|

|

9 April 2024 Record earnings for bitcoin miners |

| LMAX Digital performance |

|

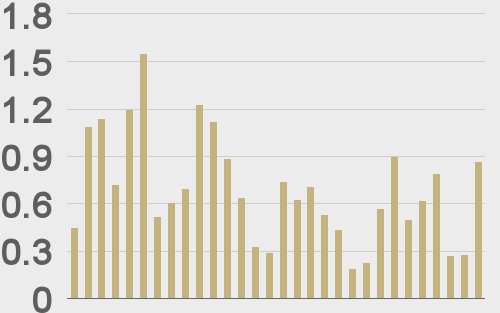

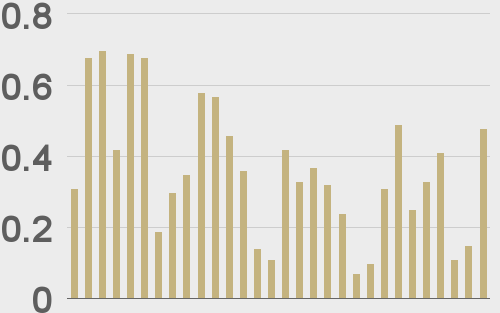

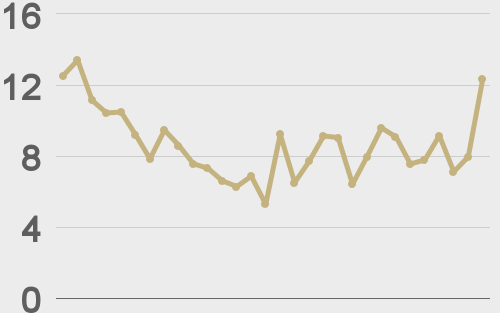

LMAX Digital volumes got off to a nice start this week. Total notional volume for Monday came in at $869 million, 26% above 30-day average volume. Bitcoin volume printed $476 million on Monday, 31% above 30-day average volume. Ether volume came in at $260 million, 28% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $18,752 and average position size for ether at $4,681. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,073 and $188 respectively. |

| Latest industry news |

|

We’re about ten days away from the highly anticipated bitcoin halving event and things are looking up. The bitcoin price has been exceptionally well supported on dips since making the latest record high, ETF flows continue to look robust, and activity on the bitcoin network has been strong. Bitcoin miners made record breaking earnings in the month of March of $2 billion, getting help from more usage of the Bitcoin network, with a lot of this coming from a surge in demand for digital assets and defi products. As a reminder, the current bitcoin block reward of 6.25 BTC will be cut in half to 3.125 BTC when the halving event occurs, most likely on April 20. Another positive update comes out of China where reports have been circulating of mainland-based equity funds submitting applications to launch bitcoin spot ETFs via Hong Kong subsidiaries. Finally, we’ve been encouraged by the bounce in the ETHBTC rate we referenced in our Monday report. On Monday, we talked about a lower rate reflecting a deterioration in sentiment. And so, the aggressive bounce over the past 24 hours has been impressive and suggests appetite is picking back up. We’ve also talked about how ETH has yet to make a fresh record high in this cycle. Back in 2021, both bitcoin and ETH made record highs. We suspect ETH will be wanting to make its own fresh record high in 2024, something that could serve as a prop to bitcoin and the broader crypto asset class. Certainly any talk around positive updates from the SEC ETH spot ETF application front will only strengthen the overall bullish case for crypto assets in 2024. |

| LMAX Digital metrics | ||||

|

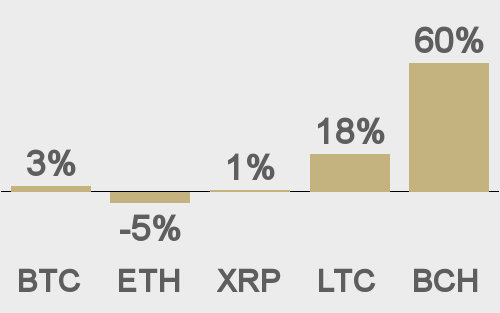

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

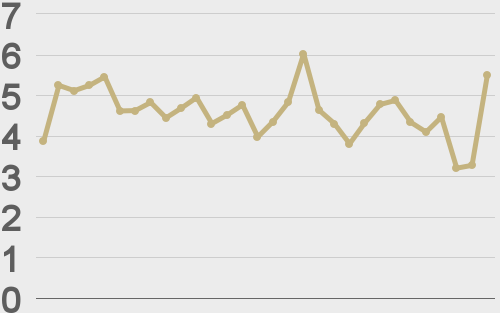

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||