|

|

| $1 billion valuation |

| LMAX Digital performance |

|

We’ve been seeing lighter volume in recent weeks, mostly on account of some very tight conditions into thinner summer doldrums trade. At the same time, there was a clear, progressive pickup in volume at LMAX Digital throughout this past week. Each day of this past week improved upon the previous day’s volume before things tapered off on a summer Friday. Total notional volume on Monday came in at $702 million, before rising to $854 million on Thursday, reflecting an 18% increase from the start of the week. Ether volume was impressive in its own right last Thursday, coming in at $270 million, 11% above 30-day average volume. Total notional volume at LMAX Digital over the weekend was also 9% higher than last weekend’s total notional volume, coming in at $794 million for Saturday and Sunday. Total notional volume over the past 30 days comes in at $26 billion. |

| Latest industry news |

|

LMAX Group, the parent company of LMAX Digital has just earned itself a $1 billion valuation after agreeing to take $300 million from private equity investor JC Flowers for a 30% minority stake in the group (subject to regulatory approval). The news further solidifies the story around mass institutional adoption of crypto in 2021. Other news around equity injections come from Revolut’s $800 million raise, Axelar’s $25 million in Series A, crypto wallet Phantom’s $9 million Series A, blockchain audit firm CertiK’s $37 million Series B, and bitcoin miner Iris Energy’s raise of $200 million. Moving on, US Treasury Secretary Janet Yellen announced federal regulators would meet this week to discuss stable coins. And over at Square, Jack Dorsey said the payments services business was working to create an open developer platform focused on bitcoin tied financial services. Looking at price action and fundamentals, we think it will be interesting to see just how well bitcoin can hold up in the face of intense downside pressure in global financial markets. We’ve highlighted short-term downside risk to bitcoin associated with risk off flow and think this will be important to keep an eye on right now as US equities falter and the US Dollar rallies. Technically speaking, Bitcoin has been trading with a heavier tone of late, but ultimately, the market is still confined to a consolidation after the healthy pullback from the record high earlier this year. At this stage, we believe additional setbacks should be limited, though a breakdown below the June consolidation low would open the next downside extension exposing a retest of critical previous resistance turned support in the $20,000 area. Back above $36,700 would now be required to take the immediate pressure off the downside, while a push through the June high at $41,330 would suggest the longer-term uptrend is finally ready to resume its course. |

|

LMAX Digital metrics |

||||

|

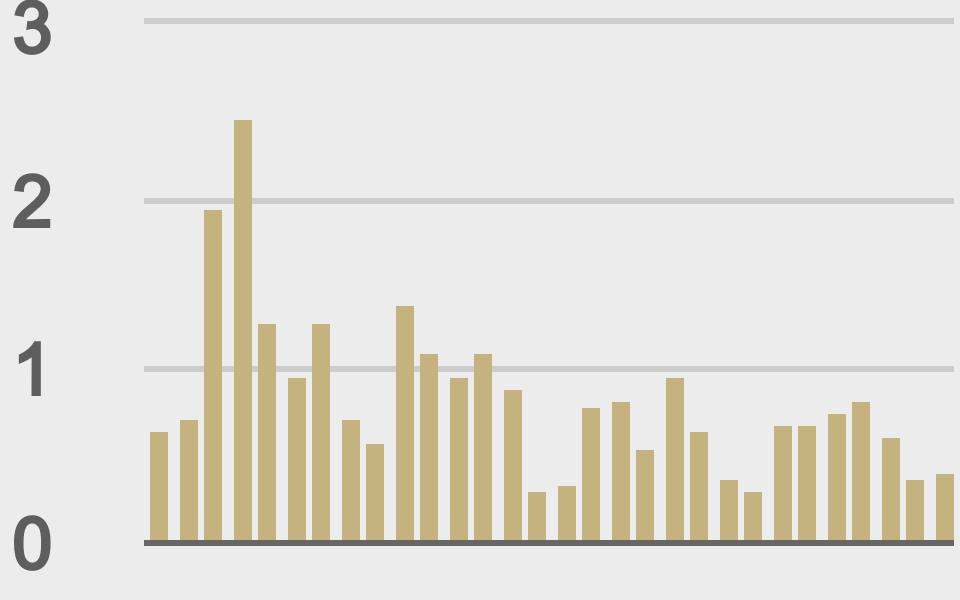

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

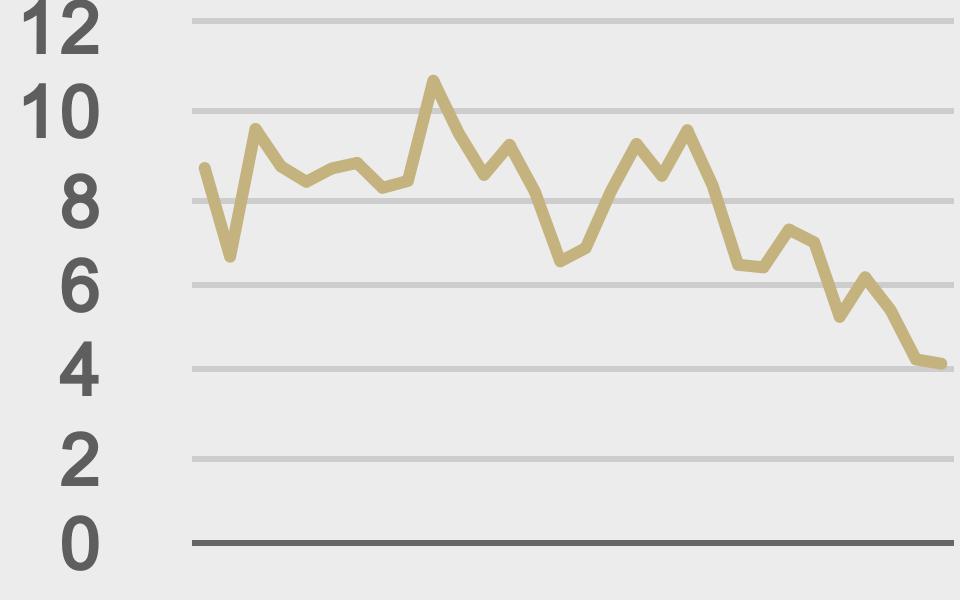

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

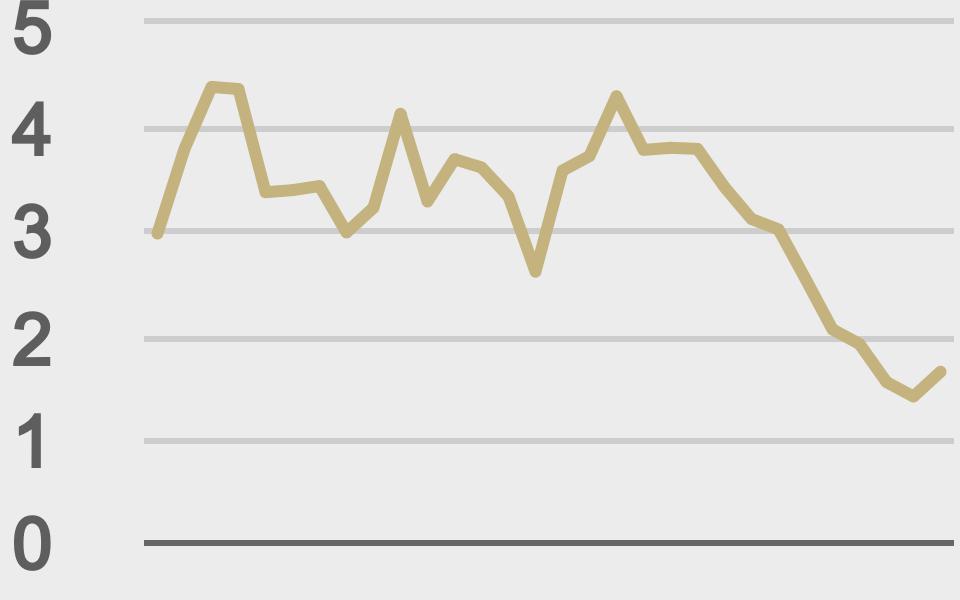

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@fintechfrank |

||||

|

@intotheblock |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||