| ||

| 20th October 2025 | view in browser | ||

| Dollar Dips: Fed Cuts, Trump-Xi truce in sight | ||

| Markets open Monday with a neutral-to-bearish dollar bias amid easing US bank fears, an impending Fed 25bps cut, delayed data, and a potential Trump-Xi truce to soften trade tensions. | ||

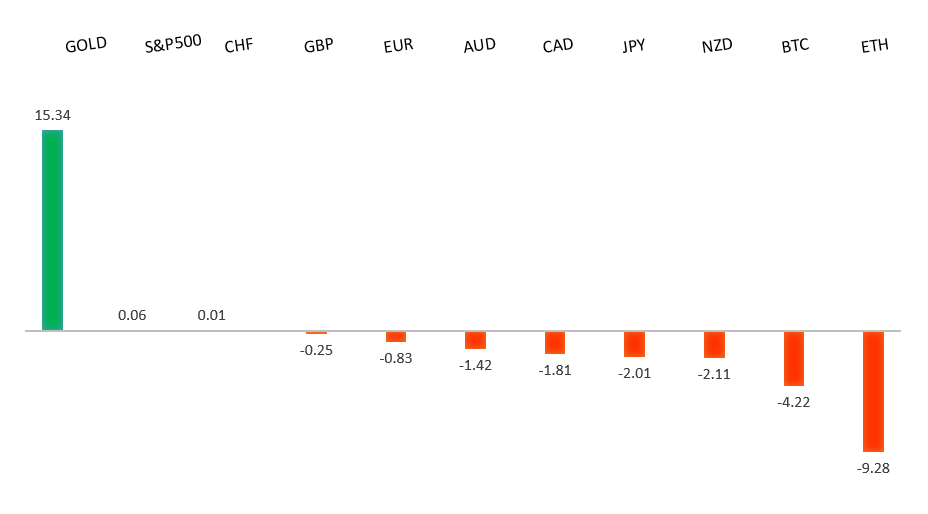

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

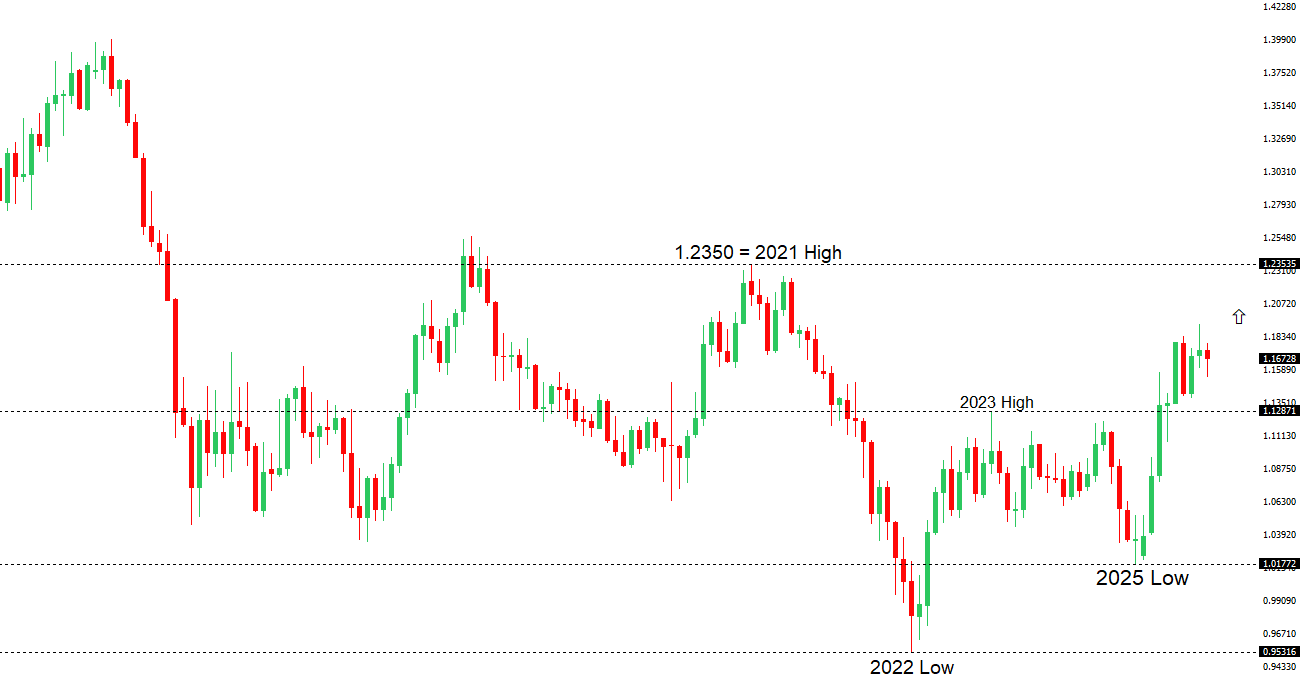

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro is expected to trend neutral to slightly bullish this week, but it remains sensitive to European geopolitical and fiscal risks. France’s credit rating was downgraded by S&P from AA- to A+ due to fiscal uncertainty and political gridlock, potentially pushing debt to 121% of GDP by 2028—yet the euro held steady, buoyed by ECB support and no risk of bank contagion. Eurozone inflation ticked up to 2.2% in September, easing ECB rate-cut pressure, while softer U.S. Fed expectations add mild euro support; markets also eye a positive Trump-Xi meeting on October 31–November 1. Germany’s September PPI is forecast at -1.5% YoY (from -2.2%), signaling easing producer deflation amid weak industrial demand, with a rebound eyed for early 2026. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The narrowing US-Japan 10-year yield spread weighed on USDJPY last week, but Sanae Takaichi’s likely victory as Japan’s next PM—sealed by today’s coalition deal with the Japan Innovation Party (Ishin)—is stoking fears of “Abenomics 2.0” and yen weakness; however, we believe these concerns are overstated, as Takaichi’s agenda will be tempered by Ishin’s focus on deregulation and targeted reforms over massive spending, while higher bond yields and the BOJ’s policy normalization limit fiscal risks. BOJ Governor Ueda recently signaled possible near-term rate hikes if economic confidence grows, though he’ll await more data amid US-China trade tensions; board pressure is mounting, with December now favored over October—especially with the new PM starting Tuesday—while key data this week includes September trade (Oct 21), PMI (Oct 22), and inflation (Oct 23), plus a speech by BOJ member Takata today. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6462 - 17 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Last week’s Australian unemployment rate rose to 4.5% in September—the highest in nearly four years—fueling calls for the Reserve Bank of Australia to cut interest rates more aggressively, possibly for a fourth time in November. Market odds for a November cut surged from 40% to nearly 80%, though RBA officials remain cautious amid lingering inflation, awaiting a key third-quarter report on October 29. Aussie bulls may need dovish U.S. Fed signals to rally further, with prices likely consolidating between key moving averages for now; antipodean currencies remain vulnerable to trade tensions, but optimism grows for a U.S.-China truce at the APEC meeting, potentially extending the tariff deadline and boosting the pair. This week features light data, spotlighting RBA Governor Bullock’s Friday speech for hints of a policy shift. | ||

| Suggested reading | ||

| Powell just gave investors another reason to worry, M. Hulbert, MarketWatch (October 18, 2025) Why The AI Economy Might Not Be A 1990s Redux, N. Irwin, Axios (October 16, 2025) | ||