| ||

| 3rd November 2025 | view in browser | ||

| Dollar dominates October, trims yearly losses | ||

| The US dollar capped October with its second-strongest monthly gain of the year, rising 2.1% on the DXY index amid sparse economic data and global uncertainties, trimming its annual loss to under 10%. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1521 - 3 November low - Medium S2 1.1500 - Psychological - Strong | ||

| EURUSD: fundamental overview | ||

| Last Friday’s Eurozone October inflation data showed headline inflation easing to 2.1% year-over-year from 2.2%, staying just above the ECB’s 2% target due to slower food and goods price rises, with core inflation steady at 2.4%. The ECB held interest rates unchanged for the third meeting amid trade uncertainties, adopting a data-dependent approach, while forecasts predict inflation dipping to 1.7% in 2026 before rising to 1.9% in 2027. Markets are pricing in less divergence between ECB and Fed policies, pressuring the EURUSD, but support holds unless new catalysts appear. This week brings final October manufacturing PMIs today, services PMIs on Wednesday, plus German factory orders, industrial production, trade data, and Eurozone retail sales through Friday. | ||

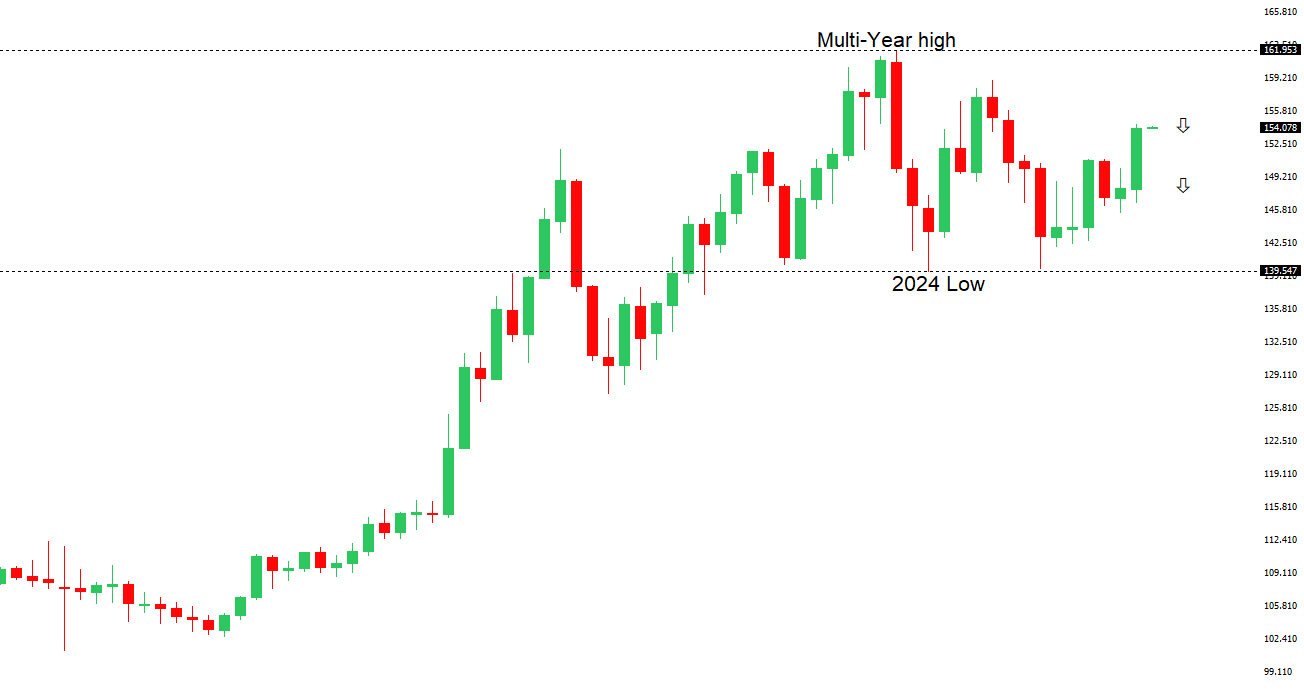

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 154.45 - 30 October high - Medium S1 151.54 - 29 October low - Medium S2 149.38 - 17 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Tokyo’s October inflation rose 2.8%, supporting expectations for gradual Bank of Japan rate hikes and helping pause the yen’s sharp decline, while bond yields mixed with two-year at 0.91% after strong demand and 10-year up to 1.66%; Finance Minister Satsuki Katayama warned of rapid yen moves, signaling closer monitoring. Markets remain divided, with hedge funds betting on yen weakening to 160 per dollar by year-end amid Fed-BOJ policy divergence and persistent USDJPY upside, though medium-term views suspect overpriced expectations of expansive fiscal and monetary stimulus under a potential Sanae Takaichi regime, likely constrained by cabinet, finance ministry, and political realities. September wage data due Thursday will be closely watched for BOJ-monitored wage-inflation progress, with Japan on Culture Day holiday today. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The recent Australian CPI data showed inflation rising to 3.2% annually, with trimmed mean up 1.0% quarter-on-quarter—exceeding RBA forecasts and Governor Bullock’s warning threshold—making a rate hold at 3.6% likely on November 4, while pushing any cuts out to mid-2026 unless labor or inflation weakens sharply. Economists expect the RBA to raise short-term inflation forecasts in its upcoming statement, though some see a return to target by late 2026 amid steady GDP growth; critics argue the bank underestimated wage pressures detached from productivity. Recent data highlights resilience: home values jumped 1.1% in October (strongest since June 2023), building approvals surged 12%, and household spending rebounded to 5.1% year-on-year, though monthly gains remain modest and driven by essentials rather than discretionary items. | ||

| Suggested reading | ||

| The Monster Lurking Behind Federal Reserve Rate Cut, L. Navellier, InvestorPlace (November 1, 2025) Why Another Fed Rate Cut In December Would Be Absurd, P. O’Hare, Briefing (October 31, 2025) | ||