|

| 23 June 2025 Keeping an eye on bitcoin $100k |

| LMAX Digital performance |

|

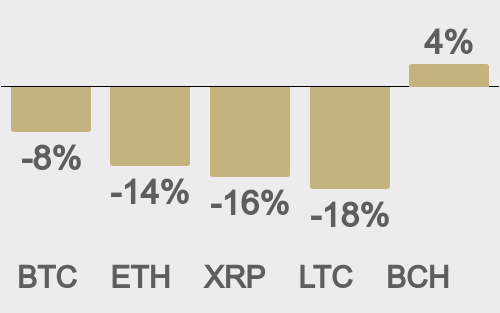

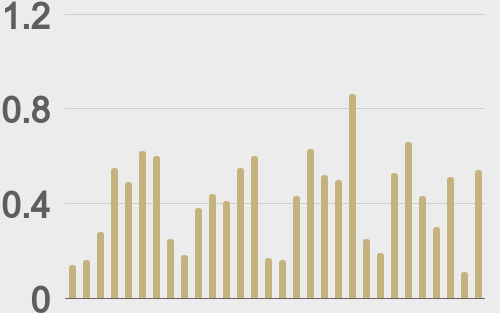

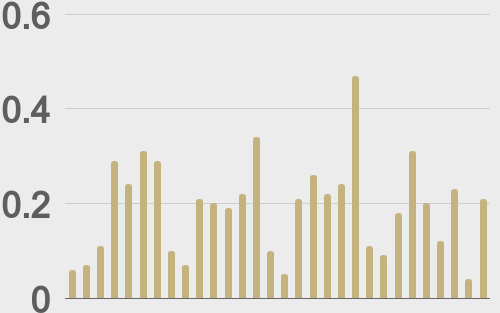

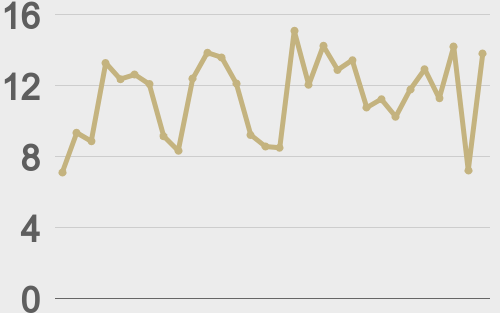

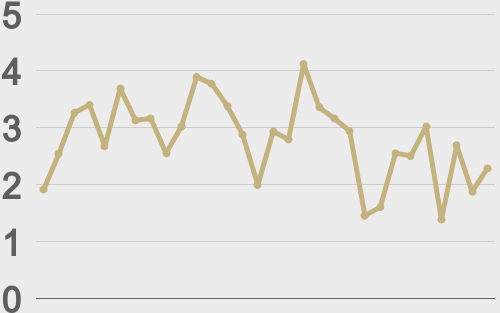

Total notional volume from last Monday through Friday came in at $2.4 billion, 17% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.04 billion, 25% lower than the previous week. Ether volume came in at $565 million, 27% lower than the week earlier. Total notional volume over the past 30 days comes in at $12.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,797 and average position size for ether at $2,829. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility is sideways after bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,955 and $140 respectively. |

| Latest industry news |

|

It’s been difficult for the crypto market to keep ignoring developments on the macro front, with escalating geopolitical tension ultimately weighing on prices over the weekend during thinner conditions. There isn’t all that much liquidity in any weekend markets when it comes to traditional assets, so at the same time, it has been interesting to see how bitcoin and ETH respond, perhaps acting as a proxy for broader sentiment. Technically speaking, though we have seen some notable levels broken that could prove to be significant over the short-term, we wouldn’t read too much into it just yet, given the price action was over the weekend, and the latest recovery into the new week. With that said, as per today’s chart analysis, it will be important to keep an eye on the $100k level in bitcoin. If the market puts in a daily close below $100k, it will suggest a double top is in place, opening a measured move pattern objective target in the $90k area. As far as ETH goes, the latest breakdown below a consolidation low in the $2,300 area introduces the possibility for a deeper correction back towards previous resistance turned support at $1,800. But the more important takeaway with respect to the overall price action is that even if we see bitcoin to $90k and ETH to $1,800, these levels will be viewed as formidable levels to look to build long positions into what is a bigger picture constructive outlook. Fundamentally speaking, it does feel like we are getting closer to the Middle East risk being contained. This coupled with softer US data pointing to a more accommodative Fed policy outlook, should ultimately be supportive of risk assets, bearish the US Dollar, and encouraging for crypto assets. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||