|

|

21 June 2023 BTC market dominance back above 50% |

| LMAX Digital performance |

|

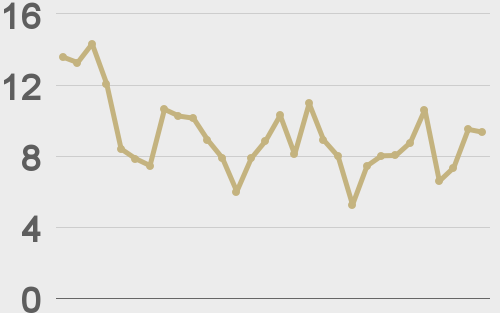

LMAX Digital volumes saw a healthy jump on Tuesday. Total notional volume for Tuesday came in at $425 million, 31% above 30-day average volume. Bitcoin volume printed $266 million on Tuesday, 50% above 30-day average volume. Ether volume came in at $115 million, 16% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,678 and average position size for ether at 2,821. Volatility is showing signs of wanting to pick back up in recent sessions after trading down to the lowest levels since earlier this year. We’re looking at average daily ranges in bitcoin and ether of $902 and $61 respectively. |

| Latest industry news |

|

It feels like larger institutional players have been quite comfortable looking to take on or add exposure to the crypto space, even in the face of the latest regulatory shakeup. Clearly this is a highly encouraging development and should only reinforce the longer-term value proposition. Earlier this week, we saw the market getting a boost from the news of BlackRock filing for a bitcoin spot ETF. Investors are optimistic BlackRock will be getting approval from the SEC. Invesco and WisdomTree have since followed with their own applications for bitcoin spot ETFs. We’ve also been hearing of moves out of Deutsche Bank, where Germany’s largest bank is looking to build out its digital assets and custody business. Meanwhile, a non-custodial crypto exchange backed by the likes of Citadel, Fidelity, and Charles Schwab has just gone live. The market recovery has been led by bitcoin, with the asset outperforming other cryptocurrencies given the much clearer path forward as a globally acknowledged digital commodity not having to contend with all of the scrutiny around securities regulation in the US. Bitcoin’s market capitalization has just pushed back above the total market capitalization of all other cryptocurrencies combined for the first time in two years. We believe this is a positive sign for the entire space as it shows market participants looking to lighten up on the fat and focus back on the assets that have the potential to perform well over the long-term. |

| LMAX Digital metrics | ||||

|

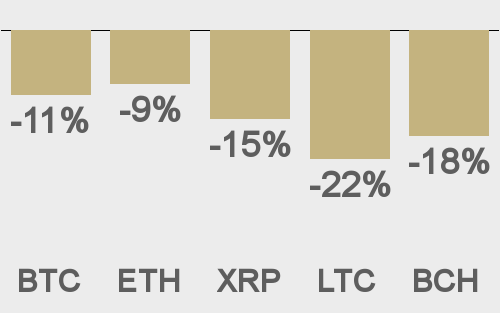

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

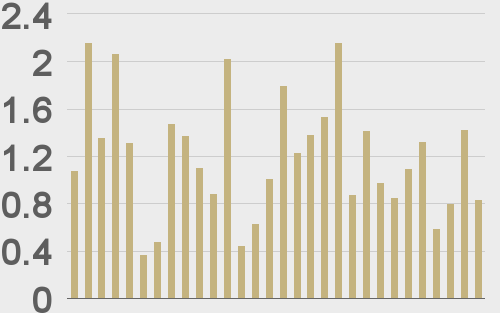

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

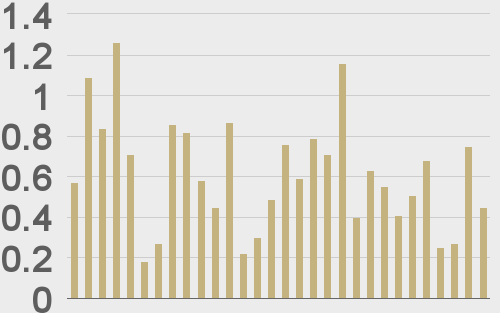

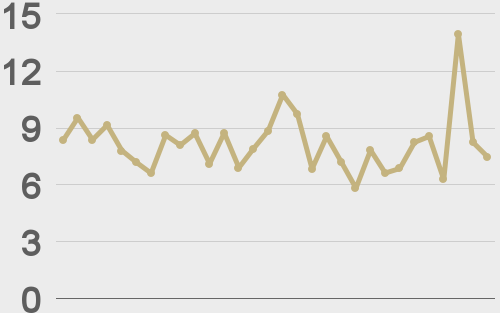

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||