|

|

14 August 2023 A case of contrasting fundamentals |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital cooled off quite a bit in the previous week, mostly on account of super tight trading conditions and summer doldrums. Total notional volume from last Monday through Friday came in at $881 million, 34% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $518 million in the previous week, 30% lower than the week earlier. Ether volume came in at $222 million, 40% lower than the week earlier. Total notional volume over the past 30 days comes in at $6.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,554 and average position size for ether at $3,307. Volatility continues to trend lower. Bitcoin volatility is at its lowest since back in January, while Ether volatility is at its lowest levels since late 2020. We’re looking at average daily ranges in bitcoin and ether of $549 and $34 respectively. |

| Latest industry news |

|

We haven’t seen much movement in crypto assets, with bitcoin and ether realized and implied volatilities trading down near multi-month lows. On a positive note, this has also resulted in a breakdown in correlation with traditional assets like stocks and the US Dollar, increasing the attractiveness of crypto as a portfolio diversifier. Macro headwinds have however presented somewhat of a challenge for crypto. Indeed, correlations have broken down. But downside pressure on US equities and concurrent demand for the US Dollar have prevented crypto from extending the 2023 recovery. At the same time, there have been plenty of crypto specific positive catalysts to keep the market well supported on dips. Certainly, BlackRock’s spot ETF application and the partial victory for Ripple Labs have inspired a more favorable reevaluation of regulatory risk within the space. Still, we are far from out of the woods on this front as we wait for additional clarity from the SEC, and additional clarity from the courts. Most recently, we learned of the SEC seeking an interlocutory appeal in the Ripple Labs case regarding the ruling that some of Ripple Lab’s sales were not classified as securities. It’s worth noting that while all of this hangs in the balance, and short of additional fundamental catalysts, there is risk the crypto market focuses back on macro themes. On the one side, this could translate to more selling pressure if risk off flow persists. On the other side, it could just as easily inspire demand on the expectation risk off flow will open the door to further stimulus and accommodation out of China and the US. And yet one more set of contrasting variables needs to be considered. Seasonality trends suggest we could see more headwinds in August and September. Historically, this time period has been more challenging for crypto assets. Alternatively, when volatility has sunk to the levels we’re seeing, forward returns have proven to be exceptionally bullish. Moving on, we’ve noticed ether has held up just a little better than bitcoin in recent sessions, perhaps in the wake of the launch of Coinbase’s new layer two solution which has been well received. Other positive news for Ethereum comes from Visa, with the major payments provider testing a new solution to allow on-chain gas fees to be paid via the Visa card. |

| LMAX Digital metrics | ||||

|

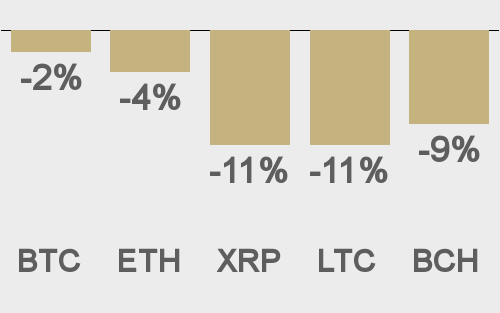

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

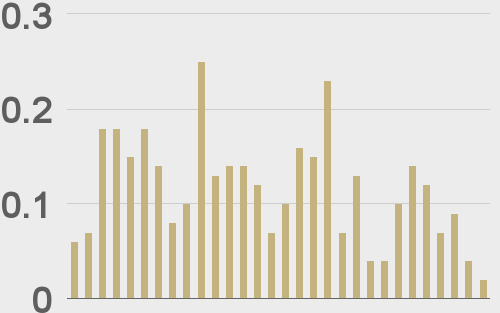

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

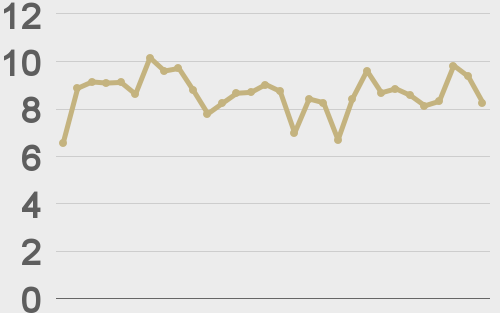

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@iamjosephyoung |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||