|

| 20 October 2025 Relief rally builds across crypto markets |

| LMAX Digital performance |

|

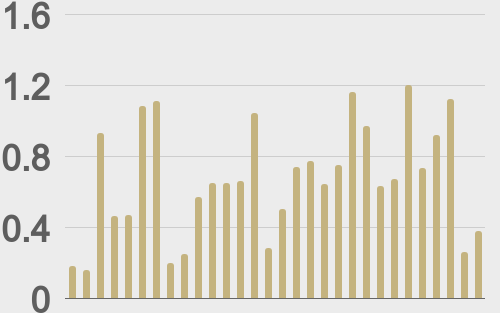

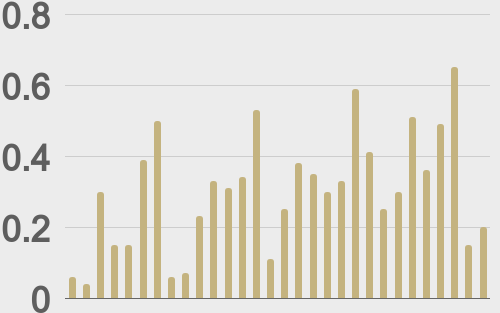

Total notional volume from last Monday through Friday came in at $4.6 billion, improving 14% from a week earlier. Breaking it down per coin, bitcoin volume came in at $2.3 billion, 18% higher than the previous week. Ether volume came in at $1.1 billion, 9% lower than the week earlier. Total notional volume over the past 30 days comes in at $20.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,634 and average position size for ether at $3,290. Bitcoin and ETH volatility has been on the rise over the past several days and is holding up. We’re looking at average daily ranges in bitcoin and ether of $3,891 and $247 respectively. |

| Latest industry news |

|

Crypto markets are entering the week on firmer footing, with bitcoin and ETH extending their recovery rally after a volatile stretch earlier this month. The move higher has been underpinned by improved risk sentiment across global markets, as fears around U.S. regional banks have eased and liquidity conditions show early signs of stabilizing. Bitcoin, in particular, has reclaimed key technical levels, with traders positioning for a more supportive policy backdrop heading into year-end. A central driver of this rebound is the growing conviction the Federal Reserve will deliver a 25-basis-point rate cut at its next meeting. Softer labor and inflation readings, coupled with dovish messaging from Fed officials, have reinforced the idea that monetary policy is set to loosen. For crypto, which remains highly sensitive to real-rate expectations and liquidity, this represents a meaningful tailwind. Lower yields tend to weaken the dollar and support speculative assets, a dynamic that has played out across both bitcoin and ETH in recent sessions. On the geopolitical front, optimism around a potential Trump-Xi truce is helping to bolster risk appetite. Reports suggesting both sides may look to de-escalate tariff tensions have contributed to a broad relief bid across equities, commodities, and digital assets alike. The market appears to be pricing in a scenario of reduced trade friction and steadier global growth — both positive for crypto’s macro correlation profile. Within the crypto ecosystem, on-chain and flow data point to gradual re-engagement from institutional players. Outflows from digital-asset funds have slowed, futures positioning has turned more neutral, and ETH’s underperformance relative to bitcoin has narrowed as investors rotate back into higher-beta names. Technically, both assets are now consolidating above important support zones, with implied volatility compressing — a sign of rebuilding confidence. Overall, the setup heading into Monday is cautiously constructive. Easing banking stress, an impending Fed rate cut, and improving geopolitical tone are working together to restore sentiment in digital assets. While short-term risks remain — including the potential for delayed economic data or surprise inflation prints — the broader narrative has turned toward stabilization and recovery across both traditional and crypto markets. |

| LMAX Digital metrics | ||||

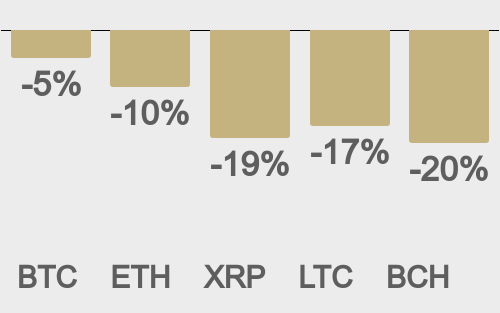

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

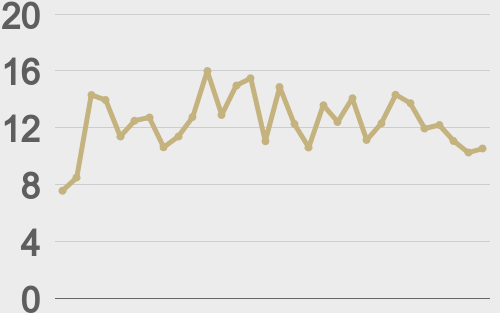

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

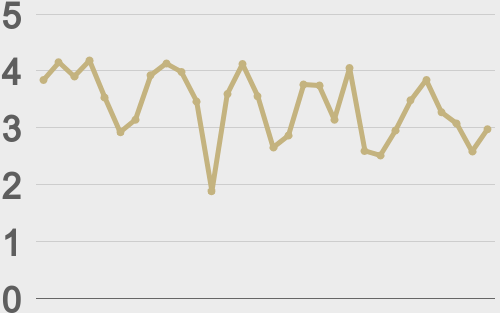

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||