|

||

| 20th July 2025 | view in browser | ||

| Powell faces pressure amid Fed rate debate | ||

| Federal Reserve members Waller, Warsh, and Bowman have been out advocating for lower interest rates, but the majority of the Fed prefers a cautious, data-driven approach, favoring a “wait and see” stance. | ||

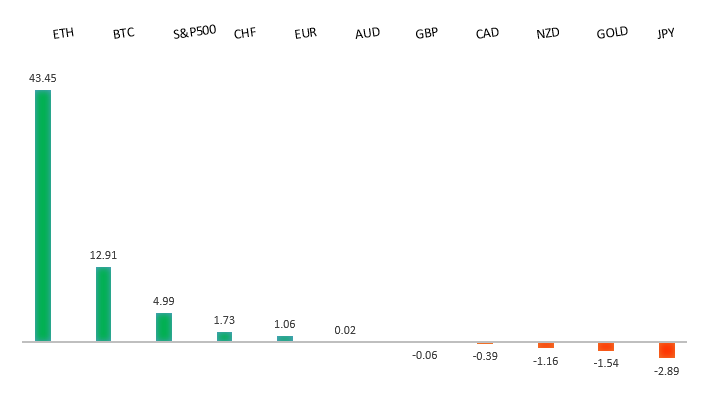

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

|

||

| R2 1.1800 - Figure - Medium R1 1.1722 - 16 July high - Medium S1 1.1557 - 17 July low - Medium S2 1.1446 - 19 June low - Strong | ||

| EURUSD: fundamental overview | ||

| Dimitar Radev, Bulgaria’s central bank chief and incoming ECB interest rate setter, warns that political uncertainties, such as France’s fiscal issues and U.S. trade policies under Trump, pose growing risks for central banks, requiring them to integrate these factors into their risk assessments. Incoming Austrian central bank Governor Martin Kocher criticizes Trump’s attacks on Fed independence, cautioning that undermining monetary policy could fuel inflation or even hyperinflation. The ECB is expected to maintain its 2% deposit rate at its July meeting, staying resilient against Trump’s threatened 30% EU import tariffs and France’s political instability, while potentially signaling a September rate cut if risks intensify. EU envoys will meet to plan countermeasures for a possible no-deal scenario, with key Eurozone data this week, including consumer confidence, PMI, and business surveys, likely to influence ECB policy expectations. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

|

||

| R2 150.00 - Psychological - Strong R1 149.19 - 16 July high - Medium S1 146.91 - 16 July low - Medium S2 145.75 - 10 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Prime Minister Shigeru Ishiba’s Liberal Democratic Party and its coalition partner Komeito lost their majority in Japan’s upper house election, marking the first time since 1955 that the LDP lacks control in either legislative chamber. Despite this, Ishiba plans to stay in office, focusing on wage growth, GDP targets, and security issues, though historical precedent suggests recent LDP leaders resigned shortly after similar losses. The opposition, while gaining seats, is too fragmented to form a stable government, pushing the LDP to seek ad hoc alliances to pass legislation. This outcome aligns with market expectations, limiting significant yen weakening, though fiscal risks may rise if the opposition demands larger stimulus. The loss complicates US-Japan trade talks and adds pressure on the Bank of Japan’s monetary normalization, but sustained economic growth and inflation should keep the BOJ’s gradual policy shift on track. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

|

||

| R2 0.6596 - 11 July/2025 high - Strong R1 0.6555 - 16 July high - Medium S1 0.6454 - 17 July low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s labor market resilience and inflation concerns led the Reserve Bank of Australia to pause rate changes in July, despite weak economic momentum and low consumer confidence. Last week’s disappointing jobs data, with unemployment rising from 4.1% to 4.3%, has increased expectations for an RBA rate cut in August, along with a likely downgrade in its employment forecast. Markets are awaiting further clues from the RBA’s July meeting minutes and Governor Michele Bullock’s upcoming speech. | ||

| Suggested reading | ||

| Debt Reckoning, M. Childs, Harper’s Magazine (July 20, 2025) Why China Should Revalue the Renminbi, M. Pettis Carnegie Endowment (July 15, 2025) | ||