| ||

| 18th June 2025 | view in browser | ||

| US Dollar holds firm despite data misses | ||

| Despite recent U.S. economic data misses, the US Dollar remains strong, gaining notably against the Pound, which fell below 1.3500. U.S. stock futures show resilience, but escalating Israel-Iran tension raises concerns, with oil prices climbing amid fears of U.S. involvement. | ||

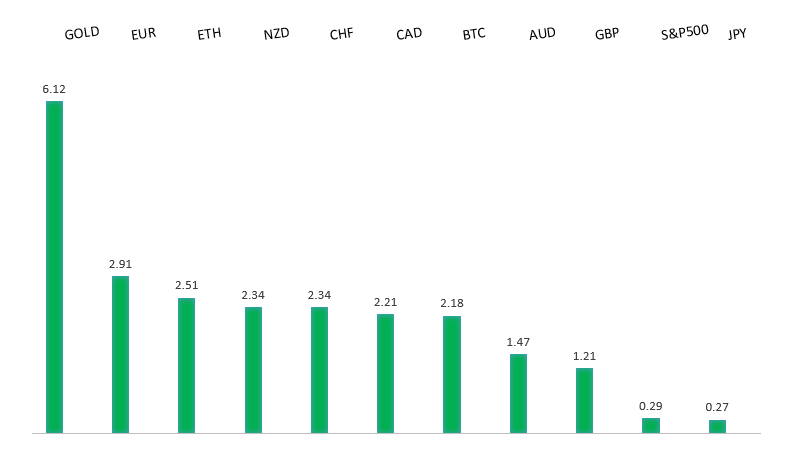

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1632 - 12 June/2025 high - Strong R1 1.1600 - Figure - Medium S1 1.1373 - 10 June low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| Since the ECB’s June rate cut, policymakers are cautiously maintaining the current 2% interest rate, with Eurozone markets expecting just one more cut in 2025, while US markets anticipate two, supporting the euro’s strength. The EU is boosting defense capabilities by streamlining regulations, aiming to speed up defense project approvals to 60 days, which could positively impact the euro. ECB President Lagarde is advocating for reforms to position the euro as a stronger alternative to the dollar, while recent German economic data, including a strong ZEW Survey Expectations score of 47.5, signals growing confidence and potential recovery from nearly three years of stagnation. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan maintained its target rate at 0.50% and announced a gradual reduction in Japanese Government Bond purchases starting April 2026, aiming for ¥2 trillion by March 2027, with flexibility to adjust based on market conditions. While signaling openness to future rate hikes if inflation and economic conditions improve, BOJ Governor Ueda noted the yen’s weakness is increasingly driving domestic inflation, which remains above the 2% target. Rising oil prices, partly due to the Israel-Iran conflict, could further push inflation, potentially forcing tighter policy. Japan’s economy faces challenges from a widening trade deficit (-¥637.6bn in May) and a -1.7% drop in exports, raising recession risks amid ongoing US-Japan trade talks and US tariffs. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6546 - 11 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar uptrend remains intact despite a rejection at the 61.8% retrace level, driven by Middle East tensions, with potential for resumed growth if the conflict cools and focus shifts to U.S. fiscal concerns. Positive Chinese economic data and optimism around U.S.-China trade talks are supporting the Australian dollar, alongside a $187.2 billion takeover bid for Santos by an Abu Dhabi-led consortium, though a regulatory block could cause a temporary dip. Recent Australian data indicates below-trend economic growth, influenced by both global and domestic factors. | ||

| Suggested reading | ||

| Israel/Iran Is a Mere Bump On the Way to S&P 500 7,000, J. Sonenshine, Barron’s (June 13, 2025) Gold Is Signaling Skepticism About the Future, J. Calhoun, Alhambra (June 15, 2025) | ||