|

|

15 May 2025 A minor pause after an impressive surge |

| LMAX Digital performance |

|

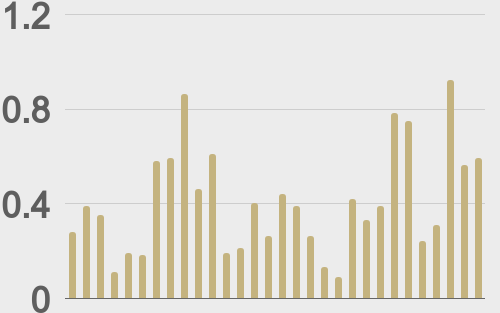

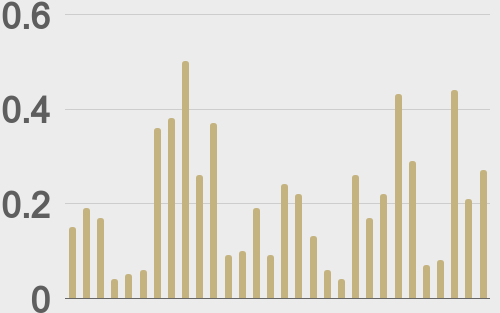

LMAX Digital volumes for Wednesday came in at $585 million, 43% above 30-day average volume. Bitcoin volume printed $266 million, 30% above 30-day average volume. Ether volume came in at $140 million, 55% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,267 and average position size for ether at $2,020. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility has been surging, nearly doubling since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,805 and $151 respectively. |

| Latest industry news |

|

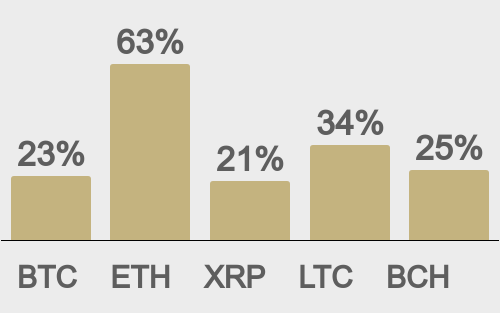

The cryptocurrency market is catching its breath after a strong rally, with Bitcoin firmly above $100,000 and ETH finally gaining traction, up 60% over the past 30 days. ETH’s outperformance, following a lackluster Q1 and early Q2, is driven by Ethereum’s network upgrades and a renewed risk appetite as fears of global economic fallout fade. Investors are embracing the improved market sentiment, propelling digital assets higher. Regulatory headwinds are tempering some of the recent enthusiasm, contributing to pockets of selling in the past few sessions. The US Senate’s bipartisan GENIUS Act, which mandates reserve-backed digital currencies and monthly reporting, faces a critical deadline but risks failure without unanimous support after a recent vote fell short. Similarly, the SEC’s delay in approving in-kind redemptions for BlackRock’s Bitcoin ETF, pending further feedback, adds uncertainty to the near-term outlook. Despite these challenges, the market’s resilience suggests these are temporary setbacks rather than significant roadblocks. Bitcoin should find robust demand near $95,000, while Ethereum appears well-supported above $2,000. President Trump’s continued endorsement of crypto, asserting US dominance over China, alongside Pitchbook data showing AI venture funding ($20 billion) dwarfing crypto’s ($861 million) in Q1, highlights substantial growth potential for digital assets. Positive signals from traditional markets are also lifting cryptocurrencies, with softer US CPI data weakening the dollar and fueling risk-on flows. Expectations of a more accommodative Federal Reserve policy are shifting yield differentials away from the dollar, benefiting all currencies, including cryptocurrencies. As the dollar softens, Bitcoin, Ethereum, and other digital assets stand to capitalize on the evolving macroeconomic landscape. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

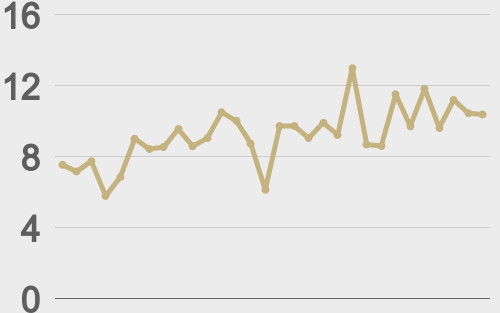

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

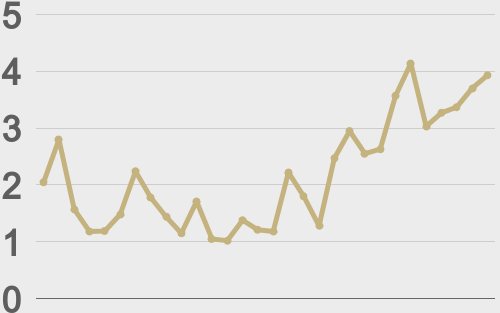

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||