|

| 20 July 2025 Regulatory clarity fuels latest surge |

| LMAX Digital performance |

|

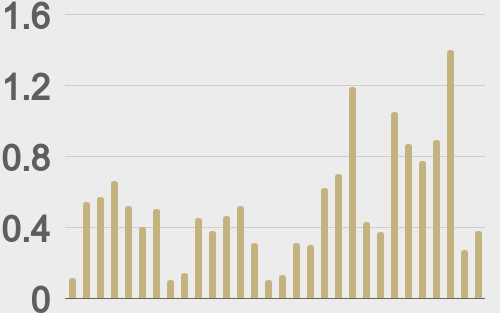

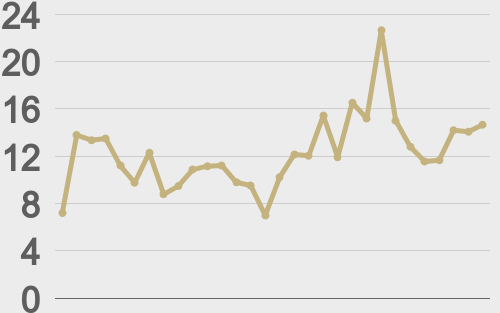

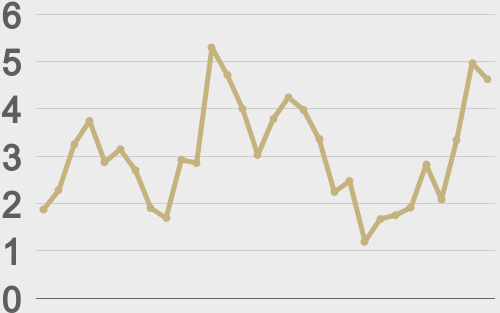

Total notional volume from last Monday through Friday came in at $5 billion, 60% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $2.2 billion, 35% higher than the previous week. Ether volume came in at $1.3 billion, 64% higher than the week earlier. Total notional volume over the past 30 days comes in at $15.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,646 and average position size for ether at $2,684. Bitcoin volatility is tracking just off yearly low levels. ETH volatility has ticked up in recent days, but is still mostly sideways since bottoming out in May. We’re looking at average daily ranges in bitcoin and ether of $2,743 and $150 respectively. |

| Latest industry news |

|

The past week has seen crypto markets rally with renewed conviction, led by ETH and continued strength in Bitcoin to fresh record highs. Overall, crypto markets have been able to shrug off off macro jitters with a notable decoupling from tech equities into the end of last week. The primary driver of bullish sentiment has been a flurry of legislative progress in Washington, with a wave of bipartisan momentum. The passage of the GENIUS Act marks a watershed moment, as the U.S. finally sets a federal framework for stablecoins — a move markets have long awaited. The bill establishes regulatory clarity for issuers and mandates consumer protections. Meanwhile, the CLARITY Act, aimed at settling the securities-versus-commodities debate for digital assets, also passed the House and heads to the Senate. These are foundational moves that reduce uncertainty and open the door for broader institutional participation. ETH’s outperformance has been notable. Beyond general optimism around regulatory clarity, there’s been renewed narrative momentum around Ethereum’s role as the backbone of tokenization and on-chain finance. The GENIUS Act’s stablecoin provisions directly benefit Ethereum’s ecosystem, which supports the vast majority of stablecoin infrastructure today. Add to that rising L2 activity and the growing belief that ETH will be central to the next phase of institutional adoption — from tokenized treasuries to permissioned DeFi — and the bid for ETH becomes more obvious. Traditional market drivers have also mostly been constructive for crypto. Treasury yields have been mixed, with the curve flattening modestly after Jerome Powell reiterated the Fed’s data-dependency, but without explicitly pushing back against market expectations for a September cut. The big picture takeaway is that the crypto industry is transitioning into a new regime. The chaotic, adversarial posture from Washington is being replaced by structured engagement, with rules, roles, and responsibilities now coming into focus. That clarity is arriving just as Wall Street is ramping up its crypto exposure — through ETFs, custody offerings, tokenization platforms, and more. |

| LMAX Digital metrics | ||||

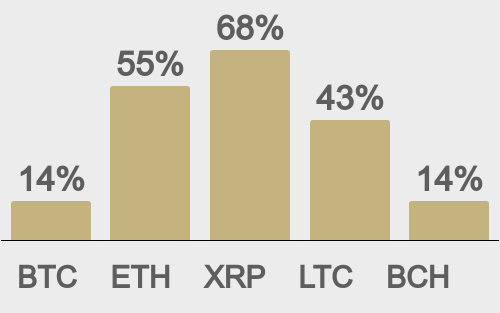

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||