|

|

17 February 2025 Is ETH finally getting ready to make a move? |

| LMAX Digital performance |

|

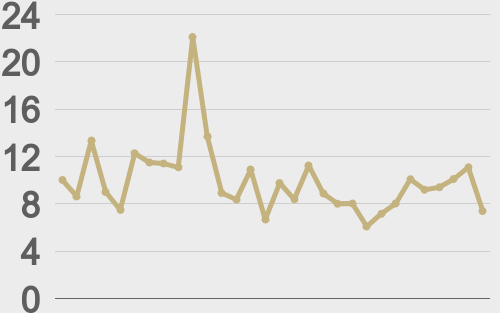

Total notional volume from last Monday through Friday came in at $2.2 billion, 47% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $911 million, 49% lower than the previous week. Ether volume came in at $407 million, 59% lower than the week earlier. Total notional volume over the past 30 days comes in at $17.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,587 and average position size for ether at $2,267. Market volatility has cooled down and is consolidating off peak levels. We’re looking at average daily ranges in bitcoin and ether of $3,344 and $178 respectively. |

| Latest industry news |

|

Bitcoin continues to trade in a multi-day range, with setbacks well supported down towards $90k. The range trade is classified as a bullish consolidation within a strong uptrend that should be looking to extend in the months ahead. We believe a lot of the consolidation has to do with the market doing a formidable job of pricing in all of the positives around mainstream adoption and a friendlier US administration. This leaves investors looking ahead for the benefits of adoption and the US administration to play out, which translates to a bit of a waiting game with respect to that next positive price catalyst. But while the market waits for bitcoin to begin its next push higher against the US Dollar, there have been some interesting developments with respect to the price of ETH relative to bitcoin that should be noted. As per today’s technical insights, there is evidence of ETH potentially wanting to finally put in a major bottom against bitcoin after downtrending since 2021. ETH outperformance relative to bitcoin is often taken as an encouraging sign for the broader crypto asset class, as it suggests investors are enthusiastic about the space and looking to expand their exposure beyond bitcoin. We believe it will be important to keep a close eye on the current monthly high in the ETHBTC ratio, with a break back above to encourage the reversal outlook. As the second largest crypto asset, ETH has been a notable laggard, unable to push to a fresh record high in 2024 despite bitcoin making its own fresh record high and continuing to do so in 2025. But if the ETHBTC ratio is indeed warning of a possible bottom, it could also suggest ETH is finally ready to make that run to retest its record high from 2021. |

| LMAX Digital metrics | ||||

|

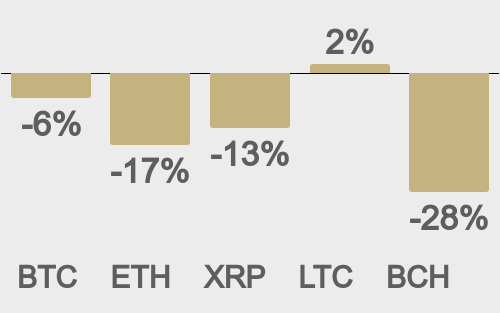

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

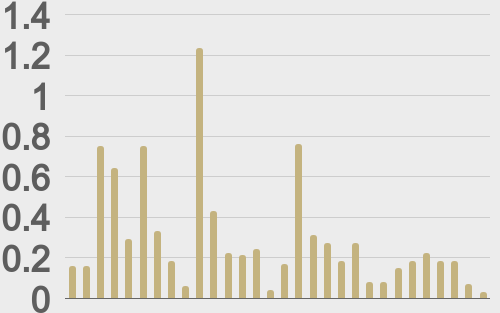

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||