|

| 24 July 2025 Appetite for ETH continues to run hot |

| LMAX Digital performance |

|

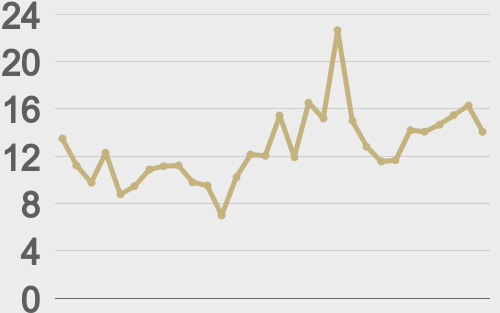

LMAX Digital volumes have been looking healthy all week. Total notional volume for Wednesday were the highest on the week, coming in at $766 million, 40% above 30-day average volume. Bitcoin volume printed $241 million, just 4% below 30-day average volume. Ether volume came in at $170 million, 25% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,883 and average position size for ether at $2,854. Bitcoin volatility is picking back up from yearly low levels, while ETH volatility is tracking near multi-day highs. We’re looking at average daily ranges in bitcoin and ether of $2,927 and $165 respectively. |

| Latest industry news |

|

Bitcoin is trading flat over the past 24 hours and volatility remains compressed despite headlines around institutional activity and onchain developments. ETH is back to outperforming bitcoin, a trend we have been seeing over the past several weeks. U.S. spot ETH ETFs have seen massive net inflows — including this week’s print of the third-largest daily figure on record — underlining an intensifying demand shock. With entities now purchasing significantly more ETH than the network has minted since May, and World Liberty Financial adding even more ETH onchain, underlying flows remain supportive. Macro and traditional markets have provided a mostly benign backdrop. U.S. equity futures have traded in narrow ranges ahead of next week’s FOMC decision. However, geopolitical tensions in the South China Sea and shifting U.S. fiscal dynamics continue to simmer under the surface. On the institutional front, a notable development came as BNY Mellon and Goldman Sachs announced a partnership to tokenize money market fund records — signaling traditional finance’s accelerating migration onchain. The initiative highlights a growing convergence that supports the medium-term bull case for tokenized real-world assets. In corporate crypto, Marathon Digital revealed plans to raise $850 million via convertible notes, allocating part of the proceeds to direct Bitcoin purchases. This mirrors MicroStrategy-style treasury strategy and adds to structural demand pressure. Meanwhile, Dan Tapiero launched a $500 million fund, framing a long-term thesis that the crypto economy could expand to $50 trillion. These flows — along with ETF demand — offer potential downside buffers despite short-term indecision in price. Finally, regulatory tensions are once again in focus. A coalition of ten crypto and fintech trade groups has urged President Trump to prevent large banks from introducing data access fees that could impede open finance innovation. |

| LMAX Digital metrics | ||||

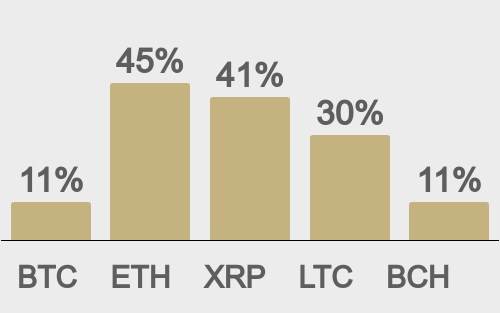

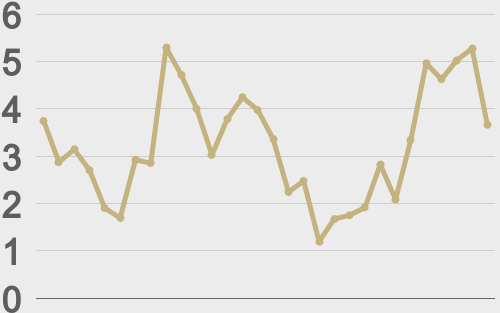

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

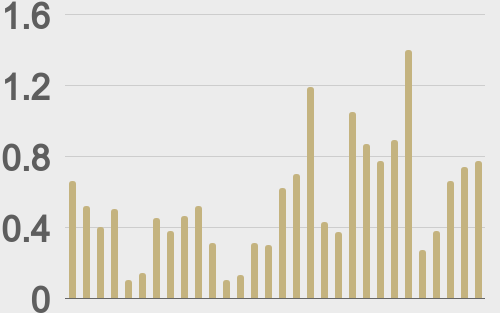

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

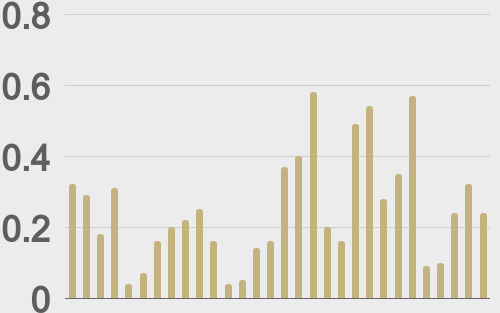

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||