| ||

| 29th December 2025 | view in browser | ||

| Calm open, big cross-currents | ||

| Global markets open the day calmly on the surface but with powerful cross-currents underneath. US equities are consolidating near record highs in thin holiday trading, with focus squarely on upcoming FOMC minutes that could clarify the widening disconnect between the Fed’s hawkish outlook and markets still pricing multiple rate cuts, even as yields ease, the dollar slides toward multi-year lows, and political uncertainty clouds Fed independence. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1400. | ||

| ||

| R2 1.1919 - 17 September/2025 high -Strong R1 1.1809 - 24 December high - Medium S1 1.1703 - 19 December low - Strong S2 1.1615 - 9 December low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro is consolidating near recent highs as ECB messaging and staff forecasts signal a neutral policy stance, with rates likely on hold through 2026, keeping policy divergence with the Fed supportive for EUR on dips. Major banks now see scope for a stronger euro in 2026 as euro-area data improve and Fed easing weakens the dollar, even if volatility persists near term. ECB projections show growth around potential and inflation near target, reinforcing the view that policy is in a “good place,” while positioning data show long EUR exposure but not at extreme levels. Near-term focus turns to upcoming euro-area manufacturing, inflation, and Swiss leading indicator data. | ||

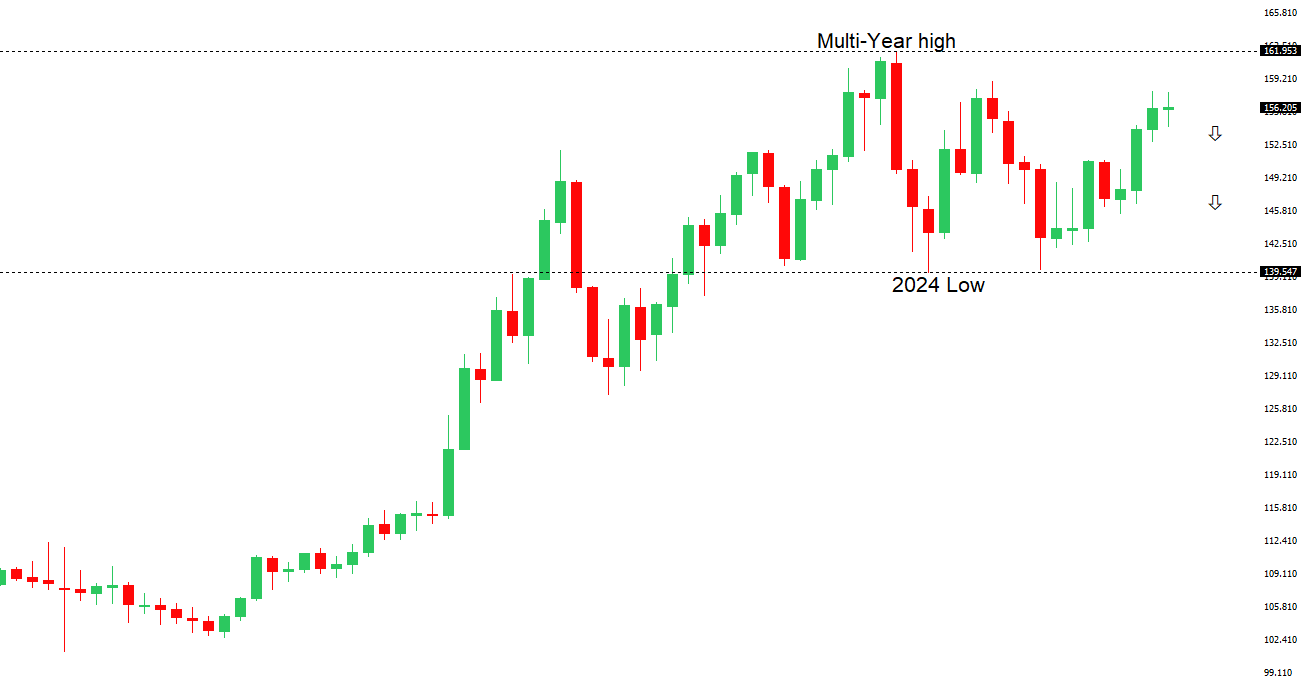

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 157.90 - 20 November/2025 high - Strong R1 157.00 - Figure - Medium S1 154.39 - 16 December low - Strong S2 153.61 - 14 November low - Medium | ||

| USDJPY: fundamental overview | ||

| The yen edged slightly higher against the dollar as markets stayed alert to possible government intervention, especially with officials signaling readiness to act if depreciation becomes excessive. Softer-than-expected December inflation data in Tokyo support a slower pace of BOJ rate hikes, even as underlying price pressures like rising rents keep gradual policy normalization on the table. While a move above 158 in USDJPY would likely increase intervention risk and near-term downside for the pair—particularly if BOJ tightening coincides with Fed easing—many banks still expect the yen to remain structurally weak into 2026 due to wide yield differentials, negative real rates, and persistent capital outflows. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6800 - Figure - Medium R1 0.6728 - 29 December/2025 high - Medium S1 0.6592 - 18 December low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar has extended its run to another new year-to-date high, supported by growing expectations that the RBA may shift toward a tightening cycle by mid-2026 as consumer spending and wage growth fuel inflation pressures. Many bank analysts expect the run to continue, helped by seasonal strength and improving global conditions, though weaker Chinese industrial profits could limit near-term gains. Any pullbacks are likely to attract buyers amid positive global risk sentiment and hopes of increased Chinese fiscal support in 2026, while Australia’s data calendar remains light this week. | ||

| Suggested reading | ||

| The blue-collar jobs revival: The skills the world needs now, I. Berwick, Financial Times (December 29, 2025) Santa Rally Is Off To a Good Start, Matters for Investors, I. Wang, Marketwatch (December 26, 2025) | ||