| ||

| 17th June 2025 | view in browser | ||

| Treasury yields steady, Fed meeting looms | ||

| The U.S. dollar continues to get sold into rallies despite escalating Middle East tensions, including Israeli airstrikes and President Trump’s call for Tehran’s evacuation. U.S. stock futures have dipped only slightly after Monday’s strong gains across major indexes led by tech and consumer stocks. | ||

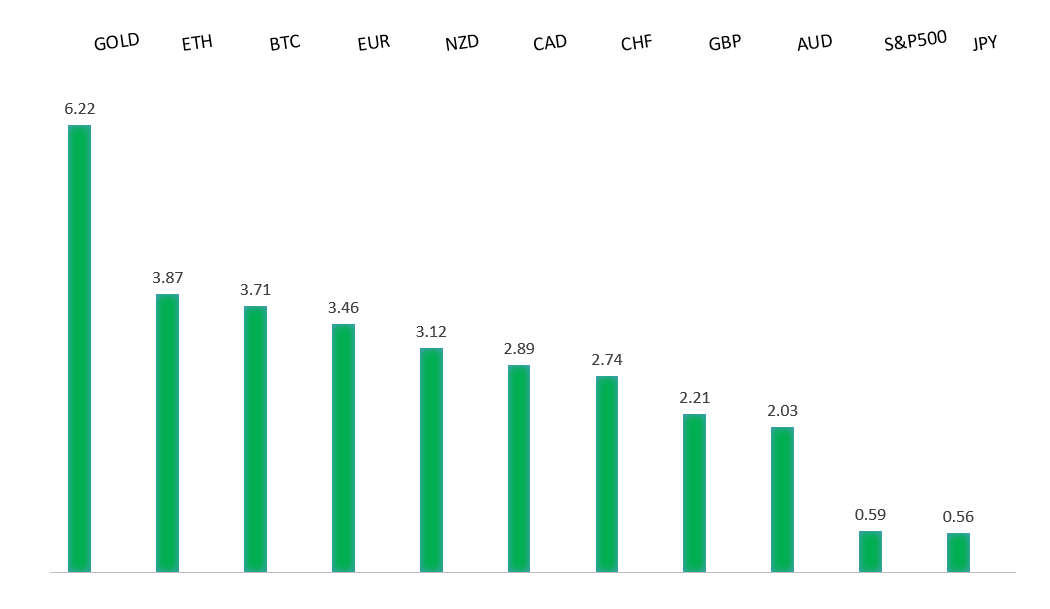

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1632 - 12 June/2025 high - Strong R1 1.1600 - Figure - Medium S1 1.1373 - 10 June low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro remains strong despite global tensions, including reported missile strikes in Israel, as markets stay calm and the ECB downplays concerns about the euro’s value near 1.15. ECB officials express a cautious, balanced view on inflation and policy amid uncertainty, while attention turns to the upcoming Fed meeting, where no policy changes are expected but Powell’s comments will be closely watched. Key economic data releases include Sweden’s labor market figures and economic forecasts, Germany’s ZEW Survey for June, and speeches from ECB members Villeroy de Galhau and Centeno, which could shed light on future monetary policy. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| The Japanese yen weakened toward 145 per dollar, declining for three days after the Bank of Japan kept its 0.5% interest rate and bond-buying plan unchanged, though it hinted at possible future adjustments. Despite no tariff deal between Prime Minister Ishiba and President Trump at the G7 summit, Japanese stocks rose, with the Nikkei 225 up 0.5% and tech stocks like Disco and Lasertec leading gains. The BOJ continues its cautious policy, planning gradual reductions in bond purchases through 2027, while monitoring global risks like rising oil prices and U.S. trade policies. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6546 - 11 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar dipped to about $0.65 as Middle East tensions, fueled by Israel’s intensified airstrikes and Trump’s call for Tehran evacuations, unsettled markets, though Iran’s interest in nuclear talks offered some hope. Australian bond yields fell to 4.24%, near six-week lows, with investors cautious ahead of a key jobs report that could impact expectations for a July rate cut, currently seen as 75% likely. The ASX 200 stayed flat at 8,549, supported by stable oil production and gains in stocks like Newmont (up 3.8%) and Block Inc. (up 3.4%). The Reserve Bank of Australia is expected to cut rates by a quarter point to 3.60% on July 8, marking its third cut this year, while also planning to disclose divided member votes. | ||

| Suggested reading | ||

| This Week’s Fed Meeting Won’t Be Market Accelerator, V. Chen, MarketWatch (June 15, 2025) A Few Pieces of Very Bad Advice, M. Housel, Collaborative Fund (June 12, 2025) | ||