|

| 11 December 2025 Hawkish Fed cut, dovish future |

| LMAX Digital performance |

|

LMAX Digital volumes have been trending up all week. Total notional volume for Wednesday came in at $415 million, 11% below 30-day average volume. Bitcoin volume printed $254 million, 8% below 30-day average volume. Ether volume came in at $75 million, 30% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,944 and average position size for ether at $2,115. Volatility has come down in recent weeks, entering a period of consolidation. We’re looking at average daily ranges in bitcoin and ether of $3,652 and $190 respectively. |

| Latest industry news |

|

Bitcoin and the broader digital asset complex extended their pullback overnight as markets digested the implications of a hawkish Fed cut. Policymakers struck a more cautious note on inflation, signaling deeper divisions over the path ahead and curbing investor appetite for risk. The tone from the FOMC—marked by skepticism around additional easing—triggered a modest risk-off move across macro assets. Crypto markets felt the impact quickly, with elevated positioning amplifying the downside and pushing bitcoin lower into thinner liquidity conditions. ETH moved broadly in line with the market, though it continues to show relative resilience compared with bitcoin. Ongoing optimism around network activity, institutional flows, and the expanding tokenization and staking ecosystem is helping limit the extent of its pullback. However, despite the initial hawkish shock, crypto also remains supported by a medium-term story in which markets still price a deeper easing cycle than the Fed’s own projections. Historically, the Fed has tended to shift toward market pricing rather than force markets to adjust to its dots. That leaves room for investors to anticipate a return to more dovish rhetoric, particularly with speculation mounting that the next Fed chair could bring a more accommodative policy bias. This prospect is helping maintain confidence in the broader bull trend. Structural tailwinds—including recovering ETF inflows and ongoing supply tightness—continue to provide a cushion beneath the market. Even with near-term volatility elevated, long-term dynamics remain constructive. Geopolitical developments such as energy market disruptions and shifting U.S. political rhetoric add to the macro noise but have had only a limited directional impact on crypto so far. Still, traders are monitoring any escalation that could influence dollar liquidity or broader risk sentiment. On-chain data shows that long-term holders remain steady, with accumulation patterns broadly intact. This suggests conviction investors view the current retracement as technical rather than a meaningful challenge to the underlying narrative. Looking ahead, attention will center on whether markets begin to fade the Fed’s hawkish tone and resume pricing a more accommodative 2026 policy path. Should that happen, the setup favors a constructive tone for bitcoin and ETH once the initial policy reaction stabilizes. |

| LMAX Digital metrics | ||||

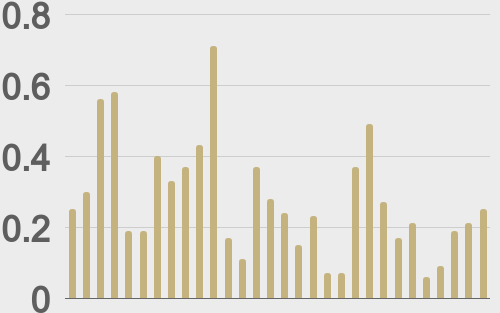

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

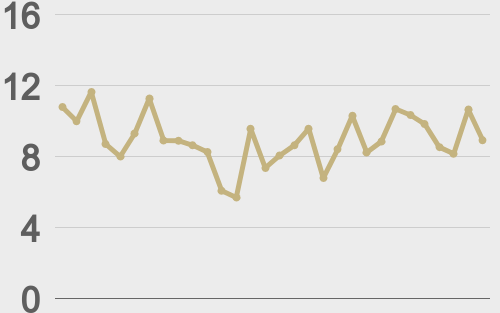

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

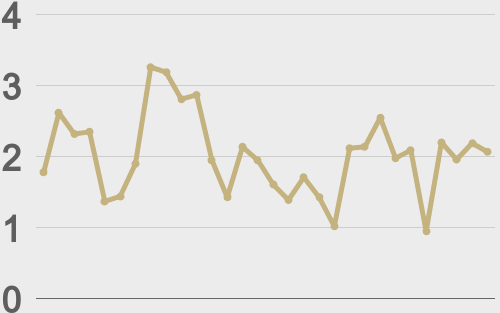

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||