|

| 23 July 2025 TradFi dives deeper into crypto |

| LMAX Digital performance |

LMAX Digital volumes were healthy on Tuesday. Total notional volume for Tuesday came in at $737 million, 37% above 30-day average volume. Bitcoin volume printed $315 million, 25% above 30-day average volume. Ether volume came in at $200 million, 48% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,864 and average position size for ether at $2,840. Bitcoin volatility is tracking just off yearly low levels. ETH volatility has ticked up in recent days, but is still mostly sideways since bottoming out in May. We’re looking at average daily ranges in bitcoin and ether of $2,951 and $158 respectively. |

| Latest industry news |

The crypto market has maintained a firm tone over the past 24 hours, with Bitcoin consolidating just below its all-time highs and ETH continuing to attract flows, despite some rotation into high-beta altcoins. Bitcoin traded in a tight range but remained comfortably above key technical levels, with markets digesting news of a $150 million BTC transfer by SpaceX — the company’s first in three years. ETH saw continued strength on the back of robust ETF activity, pointing to deepening investor interest in ETH as a strategic allocation. While the ETHBTC ratio is showing signs of consolidation, the rotation story remains intact, particularly as traditional finance ramps up its crypto engagement. Indeed, the past day has seen a series of headlines underscoring traditional finance accelerating its commitment to digital assets. JPMorgan is reportedly exploring crypto-backed lending, Western Union may soon integrate stablecoins, and PNC Bank has formalized a partnership with Coinbase, offering both client access and limited banking services to the exchange. This steady convergence between legacy finance and crypto-native infrastructure continues to lay the groundwork for broader adoption and improved capital flows. On the policy front, momentum remains strong. Senate Republicans released a discussion draft for comprehensive crypto legislation, signaling that Washington’s regulatory pivot is gaining traction after last week’s passage of the GENIUS Act. Meanwhile, multiple ETF issuers have filed amendments to allow in-kind redemptions, a move widely seen as a constructive step in aligning with SEC expectations and paving the way for broader retail access and market stability. Elsewhere, corporate crypto treasuries remain active. Companies like SharpLink, Volcon, and Strategy all expanded their BTC and ETH holdings, with Volcon raising $500 million and Strategy launching a new share class as its bitcoin treasury surpassed 600,000 coins. Notably, xTAO announced plans to go public following a fresh capital raise, underscoring the continued financialization of digital assets. And in a consumer-facing development, Telegram has officially rolled out a U.S. crypto wallet via MoonPay, expanding on-ramps for retail users just as the infrastructure beneath the space grows more sophisticated. |

| LMAX Digital metrics | ||||

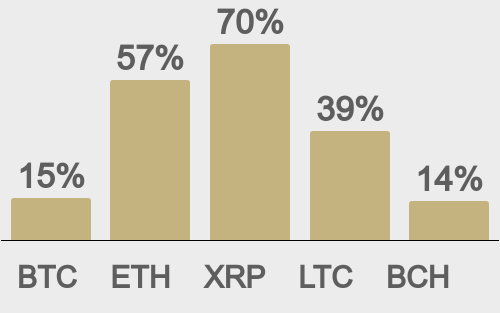

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

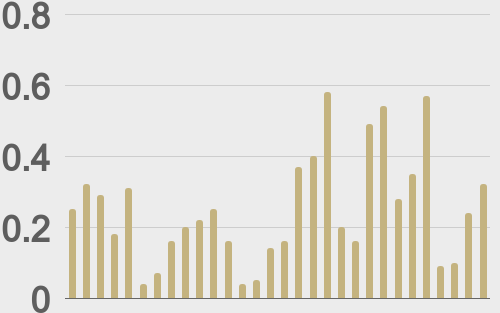

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@KaikoData | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||