| ||

| 18th November 2025 | view in browser | ||

| Yen under fire, Bitcoin slips, all eyes on Nvidia | ||

| The US dollar began the day on a strong footing, with USDJPY climbing above 155.00 despite dovish remarks from Fed Governor Waller, who reiterated support for a December rate cut amid labor market weakness and pressure on lower-income households. | ||

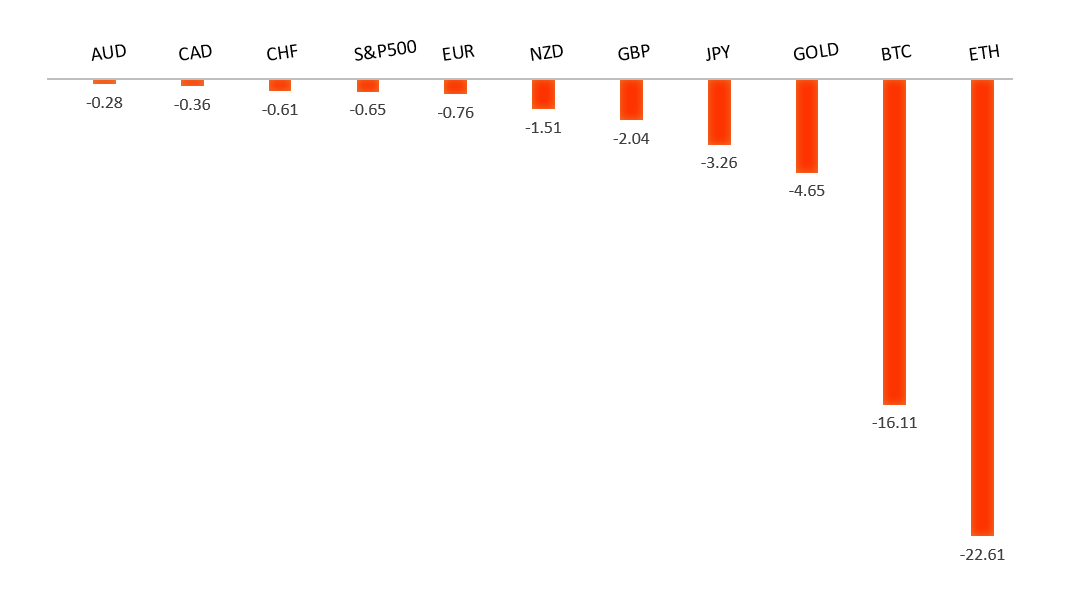

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Commission has raised its 2024 growth forecast for the eurozone to 1.3% from 0.9%, though it slightly lowered its 2026 outlook to 1.2%. Despite this, stronger-than-expected growth in the first three quarters, supported by rising consumer spending and investment, suggests continuing momentum. Inflation is projected to ease to 1.9% by 2026, while unemployment is expected to drop to 6.2%. Risks remain, including market volatility—especially in the US tech sector—domestic political uncertainty, and climate-related events. Meanwhile, China and Germany have agreed to deepen financial cooperation, enhancing yuan internationalization through measures like promoting offshore yuan markets and allowing RMB bonds as collateral. This could boost demand for the yuan and possibly support the euro through increased investment flows. Upcoming eurozone data releases include PMI figures and consumer confidence indicators later this week. | ||

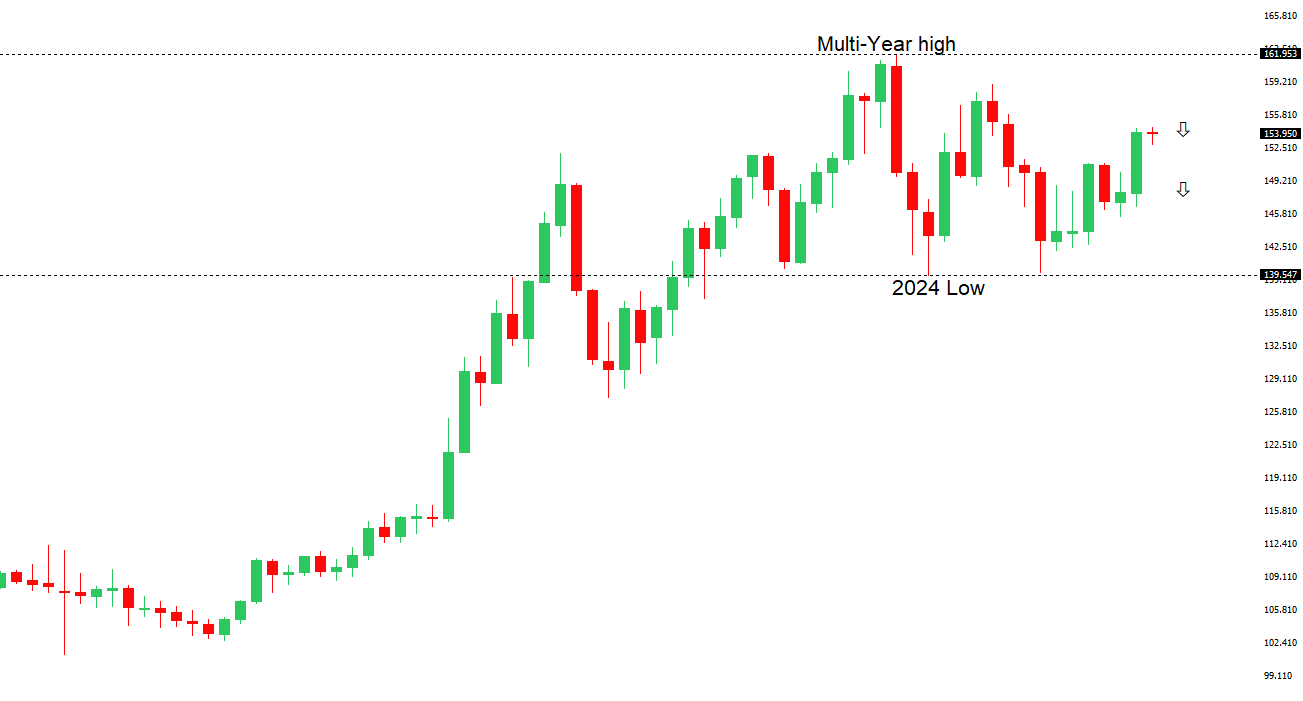

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.98 - 28 January high - Medium R1 155.38 - 18 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The yen has slightly rebounded after Japan’s finance minister cautioned against excessive currency volatility, but persistent concerns over PM Takaichi’s proposed fiscal stimulus and Japan’s widening interest rate gap with the U.S. continue to weigh on it. Despite a shrinking Bank of Japan balance sheet and signals of potential rate hikes as early as December or January, markets see limited follow-through and expect yen weakness to persist unless the U.S. Federal Reserve cuts rates more aggressively. Tensions with China and weak economic data—such as an unexpected GDP contraction—add to downside risks, though upcoming inflation and trade data, along with a key meeting between PM Takaichi and BOJ Governor Ueda, may offer fresh direction. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| China’s escalating tensions with Japan over comments on Taiwan and broader risk-off sentiment—highlighted by equity and bitcoin sell-offs ahead of key U.S. data—are weighing on risk-sensitive currencies like the Australian and New Zealand dollars. However, there’s longer-term optimism as President Trump has rolled back tariffs on imported food, including Australian beef, boosting confidence in Australia’s export sectors. With resilient economic indicators and concerns about inflation, the Reserve Bank of Australia is expected to hold rates steady at 3.6%, supported by recent data and a cautious policy stance. One well know bank believes the easing cycle is over, and upcoming remarks from the RBA’s chief economist may reinforce a hawkish tone. | ||

| Suggested reading | ||

| Can AI save America’s $1.3 trillion problem?, S. McBride, RiskHedge (November 15, 2025) Is the Biggest Tech Rally of Our Era Built on a Lie?, J. Kilhefner, InvestorPlace (November 15, 2025) | ||