| ||

| 23rd June 2025 | view in browser | ||

| Dollar holds firm amid geopolitical risks | ||

| Last week’s soft U.S. economic data, including a weaker-than-expected Philadelphia Fed Business Outlook and a negative Leading Index print, has fueled speculation about Federal Reserve policy, with Governor Waller advocating for proactive rate cuts despite a cautious committee. | ||

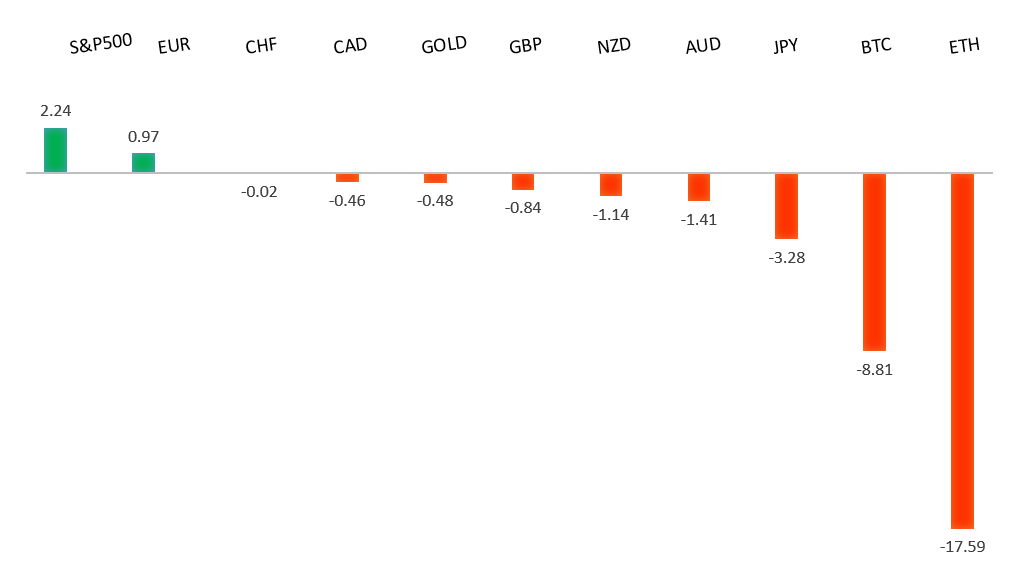

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1632 - 12 June/2025 high - Strong R1 1.1600 - Figure - Medium S1 1.1373 - 10 June low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| Weak U.S. economic data has raised expectations for Federal Reserve cuts rates later this year, while the ECB, after eight rate reductions, may pause as inflation nears 2% and unemployment stays low. The ECB’s July meeting is likely to maintain current rates, with its latest bulletin forecasting steady euro area GDP growth (0.9% in 2025) and inflation at 2% in 2025, though trade tensions and a stronger euro pose risks. In Germany, manufacturing PMI shows signs of stabilization despite ongoing contraction, while a sharp drop in services PMI (47.1 in May) threatens near-term growth. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming weeks, exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 147.67 - 14 May high - Medium S1 144.32 - 18 June low - Medium S2 142.11 - 27 May low - Strong | ||

| USDJPY: fundamental overview | ||

| Recent weak US economic data have increased expectations for two Federal Reserve rate cuts in late 2025, but the yen struggles to gain traction as doubts persist about the Bank of Japan’s ability to tighten policy. The BOJ’s cautious approach to reducing Japanese Government Bond purchases, coupled with weak demand for long-term bonds, has led Japan’s Ministry of Finance to cut issuance of 20-, 30-, and 40-year bonds. Geopolitical tensions and uncertainty over US-Japan trade talks, with a July 9, 2025, tariff deadline approaching, further pressure the yen and complicate BOJ policy. However, Japan’s June PMI data shows improvement, with manufacturing returning to growth (50.4) and services expanding (51.5), signaling economic stabilization, though the recovery remains fragile and BOJ rate hike expectations are low without a favorable trade deal resolution. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6553 - 16 June/2025 high - Strong R1 0.6500 - Psychological - Medium S1 0.6387 - 16 May low - Medium S1 0.6344 - 24 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s June 2025 preliminary PMI data shows modest economic expansion, with the Composite PMI at 51.2 (up from 50.5), Manufacturing PMI steady at 51.0, and Services PMI at 51.3 (up from 50.6). Following the RBA’s rate cuts in May 2025, these figures suggest a positive but cautious economic response, supporting the RBA’s gradual monetary easing approach. The RBA will consider these PMIs and upcoming inflation data at its next meeting to decide on further rate adjustments, with markets expecting three more cuts in 2025, potentially lowering the cash rate to 3.10%. | ||

| Suggested reading | ||

| Tariffs Will Not Repeal The Laws Of Economics, H. Marks, Oaktree (June 18, 2025) China’s Industrial Policy Has An Unprofitability Problem, N. Smith, Noahopinion (June 20, 2025) | ||