| ||

| 29th September 2025 | view in browser | ||

| US economy stays hot, Fed faces tough call | ||

| Last Friday’s stronger-than-expected US economic data, including personal income, personal spending, and a Core PCE Price Index increase, signaled robust consumer activity and persistent inflation above the Federal Reserve’s 2% target. This resilience complicates expectations for rapid Fed rate cuts, as markets anticipate a cautious, data-dependent approach. | ||

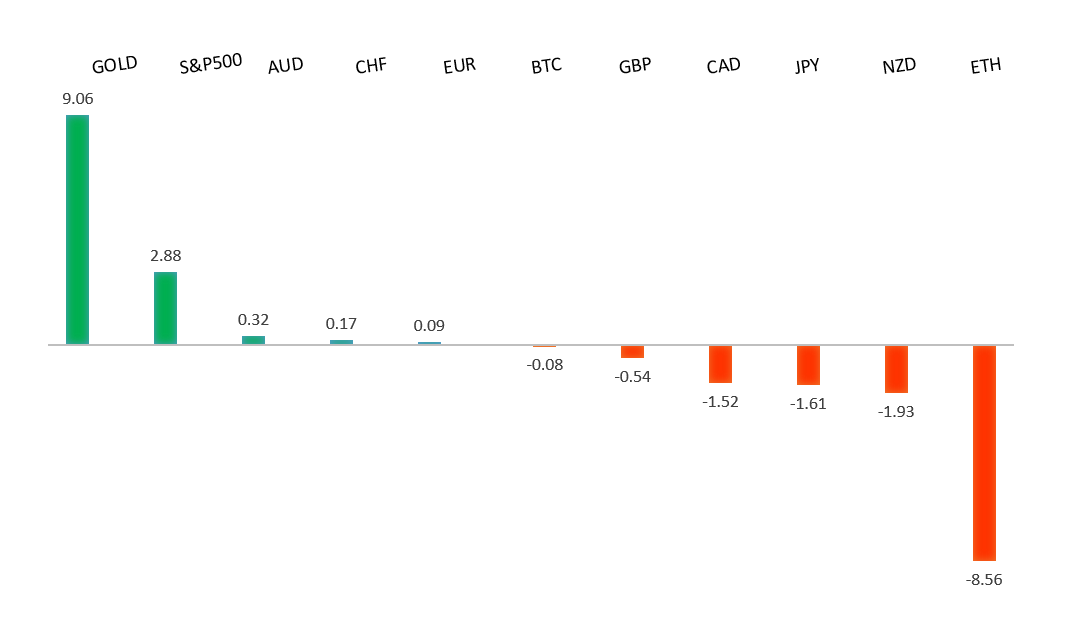

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

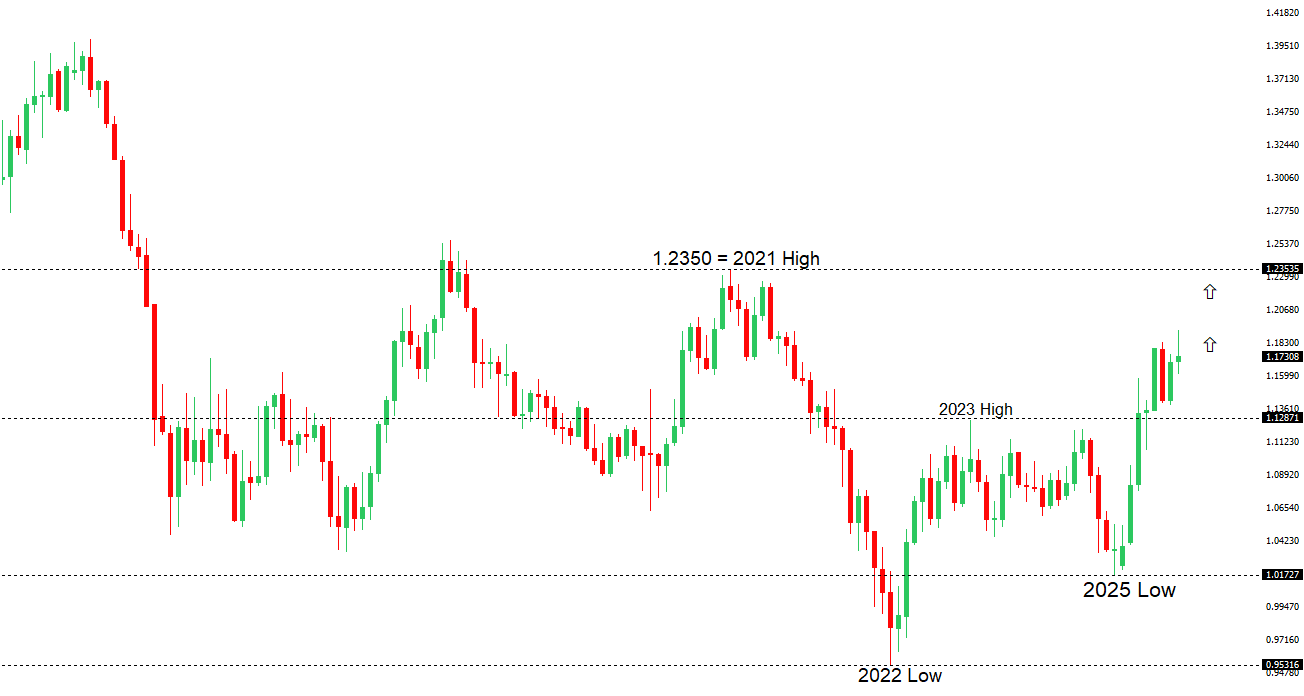

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1919 - 16 September/2025 high -Strong R1 1.1820 - 23 September high - Medium S1 1.1646 - 25 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Last week’s US data, including a revised Q2 GDP of 3.8% and strong durable goods orders, signals a robust economy, reducing expectations for Federal Reserve rate cuts from over 50bps to about 40bps by year-end, supporting the dollar. This week’s Eurozone data, such as September flash CPI, August unemployment, and PPI, along with US labor data, will influence the short-term EURUSD trend. Despite stable ECB rates at 2% and controlled inflation, rising consumer inflation expectations and potential trade uncertainties, like US tariffs, could prompt dovish ECB shifts, while long-term EURUSD bullishness persists due to divergent Fed and ECB policies and Germany’s economic reforms. | ||

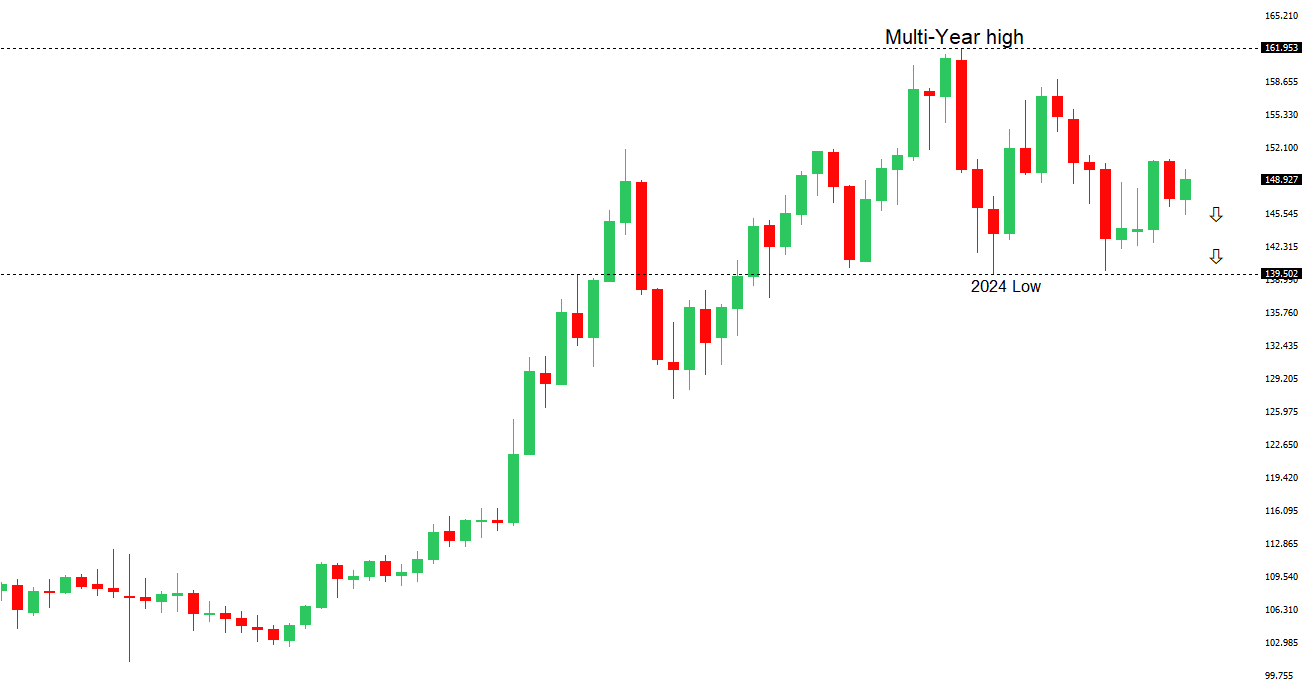

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.96 - 26 September high - Medium S1 147.46 - 23 September low - Medium S2 145.48 - 17 September low - Strong | ||

| USDJPY: fundamental overview | ||

| Last week’s softer U.S. economic data and Tokyo CPI figures, which indicated cooling inflation in Japan, have tempered expectations for aggressive Federal Reserve rate cuts and supported USDJPY’s rise above its 200-day moving average. Despite inflation remaining above the Bank of Japan’s 2% target, weaker domestic demand and wage growth suggest limited sustained inflationary pressure, reducing the urgency for immediate BOJ rate hikes. However, internal pressure is mounting within the BOJ, with a 50% chance of a 25 basis point rate hike in October, driven by hawkish board members and concerns over yen depreciation fueling import-driven inflation. Key upcoming data, including the 3Q Tankan survey and BOJ Deputy Governor Uchida’s speech, will provide further clues on the BOJ’s policy direction, while USDJPY may struggle to break the 150 level without stronger fundamental catalysts. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6707 - 17 September/2025 high - Strong R1 0.6660 - 18 September high - Medium S1 0.6520 - 26 September low - Medium S1 0.6483 - 2 September low - Strong | ||

| AUDUSD: fundamental overview | ||

| Market expectations suggest RBA Governor Michele Bullock will adopt a cautious tone at this week’s press conference, reflecting uncertainty about rate changes due to persistent inflation and a strong labor market. The RBA is likely to maintain its 3.6% cash rate, with the probability of a November rate cut dropping to 44% from near certainty. Analysts anticipate delayed rate cuts, possibly into 2026, as the RBA focuses on inflation risks, while investors monitor upcoming trade, household spending, and US jobs data for further cues. | ||

| Suggested reading | ||

| The graduate ‘jobpocalypse’: Where have all the entry-level jobs gone?, I. Berwick, FT (September 29, 2025) Controversy creates stock market bargains, D. Lefkovitz, Morningstar (September 24, 2025) | ||