| ||

| 28th May 2025 | view in browser | ||

| US data beats expectations, Dollar holds firm | ||

| President Trump’s decision to delay 50% EU tariffs until July 9, coupled with a U.S.-China trade truce, boosted market optimism, with U.S. consumer confidence rising and durable goods orders declining less than expected, easing recession fears and fueling risk-on trades. | ||

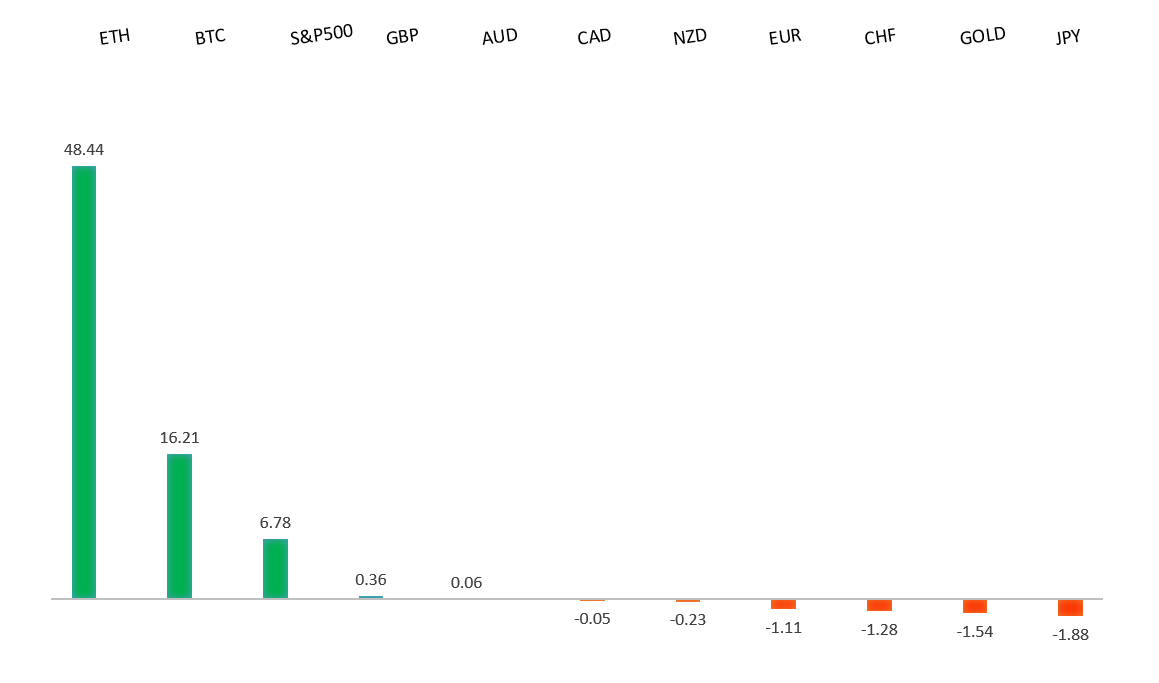

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1474 - 11 April high - Medium R1 1.1419 - 26 May high - Medium S1 1.1131 - 16 May low - Medium S2 1.1065 - 12 May low - Medium | ||

| EURUSD: fundamental overview | ||

| France’s May inflation rate dropped to 0.7% (0.6% EU harmonized), signaling cooling price pressures, with Germany, Spain, and Italy expected to report inflation at or below the ECB’s 2% target on Friday, a rare occurrence since 2021. This trend, driven by a strong euro, falling energy costs, and easing wage pressures, supports expectations for an ECB rate cut on June 5 to stimulate growth, especially amid risks like potential U.S. tariffs on EU imports. EU trade chief Maros Sefcovic is leading negotiations to avoid trade conflicts, while Eurozone CPI expectations and German unemployment data, expected to show modest changes, are due today. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.19 - 9 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s Ministry of Finance surveyed banks and investors about demand for long-term government bonds, hinting at reduced issuance, which caused 30- and 40-year JGB yields to drop sharply, weakened the yen by over 1%, and spurred buying in U.S. Treasuries. Bank of Japan Governor Ueda signaled potential rate hikes if the economy improves, supported by April’s core inflation rising to 3.5% year-on-year, with May’s Tokyo CPI expected to show further price pressures. Japan’s trade negotiator aims to resolve U.S. tariff talks before the G7 summit (June 15–17), and a deal avoiding 25% auto tariffs could boost Japan’s economy and yen long-term, potentially enabling a BOJ rate hike in July, though markets remain skeptical, pricing in minimal hikes for 2025. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6538 - 26 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| There have been more calls for a stronger Australian dollar against the U.S. dollar, driven by Australia’s better economic growth outlook, which isn’t fully priced into the Aussie’s recent slight gains. Australia’s April CPI stayed at 2.4% year-on-year, above the expected 2.3%, with trimmed mean CPI at 2.8%, signaling steady inflation that may delay RBA rate cuts. The RBA is expected to hold rates in July, with a possible cut in August, and banks predict a year-end cash rate of 3.10%–3.35%. | ||

| Suggested reading | ||

| Can he do it again with OpenAI?, J. Mathis, The Week (May 25, 2025) Multi-level marketing is a scam, D. Solovieva, Salon (May 21, 2025) | ||