|

|

27 June 2023 Traditional financial players making moves in 2023 |

| LMAX Digital performance |

|

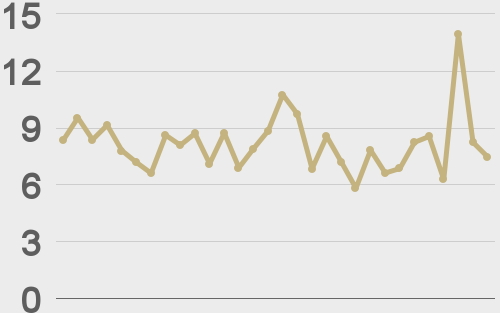

LMAX Digital volumes put in a healthy performance on Monday. Total notional volume for Monday came in at $415 million, 15% above 30-day average volume. Bitcoin volume printed $240 million on Monday, 19% above 30-day average volume. Ether volume printed $121 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,701 and average position size for ether at 2,743. Volatility has trended up in June after trading down at yearly low levels earlier in the month. We’re looking at average daily ranges in bitcoin and ether of $1,008 and $65 respectively. |

| Latest industry news |

|

We’re coming out of a light Monday session of trade, though we did see some mild profit taking on long positions which forced a bit of a correction across crypto assets. But overall, the recent bullish breakout in bitcoin to a fresh 2023 high is encouraging, setting up a higher low just below $25k and opening the door for the next major upside extension towards $40k. We’ve already highlighted some of the bullish momentum in the US, coming from moves from the likes of BlackRock, Citadel, Invesco, and WisdomTree. And on Friday, the SEC approved the first leveraged Bitcoin futures ETF offered by Florida-based Volatility Shares. It’s also worth noting JPMorgan Chase & Co. launched euro-denominated transactions on its blockchain-based payment system, JPM Coin. We’ve been getting plenty of positive news outside of the US as well. Deutsche Bank announced it had applied for a digital asset custody license in Germany. Japan made some crypto friendly tax adjustments. And HSBC Hong Kong introduced bitcoin and ether exchange traded funds. The takeaway from all of the above is that major names in the traditional financial markets are taking a very clear interest in crypto and blockchain technology, all of which encourages the outlook over the longer-term. Looking ahead, as far as this week’s economic calendar goes, we think the big risk will come later in the week when we get the US core PCE read on Friday. Global markets have been trying to get a handle on where Fed policy is headed and this reading will likely open a wave of volatility that could trickle over into crypto. |

| LMAX Digital metrics | ||||

|

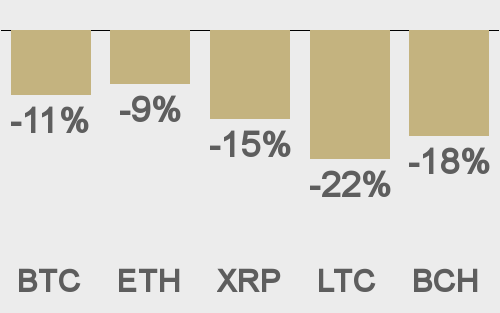

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

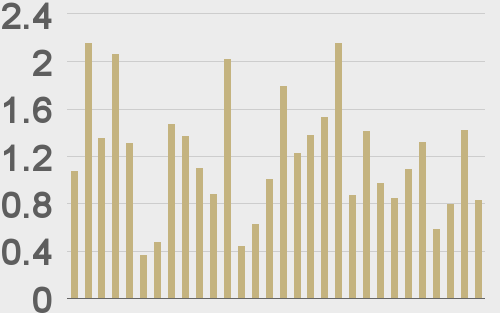

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

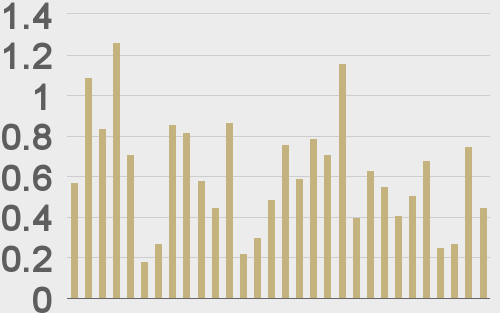

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||