surprised to see crypto assets continuing to trade with a heavy tone into Thursday. Fundamentally, we would have thought things would be looking up a little more in the aftermath of Wednesday’s US economic data. On Wednesday, US CPI came in softer than expected overall, which helped to drive risk sentiment, while also pushing yield differentials out of the US Dollar’s favor. While there was some support from the data, in the end, bitcoin and ether closed out unchanged on the day. We also saw downside pressure on bank stocks into the end of the day, yet another supportive driver of cryptocurrencies in recent weeks. But in the end, both bitcoin and ether are flirting with important short-term support levels, that if broken, could open a more sizable pullback. As per our technical insights, there is risk we see a deeper drop in bitcoin that takes the price back down into the $22,000 area. But we also believe that should be the extent of any additional declines in 2023, with the greater risk favoring a higher low and bullish continuation back through the yearly high. The biggest concern in the space right now is the lack of regulatory clarity, something that could very well be weighing on crypto sentiment. Market participants have grown increasingly frustrated on this front, particularly in the United States. Still, we are confident clarity will ultimately be given and will help to drive things forward and accelerate adoption looking out into the fourth quarter and into 2024. |

| LMAX Digital metrics | ||||

|

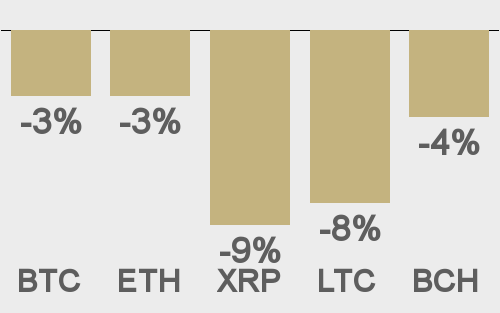

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

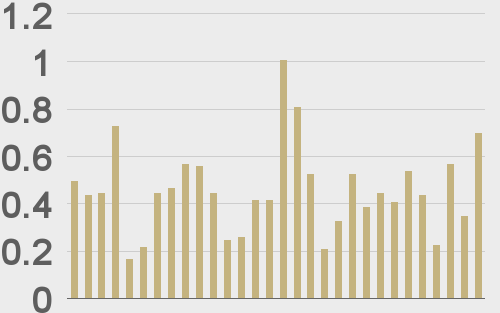

Total volumes last 30 days ($bn) |

||||

|

||||

|

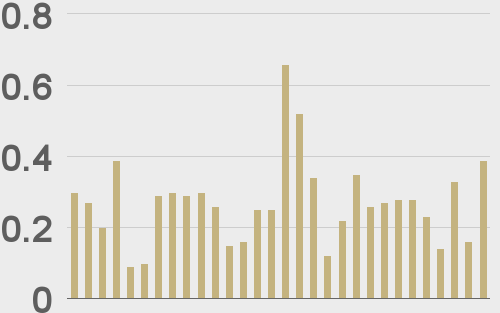

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

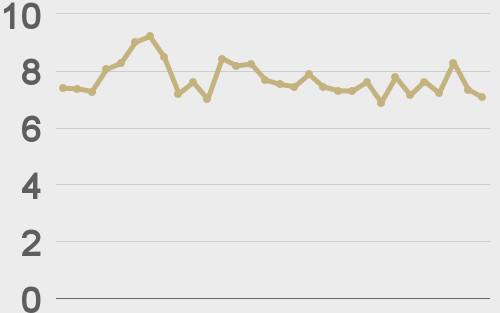

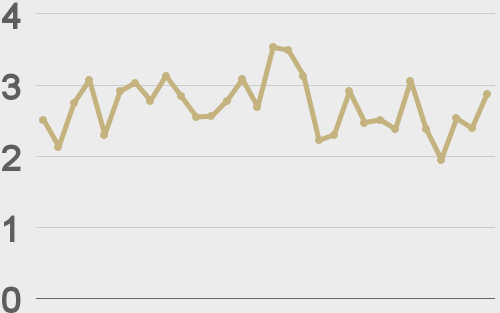

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||