|

| 8 October 2025 Crypto momentum stalls amid risk-off tone |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive overall on Tuesday. Total notional volume came in at $770 million, 33% above 30-day average volume. Bitcoin volume printed $349 million, 43% above 30-day average volume. Ether volume came in at $277 million, 41% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,931 and average position size for ether at $3,581. Bitcoin volatility is trending higher, recovering from the lowest levels of the year. ETH volatility has stabilized after a period of cool down from multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $2,741 and $180 respectively. |

| Latest industry news |

|

Bitcoin has come under some pressure over the past 24 hours after briefly testing new highs earlier in the week. The move reflects some cooling of momentum following strong ETF inflows and heavy institutional participation. A firmer U.S. dollar and broader risk-off tone across assets have also acted as headwinds, leaving bitcoin more inclined to want to consolidate within its recent range rather than breaking higher. ETH has underperformed bitcoin over this period, falling more sharply and struggling to hold the $4,500 area. Resistance near $4,700–4,800 has proven sticky, with technical signals pointing to short-term overextension. While medium-term narratives around network upgrades and on-chain growth remain supportive, near-term price action suggests ETH may need a little more consolidation before attempting another leg higher. Across the broader digital asset space, liquidations of leveraged long positions have amplified intraday volatility. Nevertheless, selective outperformance is emerging in certain DeFi tokens and exchange coins, as investors look for opportunities beyond the two majors. In traditional markets, investor focus remains on U.S. fiscal dynamics and monetary policy. Political gridlock in Washington and uncertainty around government funding deadlines have supported safe-haven assets, though rising Treasury yields and dollar strength present a drag on risk sentiment. Global equities have traded with caution, reinforcing crypto’s role as both a risk proxy and an alternative store of value depending on the narrative of the day. Looking ahead, the balance of flows into crypto ETFs and central bank policy expectations will likely determine direction. A dovish inflection in policy or stabilization in U.S. politics could open the door for renewed upside, while hawkish surprises or regulatory shocks would pose the greatest near-term risks to the rally. |

| LMAX Digital metrics | ||||

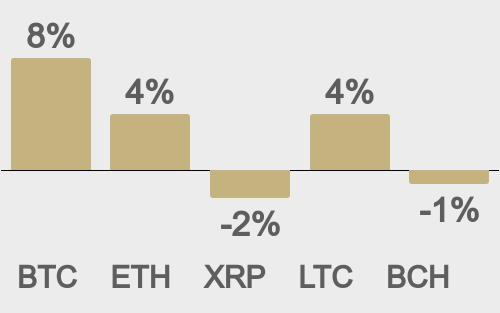

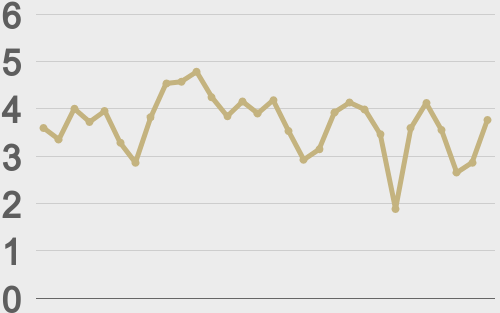

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

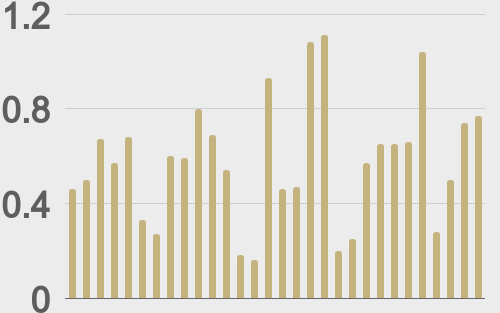

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

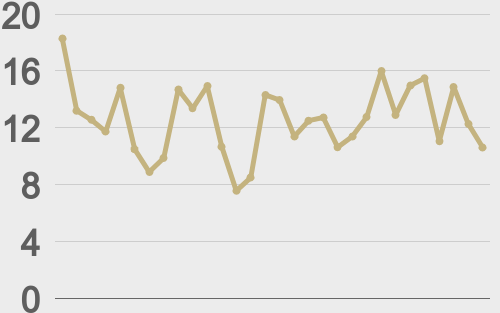

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||